41 qualified dividends and capital gain tax worksheet calculator

How Dividends Are Taxed and Reported on Tax Returns - The Balance 2 days ago · Dividends can be taxed at either ordinary income tax rates or at the lower long-term capital gains tax rates. Dividends that qualify for long-term capital gains tax rates are referred to as "qualified dividends." In 2022, ordinary income tax rates range from 10% and 37% while long-term capital gains tax rate is capped at 20%. 2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet Oct 20, 2022 · The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12% ...

Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... There may not be any 30% tax on certain short-term capital gain dividends from sources within the United States that you receive from a mutual fund or other RIC. The mutual fund will designate in writing which dividends are short-term capital gain dividends. This tax relief will not apply to you if you are present in the United States for 183 ...

Qualified dividends and capital gain tax worksheet calculator

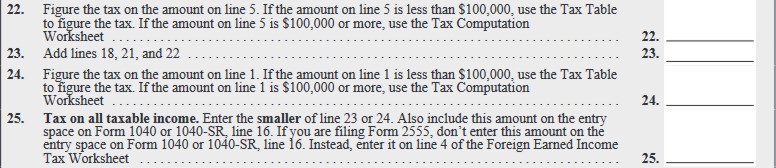

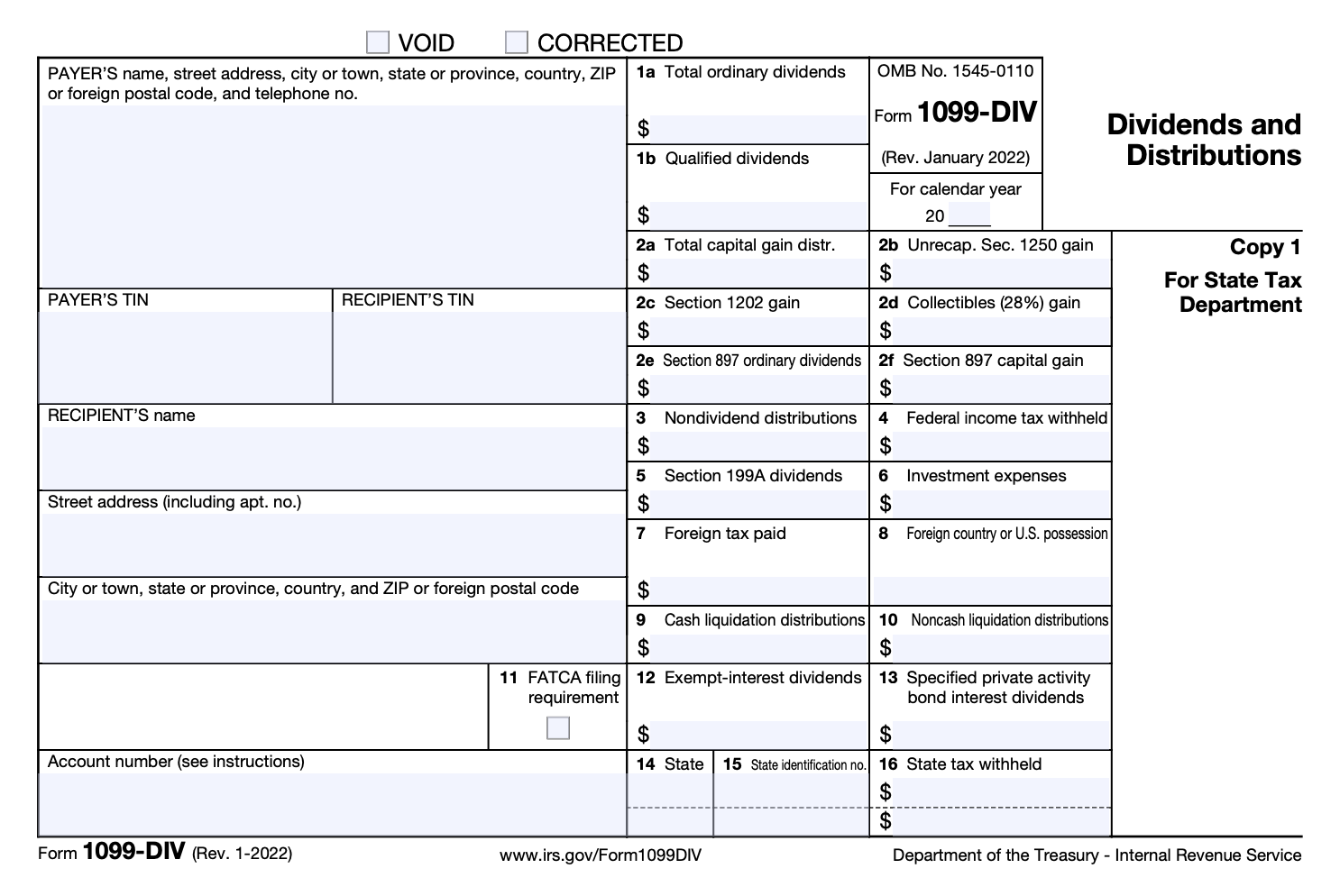

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience. Publication 525 (2021), Taxable and Nontaxable Income Any excess gain is capital gain. If you have a loss from the sale, it's a capital loss and you don't have any ordinary income. Your employer or former employer should report the ordinary income to you as wages in box 1 of Form W-2, and you must report this ordinary income amount on Form 1040 or 1040-SR, line 1. Publication 550 (2021), Investment Income and Expenses ... Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D

Qualified dividends and capital gain tax worksheet calculator. Publication 925 (2021), Passive Activity and At-Risk Rules For individuals, your capital loss deduction is limited to the amount of your capital gains plus the lower of $3,000 ($1,500 in the case of a married individual filing a separate return) or the excess of your capital losses over capital gains. See Pub. 544 for more information. . Publication 550 (2021), Investment Income and Expenses ... Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D Publication 525 (2021), Taxable and Nontaxable Income Any excess gain is capital gain. If you have a loss from the sale, it's a capital loss and you don't have any ordinary income. Your employer or former employer should report the ordinary income to you as wages in box 1 of Form W-2, and you must report this ordinary income amount on Form 1040 or 1040-SR, line 1. Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience.

0 Response to "41 qualified dividends and capital gain tax worksheet calculator"

Post a Comment