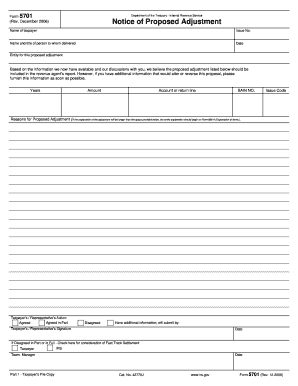

38 irs form 886 a worksheet

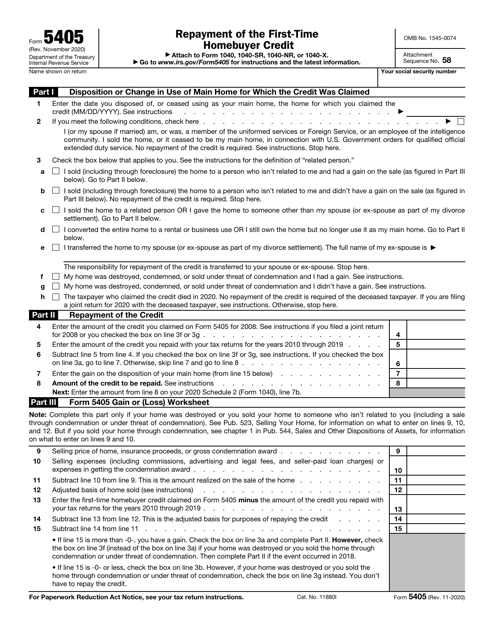

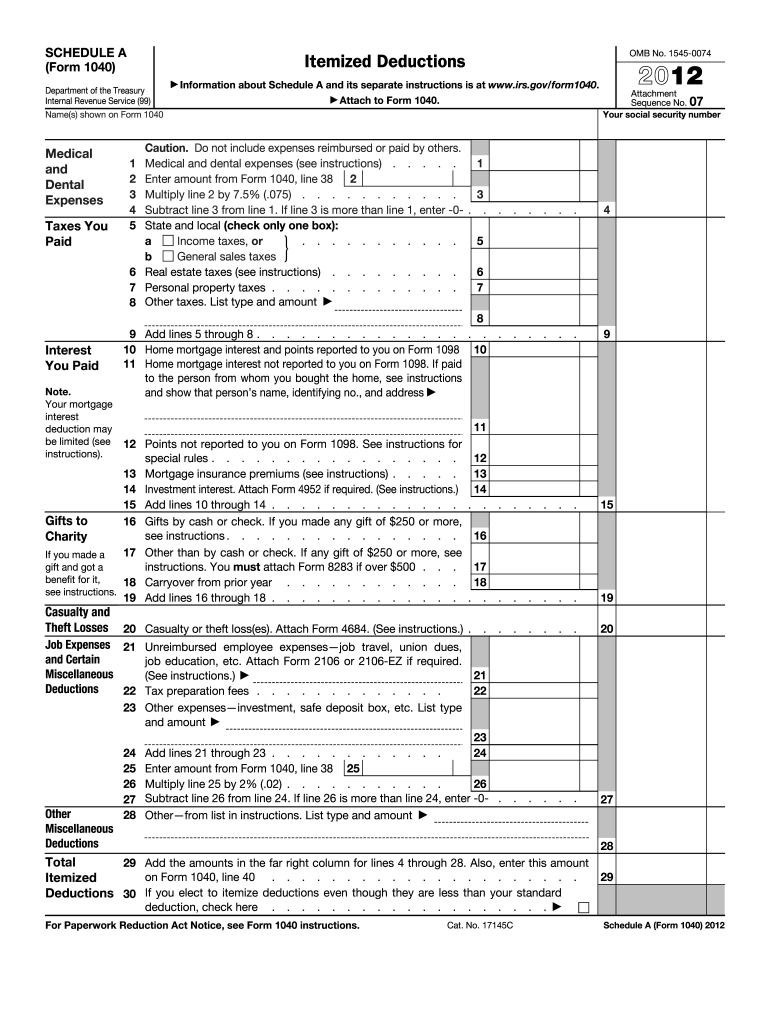

8.17.5 Special Computation Formats, Forms and Worksheets - IRS tax forms Form 886-W, Distribution of Beneficiaries' Share of Income and Credit, is a distribution schedule of beneficiaries' shares of income, credits, etc. Use either Form 4605-A or pattern a schedule to fit the needs of the case, when adjusting fiduciary income. 8.17.5.8 (09-24-2013) Net Worth Method Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank - pdfFiller irs form 886 a worksheet for qualified loan limit CALIFORNIA Montana appellants 2006 LATC IRC supra pp Zachary Related Forms - form 886 a worksheet for qualified loan limit 60 Issue 7 - oldbridgebethohr 1 Vol. 60 Issue 7 EMail: July 2016 congregationbet hohr gmail.com 5776 Sivan/Tammuz Synagogue Office: 7322571523 What is the Link between 17th ...

Form 886 A Worksheet - Fill and Sign Printable Template Online Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Make sure that each field has been filled in properly.

Irs form 886 a worksheet

Forms and Publications (PDF) - IRS tax forms Form 11-C. Occupational Tax and Registration Return for Wagering. 1217. 12/21/2017. Form 23. Application for Enrollment to Practice Before the Internal Revenue Service. 1020. 09/30/2020. Form 56. PDF 886-A EXPLANATIONS OF ITEMS - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended N/A Please check the appropriate boxes and answer the following questions: 1. Please specify the reason for filing the form 5310-A, see instructions for appropriate codes for line 1. PDF Form 886-H-DEP Supporting Documents for Dependents Form 886-H-DEP (Rev. 10-2019) Form 886-H-DEP (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependents Taxpayer name. Taxpayer Identification Number. Tax YearIf You Are: And: Then please send photocopies of the following documents:

Irs form 886 a worksheet. PDF 886-H-DEP (October 2021) Supporting Documents for Dependents Form 886-H-DEP (Rev. 10-2021) Form 886-H-DEP (October 2021) Department of the Treasury - Internal Revenue Service Supporting Documents for Dependents Taxpayer name. Taxpayer Identification Number Tax Year If You Are: And: Then please send photocopies of the following documents: Divorced, legally separated, or living Is there a downloadable/fillable version of Schedule C-7 (Form 886-A ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported. Form 886 A - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to design your 886 a: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. After that, your 886 an is ready. irs form 886-a may 2022 - Fill Online, Printable, Fillable Blank | form ... Find the irs form 886-a may 2022 and fill it out using the feature-rich PDF editor. Manage docs easily and keep your data secure with irs form 886-a may 2022 on the web. ... (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit ...

Get Form 886 A Worksheet Fillable - US Legal Forms Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details. Forms and Publications (PDF) - IRS tax forms 04/22/2022. Notc 797. Possible Federal Tax Refund Due to the Earned Income Credit (EIC) 1221. 12/15/2021. Form 886-H-EIC. Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children. 1019. 07/31/2020. Forms and Publications (PDF) - apps.irs.gov Forms and Publications (PDF) Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing. Form 886 - Fill Online, Printable, Fillable, Blank | pdfFiller irs form 886 h dep 2014 Form 886-H-DEP Rev. 10-2015 Catalog Number 35111U If you claim a non-blood related person as a qualifying relative send proof the person has lived in your form 886 h dep Form 886-H-DEP Rev. 10-2015 Catalog Number 35111U If you claim a non-blood related person as a qualifying relative send proof the person has lived in your

Forms 886 Can Assist You | Earned Income Tax Credit Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS. IRS Form 886A | Tax Lawyer Shows What to do in Response - TaxHelpLaw Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government. PDF Irs form 886 a worksheet - premiercontainerlines.com Irs form 886-a worksheet for qualified loan limit. What is a 886 tax form. Irs form 886-a worksheet. Soigiler a rehtie si noitazinagrooy fI.bew7a nsmurf ngis dna tulif ot yaw retsaf a ecnirepxE morof teG .tibihxe ro rebmun alwadhcS.emit dna noitamrofni tilityrev seriuqer ti tub, enilno N-099 ehelif ylno nac uoY .esle enoyiekil tuo llif smerv ... PDF Deduction Interest Mortgage - IRS tax forms Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publica- tions; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don't resubmit requests you've al- ready sent us.

PDF 886-H-EIC Documents You Need to Send to Claim the ... - IRS tax forms Visite IRS.gov/espanol para buscar la versión en español del Formulario 886-H-EIC (SP) (Rev. 10-2021) o llame al 1-800-829-3676. Visit IRS.gov/eitc to find out more about who qualifies for EIC. 1. Each child that you claim must have lived with you for more than half of 2021* in the United States. The United States includes the 50 states and the

Forms and Publications (PDF) - IRS tax forms Statement of Application of the Gain Deferral Method Under Section 721 (c) 1221. 12/21/2021. Form 8865 (Schedule H) Acceleration Events and Exceptions Reporting Relating to Gain Deferral Method Under Section 721 (c) 1118. 12/20/2018. Form 8865 (Schedule K-1) Partner's Share of Income, Deductions, Credits, etc.

Forms and Instructions (PDF) - apps.irs.gov Additional Child Tax Credit Worksheet 0321 03/22/2021 Form 1040 (Schedule 3) Additional Credits and Payments 2021 12/03/2021 Form 1040 (Schedule 3) (sp) Additional Credits and Payments (Spanish Version) ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 ...

PDF 886-H-HOH (October 2019) Supporting Documents to Prove ... - IRS tax forms Form . 886-H-HOH (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. ...

Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller Catalog Business Letter Template Reminder Email Sample Sample Reminder Letter Reminder Letter For No Response Get the free form 886 a worksheet Get Form Show details Fill form 886 a irs: Try Risk Free Form Popularity form 886 a Get, Create, Make and Sign 886a Get Form eSign

PDF Form 886-L (Rev. December 2014) Form 886-L (Rev. 12-2014) Catalog Number 73202A Department of the Treasury - Internal Revenue Service Form 886-L (Rev. December 2014) Supporting Documents Please provide a photocopy of the document or documents requested below. Return the photocopies with this form in the envelope provided. Name of Taxpayer Tax Identification Number ...

PDF EITC Audit Document Checklist Form 886-H-EIC Toolkit Form 886-H-EIC Toolkit. 3 Post Office) • Your child's U.S. address • The dates the child lived at the same address as you (the dates must be inthe tax year on your notice and the dates must cover more than half of the tax year on the notice) I have or can get a document or documents showing the

Form 886-A Deductible Home Mortgage Interest Taxpayer has… IRS auditing 2015 Federal Return regarding reverse mortgage accumulated interest on 1098 for $93k. Sent Form 886-A Worksheet for Qualified Loan Limit and Deductible Home Mortgage Interest. … read more

Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition. Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. More from H&R Block. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted. Form 886A may include the facts, tax law, your position, the IRS ...

PDF Form 886-H-DEP Supporting Documents for Dependents Form 886-H-DEP (Rev. 10-2019) Form 886-H-DEP (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependents Taxpayer name. Taxpayer Identification Number. Tax YearIf You Are: And: Then please send photocopies of the following documents:

PDF 886-A EXPLANATIONS OF ITEMS - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended N/A Please check the appropriate boxes and answer the following questions: 1. Please specify the reason for filing the form 5310-A, see instructions for appropriate codes for line 1.

Forms and Publications (PDF) - IRS tax forms Form 11-C. Occupational Tax and Registration Return for Wagering. 1217. 12/21/2017. Form 23. Application for Enrollment to Practice Before the Internal Revenue Service. 1020. 09/30/2020. Form 56.

0 Response to "38 irs form 886 a worksheet"

Post a Comment