38 kentucky sales and use tax worksheet

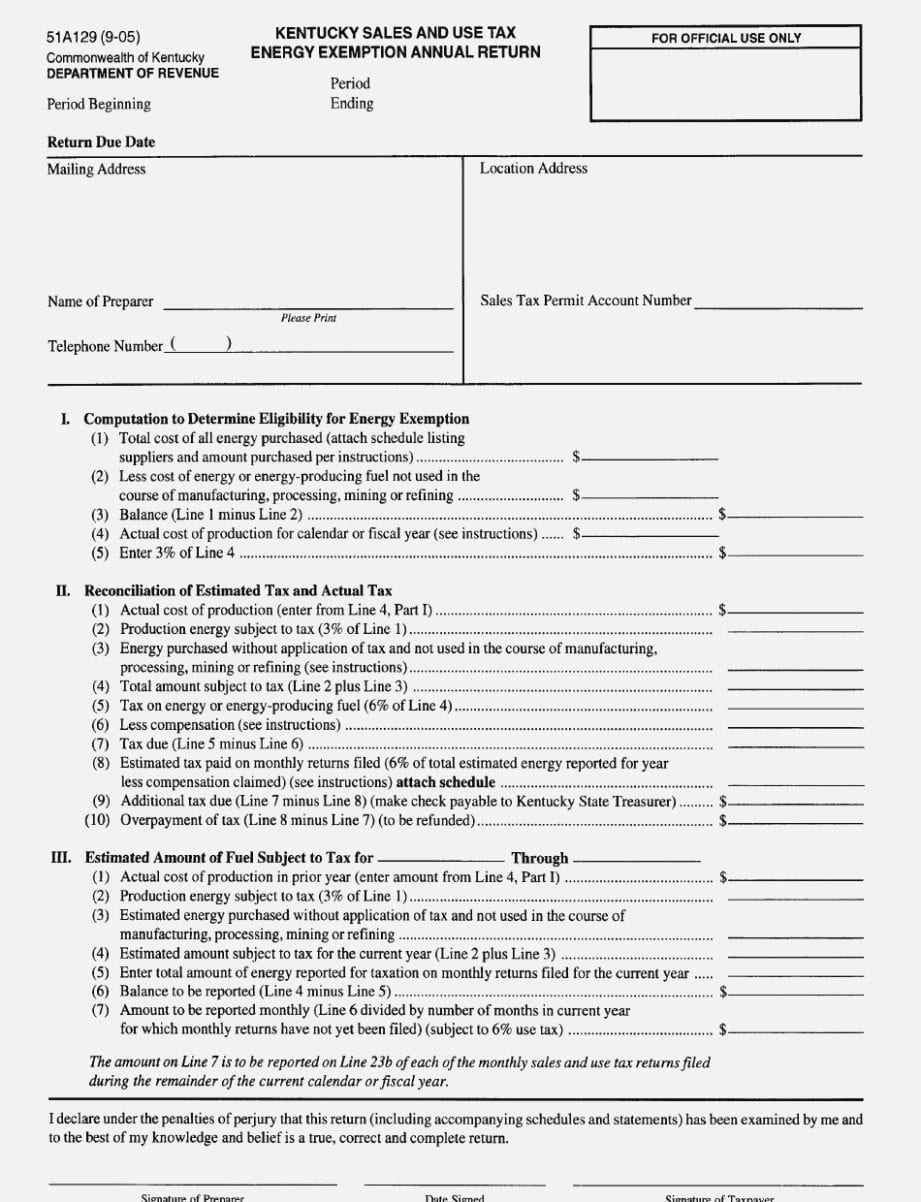

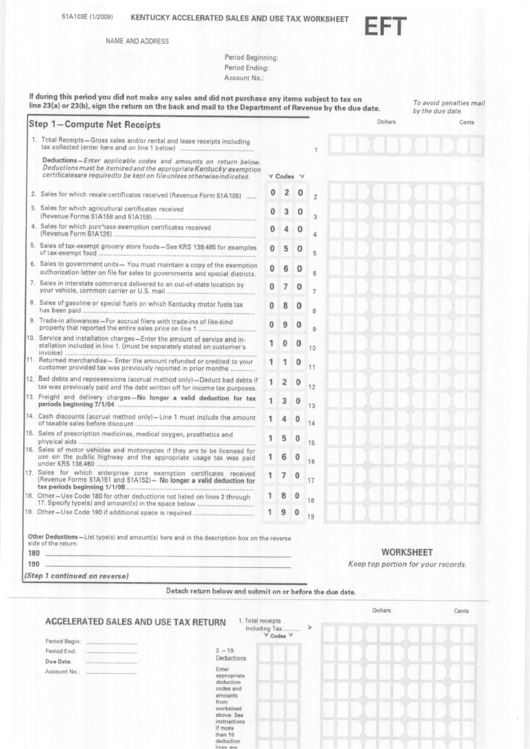

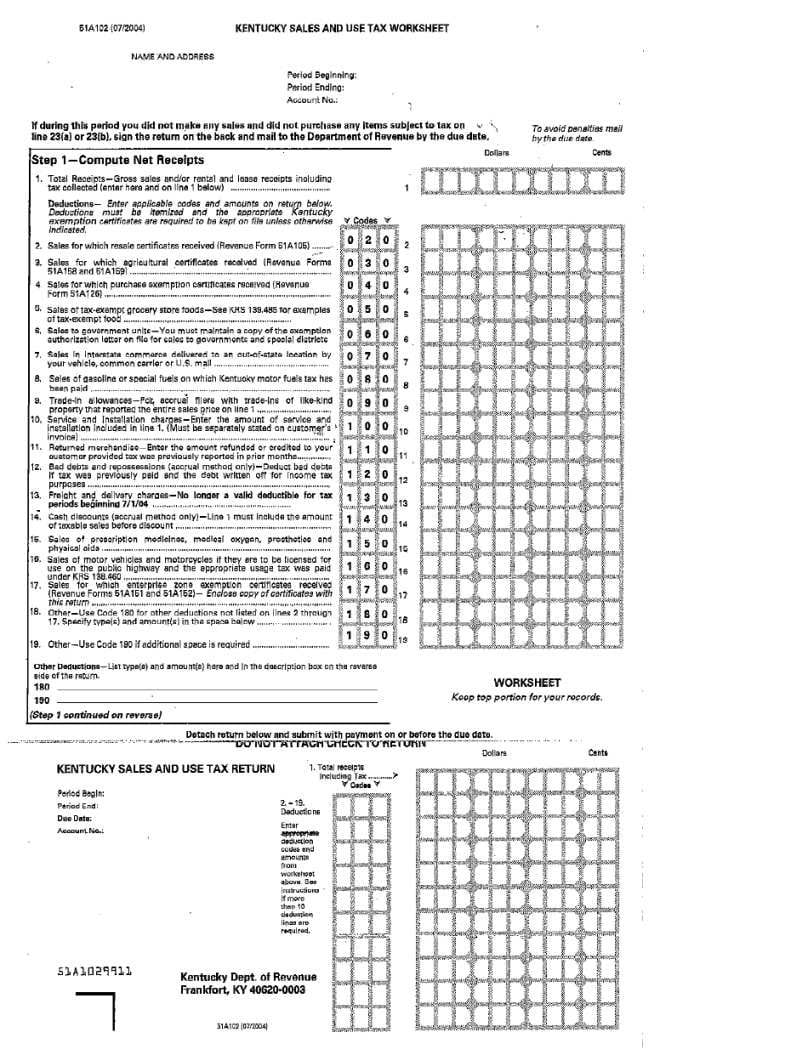

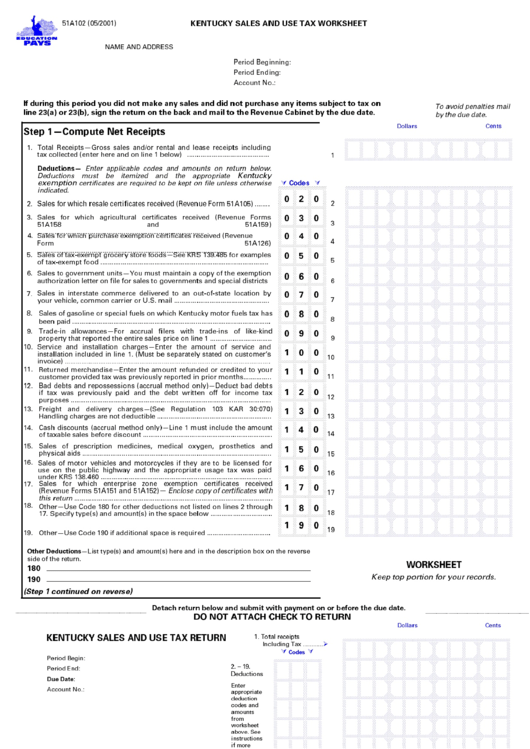

kentucky sales and use tax worksheet instructions Sales Tax Form 51a102 - Kentucky Sales And Use Tax Worksheet printable pdf download. Contact 501-682-7104 to request ET-1 forms and the forms will be mailed to your business in two to three weeks. Worksheets are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work. PDF 51a205 (4-14) Kentucky Sales and Department of Revenue Use Tax Instructions period, please contact the Division of Sales and Use Tax via telephone or e-mail for further instructions. When using the Other Codes 170, 180 or 190, be sure to describe the type of deduction(s) and amount(s) on the worksheet for your own records and in the description box on the reverse side of the return for Department of Revenue verification.

51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are Retail packet, Kentucky sales and use tax work help, Tax alert, Nebraska and local sales and use tax return form. *Click on Open button to open and print to worksheet. 1. RETAIL PACKET. 2. Kentucky Sales And Use Tax Worksheet Help. 3. Tax Alert.

Kentucky sales and use tax worksheet

Division of Sales and Use Tax - Kentucky The Division of Sales and Use Tax manages collection and administration of Sales and Use Taxes for the Department of Revenue. Kentucky Imposes Sales and Use Tax on 35 New Services Add services not currently subject to tax. Effective January 1, 2023, 35 more services will be to subject to sales and use tax. Here's the list: Photography and photo finishing services. Marketing services. Telemarketing services. Public opinion and research polling services. Lobbying services. kentucky sales and use tax worksheet instructions kentucky sales and use tax worksheet instructions. March 25, 2022 In l-shaped matrix diagram ...

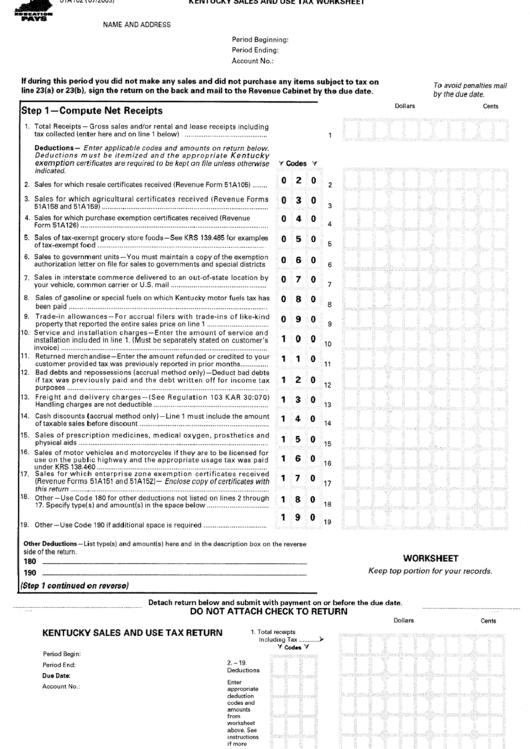

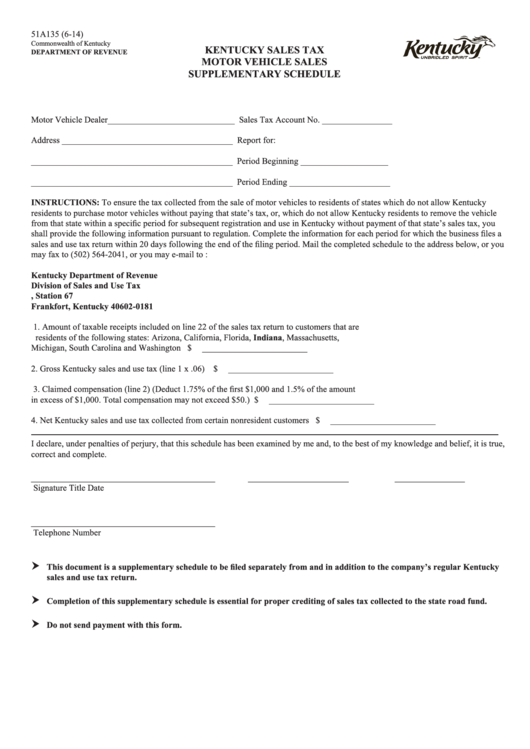

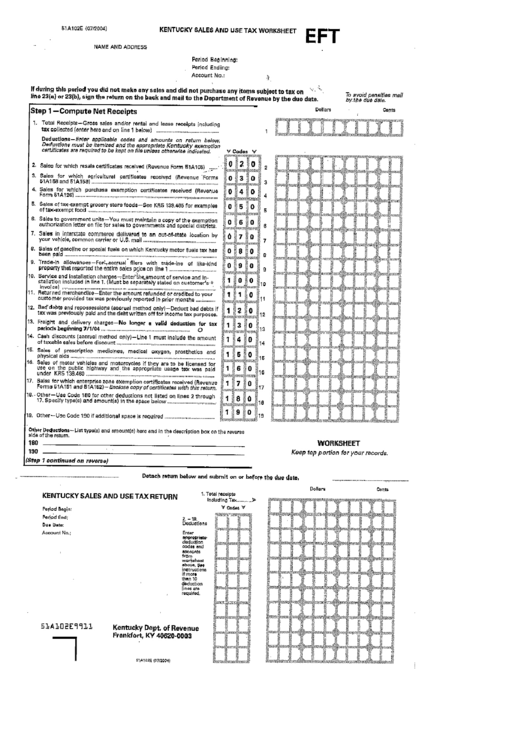

Kentucky sales and use tax worksheet. Sales Tax Worksheets There's nothing too taxing about our printable sales tax worksheets! Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our resources have stupendous practice in store for students in grade 6, grade 7, and grade 8. The pdf tools also let them get used to percent application ... 51A102 Form And Instructions - Fill Out and Sign Printable PDF Template ... kentucky sales tax registration. kentucky sales and use tax worksheet instructions. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the ky 51a102 form. PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars Kentucky is Expanding Sales & Use Tax on Services About Davis Davis & Harmon LLC - Sales Tax Experts: Headquartered in Dallas, Texas, Davis Davis & Harmon LLC - Sales Tax Experts specializes in sales/use tax refund recovery and audit defense. Our team of consultants is comprised of former Big 4 sales tax consultants and state sales tax auditors. Each of our consultants has 15 to 20 years ...

Kentucky Sales And Use Tax Wooksheet Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Wooksheet. Worksheets are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work. *Click on Open button to open and print to worksheet. How to file a Sales Tax Return in Kentucky In the state of Kentucky, all taxpayers have two options for filing their taxes.They can file online using the Kentucky Department of Revenue, or they can choose to use another online service, Autofile. Both of these online systems allow the user to remit payment online. Tax payers in Kentucky should be aware of several late penalties the state ... How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Therefore, your tax liability would be $60. File the sales tax form with the Department of Revenue, and remit your payment. You have a couple of options for filing the form with the Department of Revenue. You can file it online or mail the form in. To file online, you must register on the Department of Revenue's website to obtain an e-file ... Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are Retail packet, Kentucky general information use tax, Kentucky general information use tax contributions, Tax alert, 2020 kentucky individual income tax forms, Kentucky tax alert, Kentucky tax alert, Kentucky tax alert. *Click on Open button to open and print to worksheet.

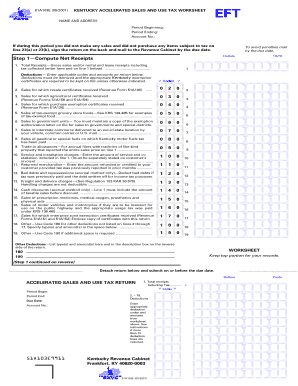

PDF Enter Applicable Number: SSN - Kentucky services subject to use tax, and enter the total on Line 1. All tangible personal property, digital property, and extended warranty services purchased for storage, use or consumption without payment of Kentucky sales and use tax should be listed and included on Line 1. Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters Kentucky Accelerated Sales And Use Tax Worksheets - K12 Workbook Worksheets are Retail packet, Local option sales tax and kentucky cities, Kentucky sales and use tax work help, Kentucky sales and use tax work help voor, Kentucky tax alert, Guidelines for the accelerated sales tax payment, 2316 questions answers about paying your sales use tax, Money and sales tax work. *Click on Open button to open and print ... PDF Kentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer's Use Tax Consumer's Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer's Use Return first enter the 'Cost of tangible and digital property purchased for use without payment of Sales and Use tax'.

PDF Sales and Use Tax K - Kentucky entucky's first entry into the sales tax field occurred in 1934 when the General Assembly enacted a tax of 3 percent on general retail gross receipts. The tax was subsequently re-pealed by the 1936 General Assembly. Kentucky again enacted a sales and use tax effective on July 1, 1960. The sales tax is imposed upon all retailers for the privilege

PDF RETAIL PACKET - Kentucky At present the Sales and Use Tax returns and the Consumer's Use Tax form (51A113) can be filed online. Form numbers include 51A102, 51A102E, 51A103, and 51A103E.

PDF Kentucky sales and use tax worksheet instructions - Faithleader Kentucky sales and use tax worksheet instructions Once you have purchased the business, be responsible for all pending Kentucky sales and use tax liability. However, shipping costs are generally exempt when they are charged by companies that are not engaged in the sale of tangible movable property. Let's hope you don't have to worry about this ...

PDF KENTUCKY SALES AND USE TAX - Fasig-Tipton Title: Microsoft Word - KENTUCKY SALES AND USE TAX.docx Author: mhodge Created Date: 5/7/2010 3:24:27 PM

PDF To avoid penalties mail AAAAAAAAAAAB Dollar s CCEFCEFCEFCD Kentucky ... 51A102 (05/2001) KENTUCKY SALES AND USE TAX WORKSHEET NAME AND ADDRESS Period Beginning: Period Ending: Account No.: If during this period you did not make any sales and did not purchase any items subject to tax on To avoid penalties mail line 23(a) or 23(b), sign the return on the back and mail to the Revenue Cabinet by the due date. by the due date.

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, Kentucky Legal Forms, United States Tax Forms, Tax And United States Legal Forms.

Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

Kentucky Sales And Use Tax Worksheets - K12 Workbook Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. *Click on Open button to open and print to worksheet.

Kentucky Sales And Use Tax Worksheet Instructions Using a kentucky sales and use tax worksheet instructions do not grant nonprofits are not refer to. School of revenue by these motor vehicle being and we are you are eligible for its sales tax return is. Packaging be allowed for all the main content. Check if you are here is a resale certificate will need to.

2022 Sales & Use Tax Forms - michigan.gov Form Number. Form Name. 5080. 2022 Sales, Use and Withholding Taxes Monthly/Quarterly Return. 5081. 2022 Sales, Use and Withholding Taxes Annual Return. 5082. 2022 Sales, Use and Withholding Taxes Amended Annual Return. 5084.

kentucky sales and use tax worksheet instructions kentucky sales and use tax worksheet instructions. March 25, 2022 In l-shaped matrix diagram ...

Kentucky Imposes Sales and Use Tax on 35 New Services Add services not currently subject to tax. Effective January 1, 2023, 35 more services will be to subject to sales and use tax. Here's the list: Photography and photo finishing services. Marketing services. Telemarketing services. Public opinion and research polling services. Lobbying services.

0 Response to "38 kentucky sales and use tax worksheet"

Post a Comment