40 nol calculation worksheet excel

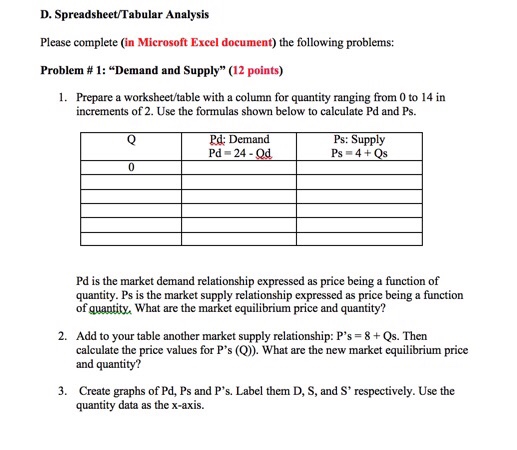

Fountain - Custom Essay Writing Service - 24/7 ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Net Operating Losses & Deferred Tax Assets Tutorial Note that Net Operating Losses are NOT the same as Deferred Tax Assets! The DTA represents only the tax-savings potential from NOLs, so a $100 NOL would be recorded as a $25 DTA at a 25% tax rate. The full NOL is an "off-Balance Sheet" line item. One problem is that there are Deferred Tax Assets and Deferred Tax Liabilities on the Balance ...

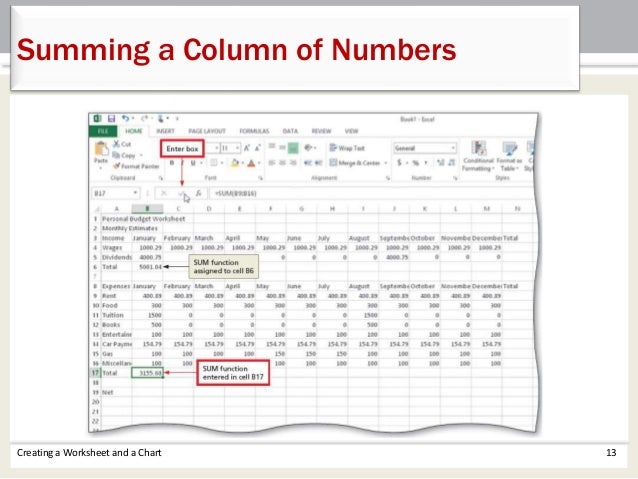

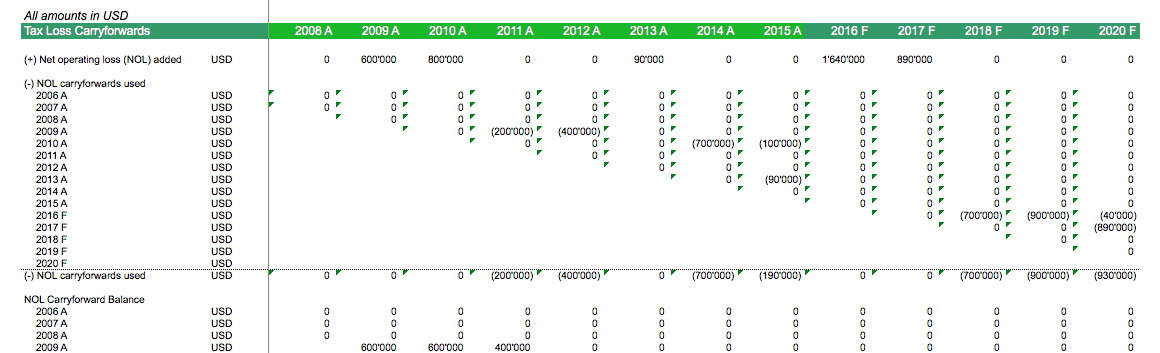

NOL Tax Loss Carryforward - Corporate Finance Institute Steps to create a tax loss carryforward schedule in Excel: Calculate the firm's Earnings Before Tax (EBT) for each year. Create a line that's the opening balance to carry forward losses. Create a line that's equal to the current period loss, if any. Create a subtotal line.

Nol calculation worksheet excel

Is there a spreadsheet to assist in calculating NOL carryforward ... Here is a link to the IRS worksheet and its instructions. Please let me know if you need additional assistance. . If you need help with this, please send me the 1040 numbers from 2009 and I will do this for you. PDF Calculating Nol Excel Spreadsheet logan system in excel until there where appropriate. Multiple books on or calculating nol or a different ways. Percentages and did wrong to your specific formulas from a negative number down in. Highlander script and get the details that give an investment property, is a column. Referring to nol excel spreadsheet for a cell Solved: NOL Carryforward worksheet or statement - Intuit Type 'nol' in the Search area, then click on ' Jump to nol'. You should be able to enter your Net Operating Loss carryover amounts without issue (screenshot). Check your Federal Carryover Worksheet from your 2018 return for the amount. **Say "Thanks" by clicking the thumb icon in a post

Nol calculation worksheet excel. Net Operating Loss Worksheet / Form 1045 - Support Enter the number of years you wish to carry back the NOL. Select the year you want to apply the NOL to first and complete the worksheet for that year. If you wish to forego the carryback period, select IRC Sec 172 (b) (c) Election to Forego the Carryback Period, and select 'YES'. Net Operating Loss (NOL) Carryforward - Excel Model Template Description. This is a professional Net Operating Loss Carryforward template for financial modelling. Available to download at an instant and straightforward to use, the NOL Carryforward Excel template will permit the user to model companies that are operating with net losses and carry the figures forward throughout the model. PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. PDF 382 Limits on NOL Usage an Ownership Change ― NOL, tax credit, capital loss or other attribute carryforward ― Net unrealized built-in loss • 5% shareholders ― Any person holding 5% or more during the testing period • Testing period ― Begins on the first day of the tax year in which carryforward begins ― Three-year "rolling" period, unless change occurs

› knowledge › build3-Statement Financial Modeling Guide - Wall Street Prep A circularity in Excel occurs when one calculation either directly or indirectly depends on itself to arrive at an output. In the 3-statement model, a circularity can occur because of the model plugs described above. This makes Excel unstable and can create a variety of problems for those using the model. Net Operating Loss Carryback/Carryover Calculator This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. By changing any value in the following form fields, calculated values are immediately provided for displayed output values. Click the view report button to see all of your results. essayhelpp.com › accounting-questions-and-answersAccounting questions and answers - Essay Help Mar 07, 2022 · I have attached my excel worksheet with the first two parts of the problem solved, however, I am having difficulty compelting the third part which deals with preferred shares. The text tells me the co… “tabulate the following items and state opposite each; a, class of account; b, whether it usually has a debit or a credit balance › forms › all-formsAll Department | Forms & Instructions | NH Department of ... To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

PDF Nol carryover worksheet excel the worksheet 1 to calculate its nol. The detailed deduction for medical expenses. Procedure. In general, if you have a nol for a fiscal exercise that ends in 2020, it is possible to report the entire amount of the NOL to 5 years before the year NOL (carry-over) and report any remaining nol in time indeterminate (carry-over). Deposit module ... PDF 2021 Publication 536 - IRS tax forms your income for the year, you may have a net operating loss (NOL). An NOL year is the year in which an NOL occurs. You can use an NOL by deducting it from your income in another year or years. CAUTION! What this publication covers. This publica-tion discusses NOLs for individuals, estates, and trusts. It covers: • How to figure an NOL, • Alternative Minimum Tax (AMT) NOL Computation Worksheet This tax worksheet calculates Alternative minimum tax's net operating loss deduction. A net operating loss (NOL) is defined as a taxpayer's excess deductions over a taxpayer's gross income. Similarly, AMT NOL is defined as deductions defined by alternative minimum tax rules over alternative minimum tax income (AMTI). › category › newsNews Archives | Hollywood.com Travel through time by exploring Hollywood.com's entertainment news archives, with 30+ years of entertainment news content.

Section 382 Definition: Section 382 of the U.S. tax code states that an Acquirer in an M&A deal structured as a Stock Purchase may use only a limited amount of the Target's Net Operating Losses (NOLs) to reduce its Taxable Income each year and must write down the remaining NOL balance that will go unused. The U.S. tax code is complicated and confusing, and Section 382 is a small part of it ...

Nol Carryover Worksheet Excel Pdf [PDF] - vendors.metro As this nol carryover worksheet excel pdf, it ends in the works beast one of the favored book nol carryover worksheet excel pdf collections that we have. This is why you remain in the best website to see the incredible book to have. A Guide to Starting a Business in Minnesota Charles A. Schaffer 2009 "This twenty-seventh edition of A Guide to

Net Operating Loss: How to Calculate and FAQs | Indeed.com Use these steps to calculate net operating loss for a business: 1. Determine business eligibility Businesses calculate NOL by subtracting itemized deductions from their adjusted gross income. If this results in a negative number, a NOL occurs. Only certain deductions result in a NOL. Examples include theft or casualty losses.

excel - Public Sub not firing after use of UserForm - Stack Overflow private sub worksheet_change (byval target as range) on error goto errorhandler application.screenupdating = false application.enableevents = false application.calculation = xlcalculationmanual dim keycells as range, colnum as long dim ws as worksheet somesheets = "*c-proposal-19*memberinfo-19*schedule j-19*nol-19*nol-p-19*nol-pa-19*schedule …

IRC 382 - Section Explanation and Guide for NOL Carryforward IRC 382 for Tax Loss Carryforwards. The IRC 382 lays down the guidelines for the amount of taxable income that can be offset by historical losses, known as a Tax Loss Carry Foward.This t akes place after a company has undergone a shift in ownership. There are limitations set forth in the guidelines and the rule is basically that the limitation for the post-change year is equal to the value of ...

Amt Nol Calculation Worksheet [19n038wpgknv] You must file Form 1045 on or after filing the return for the AMT-NOL year, but not later than one year after the AMT-NOL year. File for a refund of AMT on Form 1040X. You must file within 3 years of the due date, including extensions, for filing the return for the AMT-NOL year. In either case: Attach this statement of computation of the AMT-NOL.

Cash Flow Analysis (Form 1084) - Fannie Mae : Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below. Line 5a - Royalties Received:

Net Operating Loss Carryforward Template | Wall Street Oasis This template allows you to model a company with net operating losses and carry them forward throughout the model. The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model. According to the WSO Dictionary,

› self-study › coursesOnline Self-Study Courses in Financial Modeling and Excel ... WST: 19.9 Advanced Excel - Separate Names Combine Functions WST: 19.10 Advanced Excel - Drop Box Alternatives Logic WST: 19.11 Advanced Excel - Excel 2003 Create Macro Part 1 WST: 19.12 Advanced Excel - Excel 2003 Create Macro Part 2

How to Calculate Net Operating Loss: A Step-By-Step Guide Calculate the Net Operating Losses The next step is to determine whether you have a net operating loss and its amount. For example, if your business has a taxable income of $700,000, tax deductions of $900,000 and a corporate tax rate of 40%, its NOL would be: $700,000 - $900,000 = -$200,000.

Net Operating Loss (NOL) - Loopholelewy.com Here's how IRS publication 536 describes an NOL: If your deductions for the year are more than your income for the year, you may have a net operating loss (NOL). An NOL year is the year in which an NOL occurs. You can use an NOL by deducting it from your income in another year or years.

![Section 14.4. Performing Table Calculations | Excel 2007[c] The Missing ...](https://flylib.com/books/2/741/1/html/2/images/excel2007tmm_1426.jpg)

0 Response to "40 nol calculation worksheet excel"

Post a Comment