39 va residual income worksheet

Getting A VA Loan Using Self-Employed Income VA Self-Employed Income Calculation. If your business made $100,000 last year, but you wrote off $50,000 in losses or expenses, lenders will only count the remaining $50,000 as effective income toward a mortgage. Needless to say, that can come as a shock to many prospective borrowers. Debt-to-Income Ratio Calculator for Mortgage Approval: DTI ... Calculate Your Debt to Income Ratio. Use this to figure your debt to income ratio. A back end debt to income ratio greater than or equal to 40% is generally viewed as an indicator you are a high risk borrower. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments & find local lenders.

PDF LOAN ANALYSIS - Veterans Affairs section e - monthly income and deductions. 44. items. 31. 40. 41. 42. spouse borrower. 43. total. approve application reject application $ $ $ gross salary or earnings from employment. deductions € pension, compensation or other net income€ (specify) € total€ (sum of lines 37 and 38) net take-home pay

Va residual income worksheet

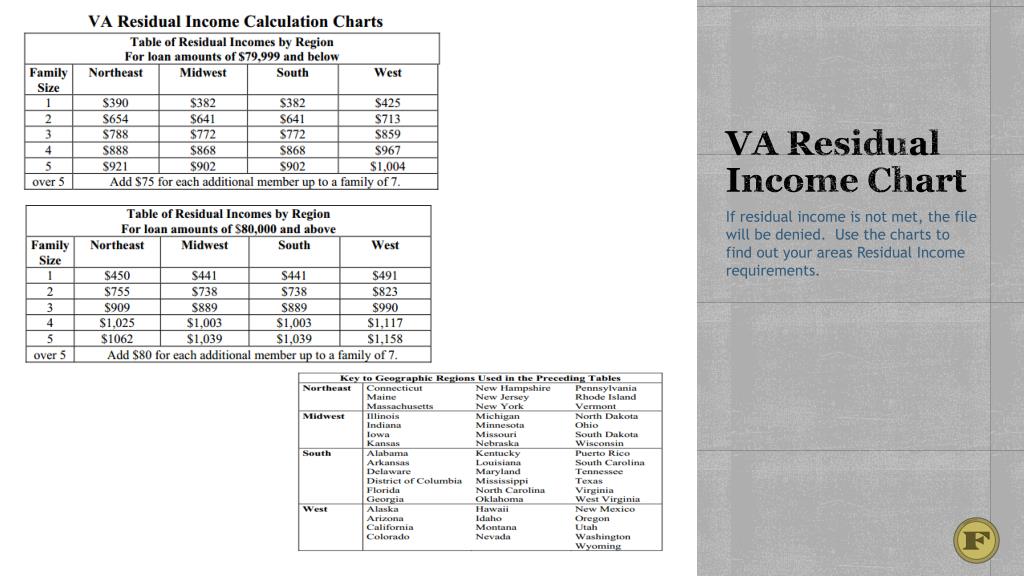

Fha Residual Income Worksheet | Newhomesnf The VA's residual income guideline offers a powerful and realistic way to look at affordability and whether new homeowners have enough income to cover living expenses and stay current on their mortgage. Residual income is a major reason why VA loans have such a low foreclosure rate, despite the fact that about 9 in 10 people purchase without ... VA Mortgage: Residual Income Guidelines For All 50 States For applicants whose residual income exceeds the VA's minimum residual income guidelines by 20% or more, debt-to-income ratios can be a non-factor. >A VA loan borrower in Ohio, then, with a family... VA Residual Income Guidelines - Veteran.com The VA might also refer to your residual income as your "balance available for family support." VA Residual Income Charts Here are the residual income charts for VA loans under $80,000 and VA loans over $80,000. We've further broken each chart down by family size and location. Finance your Dream Home $0 Down and No PMI.

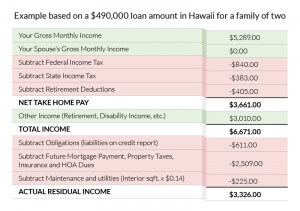

Va residual income worksheet. Chapter 4 Credit UnderwritingOverview - Veterans Affairs b. Debt-to Income Ratio. VA’s debt-to-income ratio is a ratio of total monthly debt payments (housing expense, installment debts, and other obligations listed in section D of VA Form 26-6393, Loan Analysis, to gross monthly income. It is a guide and, as an underwriting factor, it is secondary to the residual income. Residual Income Formula | Calculator (Examples With Excel Template) Residual Income = Operating Income - Minimum Required Rate of Return * Average Operating Assets. Residual Income = $50,000 - 15% * $225,000. Residual Income = $16,250. Therefore, the company is able to generate a residual income of $16,250 during the year. VA Residual Income Calculator | Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense. PDF CBC Residual Income Worksheet - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11.

What Is A Tangible Net Benefit? | Rocket Mortgage 27.01.2022 · If this is the case, you have more residual income after the refinance and it’s considered beneficial. Tangible Net Benefits And FHA Streamline Refinances An FHA Streamline refinance allows those who have an existing Federal Housing Administration (FHA) loan to do a rate/term refinance into another FHA loan for the purposes of a lower interest rate, modified … Residual Income (Definition, Formula) | How to Calculate? Equity Charge = US$4,800,000. Residual Income can be calculated using the below formula as, Residual Income = Net Income of the firm - Equity charge: = US$4,700,500 - US$4,800,000. As seen from the negative economic profit, it can be concluded that AEW has not to earn adequate to cover the equity cost of capital. What Is A Tangible Net Benefit? | Rocket Mortgage Jan 27, 2022 · They have to end up with a higher residual income level to qualify under this test. Tangible Net Benefits And VA Streamline Refinances. VA Streamlines (also referred to as the Interest Rate Reduction Refinance Loans, or IRRRLs) are refinances of existing Department of Veterans Affairs (VA) loans to help lower the interest rate or change your ... Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

VA Residual Income Chart Shows How Much You Need to be VA Eligible VA Residual Income Chart Requirements Three factors determine the minimum amount of residual income you will need to qualify for your loan. These figures come from the Department of Labor's Bureau of Labor Statistics' report called the Consumer Expenditures Survey. 3 Residual Income Factors Loan Size Family Size Region of the Country Va Residual Income Worksheet Pdf Excel Details: Residual Income Worksheet 2 of 3 01/09/2019 INSTRUCTIONS FOR COMPLETING RESIDUAL INCOME WORKSHEET SECTIONS A. GENERAL LOAN INFORMATION Enter loan data and borrower information. SECTION B. MONTHLY INCOME Item SpecialInstructions 5 Enter the applicant's monthly taxable qualifying income (minus any unreimbursed expenses.) How To Calculate VA Residual Income | 2022 Charts How do I calculate VA residual income? To find your approximate residual income, add up your regular monthly living expenses and subtract the total — along with your debt payments — from your gross monthly income. The money leftover after paying living expenses and debt is your residual income, which is also known as your discretionary income. Residual Income - Blueprint Monthly Income Taxes - Taxable Income Amount: $0.00; Suggested Federal Rate: Federal Income Tax: $0.00: Suggested State Rate: State Income Tax: $0.00: Social Security/Medicare: $0.00: Total Income Tax: $0.00: Residual Income Residual Income Amount: $0.00; Adjustment to required residual income

Debt-to-Income Ratio Calculator for Mortgage Approval: DTI … VA: N/A: lender benchmark of 41%; varries by lender: USDA: 29% to 32%, higher with compensating factors: 41%, or 44% with a PITI below 32% : On June 22, 2020 the CFPB announced they were taking steps to address GSE patches which could see the DTI ratio removed as a requirement for qualifying mortgages. They would instead rely on loan pricing …

PDF VA Home Loan Prequalification Worksheet - Learning Library VA Home Loan Prequalification Worksheet . Residual Incomes by Region For loan amounts of $79,999 and below Family Size Northeast Midwest South West 1 $390 $382 $382 $425 2 $654 ... adequate by two considerations: residual income and the debt-to-income ratio If a loan analysis

PDF Working with Ability-to-Repay (ATR/QM) and HOEPA Regulations mortgage-related obligations, income or assets, employment status, simultaneous loans, debt, alimony, child support, DTI or Residual Income, and credit history.' • Appendix B, "Bona Fide Discount Point Assessment Quick Entry Field Definitions", provides field IDs for the fields in the Bona Fide Discount Point

PDF FHA Office of Single Family Housing Financial Assessment Worksheet that was included in the HECM Financial Assessment and Property Charge Guide, which was an attachment to Mortgagee Letter 14-22, dated November 10, 2014. ... SECTION J Residual Income Shortfall Added a section for documenting calculation of Residual Income Shortfall. RESULTS OF FINANCIAL ASSESSMENT

VA Residual Income Chart - How to Calculate Residual Income VA Residual Income Charts The residual income minimums reflect how housing costs and other expenses vary based on family size and where in the country you're buying. That's why larger families in the Northeast and the West need more residual income than similar families in the Midwest and South.

Earnest money check, down payment and closing costs: When are … 28.02.2019 · 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2, 2020 8 Ways To Get A Mortgage Approved (And Not Mess It Up) May 26, 2016 4 ways to keep your ...

PDF Chapter 4 Credit Underwriting Overview - Veterans Affairs 2 Income - Required Documentation and Analysis 4-7 3 Income Taxes and Other Deductions 4-32 4 Assets and Closing Requirements 4-35 ... 8 Automated Underwriting Cases (AUS) 4-56 9 How to Complete VA Form 26-6393, Loan Analysis 4-64 10 How to Analyze the Information on VA Form 26-6393, Loan Analysis 4-70 . VA Pamphlet 26-7, Revised Chapter 4 ...

Property Valuation: Definition & Principles - Study.com 29.11.2021 · What is the maximum amount that can be loaned on a property whose net operating income (NOI) is $500,000 per year, suppose the underwriting criteria is a maximum loan/value ratio (LTV) of 75%, and we

Mortgage-backed security - Wikipedia The total face value of an MBS decreases over time, because like mortgages, and unlike bonds, and most other fixed-income securities, the principal in an MBS is not paid back as a single payment to the bond holder at maturity but rather is paid along with the interest in each periodic payment (monthly, quarterly, etc.). This decrease in face value is measured by the MBS's …

PDF SUMMARY PAGE The figures on this summary must match exactly the final ... INCOME AND DEBT WORKSHEET 01/09/14 Posted 08/20/14 Page 1 of 6 Borrower Name: _____ Loan Number: _____ ... Residual Income Evaluation Attestation RE: Date of Evaluation The undersigned hereby affirms and attests that in connection with the mortgage loan for . Borrower name(s) securing the property located at .

Florida Seller Closing Costs & Net Proceeds Calculator Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if applicable. Click on "Print Column A" to print a nice clean ...

PDF Va Underwriting Checklist VA UNDERWRITING CHECKLIST _____ VA Disclosures ___ VA 26-1880 Request for Certificate of Eligibility ___ VA 26-261a Certificate of Veteran Status ___ VA 26-8937 Verification of VA Benefits ___ VA 26-1802a Application Addendum ___ VA 26-0551 Debt Questionnaire ___ VA 26-0503 Federal Collection Policy ___ VA 26-0592 Counseling Checklist

Mortgage-backed security - Wikipedia A net interest margin security (NIMS) is re-securitized residual interest of a mortgage-backed security; A principal-only stripped mortgage-backed security (PO) is a bond with cash flows backed by the principal repayment component of property owner's mortgage payments. There are a variety of underlying mortgage classifications in the pool:

Get Va Residual Income Calculator - US Legal Forms Now, creating a Va Residual Income Calculator takes at most 5 minutes. Our state online blanks and clear guidelines eliminate human-prone errors. Adhere to our simple steps to have your Va Residual Income Calculator prepared rapidly: Find the web sample from the library. Type all necessary information in the required fillable areas.

0 Response to "39 va residual income worksheet"

Post a Comment