42 self employed expense worksheet

How Much Can I Contribute To My Self-Employed 401k Plan? 22/03/2022 · A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan. For 2021, the IRS says you can contribute up to $61,000 in your self-employed 401k plan. The amount … 1099 Taxes Calculator | Estimate Your Self-Employment Taxes As a self-employed individual, you are generally responsible for estimated quarterly tax payments and an annual return. You are responsible for federal and state (if applicable) taxes on your adjusted gross income.So the more tax deductions you can find, the more money you’ll keep in your pocket. Filing an annual return: To file yearly taxes, you’ll need a Schedule Cform.

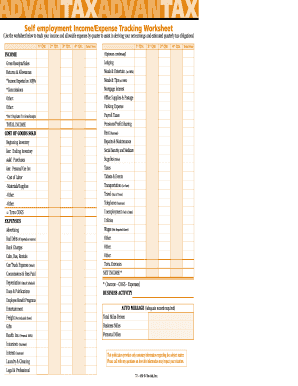

Tax Worksheet for Self-employed, Independent contractors, … Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate. If it goes in the wrong category it does not affect the ...

Self employed expense worksheet

PDF Hockert & Sroga, LLC - Certified Public Accountants - Minneapolis and ... small business/self-employed income and expense worksheet business name federal id # or ssn income gross receipts refunds/returns cost of goods sold -inventory boy / eoy -purchases, labor, materials and supplies other income total gross income expenses advertising car & truck expenses commissions & fees contract labor 15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ... The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula

Self employed expense worksheet. Self-Employment Tax: Everything You Need to Know - SmartAsset 07/01/2022 · SECA established that self-employed individuals would be responsible to pay the whole 15.3% FICA. This tax paid by self-employed individuals is known as the SECA, or more simply, the self-employment tax. Self-Employment Tax Calculation. The second portion of your self-employment tax funds Medicare. The rate for Medicare lands at 2.9%. Unlike ... Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). Tracking your self-employed income and expenses - Viviane Ayala Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software Guide On Self-Employed Bookkeeping With FREE Excel Template One adjustment that needs completing is deducting the owner drawings as it is not an expense of the business. In the example, the sales are 40175.34 and expenses 36754.74 - 8400 = 28354.74. The total profit for the company is 40175.34 - 28354.74 = 11820.60. The business owner will need to pay taxes on the profit.

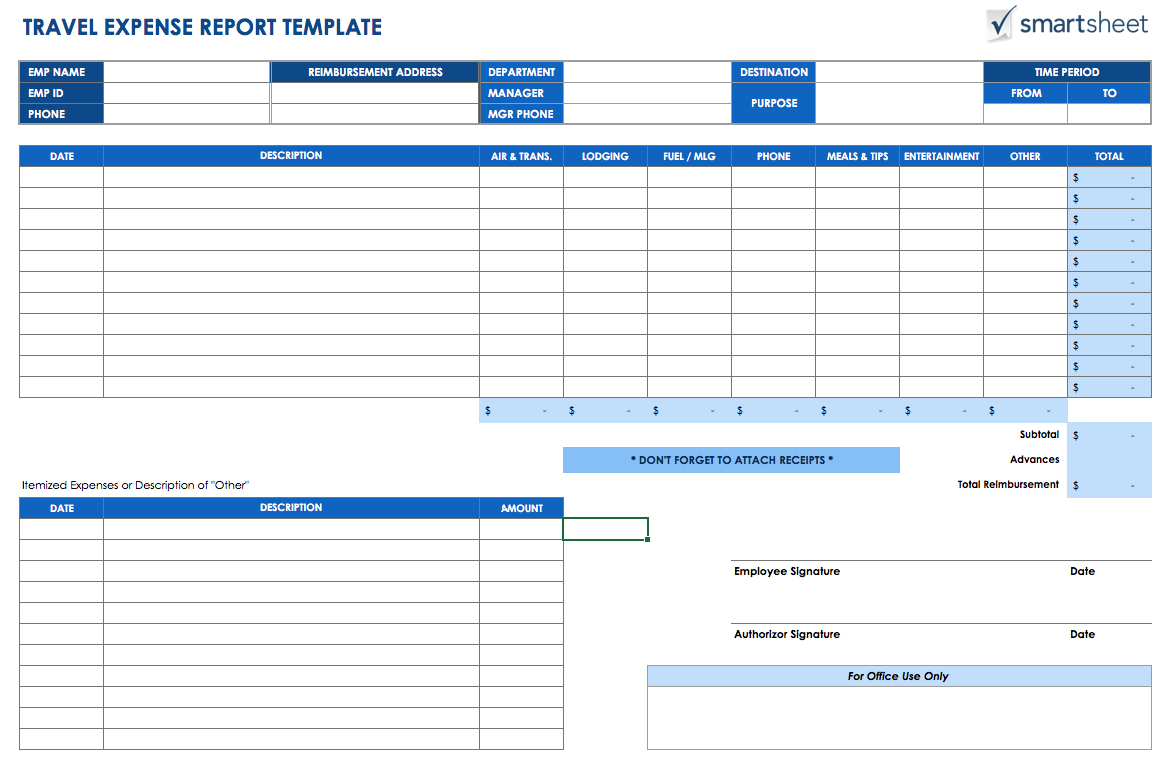

Self Employed Travel and Subsistence – Tax allowable or not? 20/07/2020 · This is a popular topic for our self employed clients… Subsistence includes accommodation, food and drink costs whilst away from the permanent workplace. Subsistence expenditure is specifically treated as a product of business travel and is therefore treated as part of the cost of that travel. The cost of food, drink and accommodation is generally not an … 12+ Business Expenses Worksheet Templates in PDF | DOC self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair. PDF Self Employment Monthly Sales and Expense Worksheet - Wa SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) 3. Expenses List your business expenses for the month. See instruction on page 1 for information on business expenses and what we do not count as a business expense. List additional expenses on a separate sheet of paper if needed. DATE PAID TO EXPENSE TYPE Small Business, Self-Employed, Other Business | Internal … 04/11/2021 · Most self-employed individuals will need to pay self-employment tax (comprised of social security and Medicare taxes) if their income (net earnings from self-employment) is $400 or more. Use Schedule SE (Form 1040), Self-Employment Tax to figure the tax due. Generally, there's no tax withholding on income you receive as a self-employed individual as long as you …

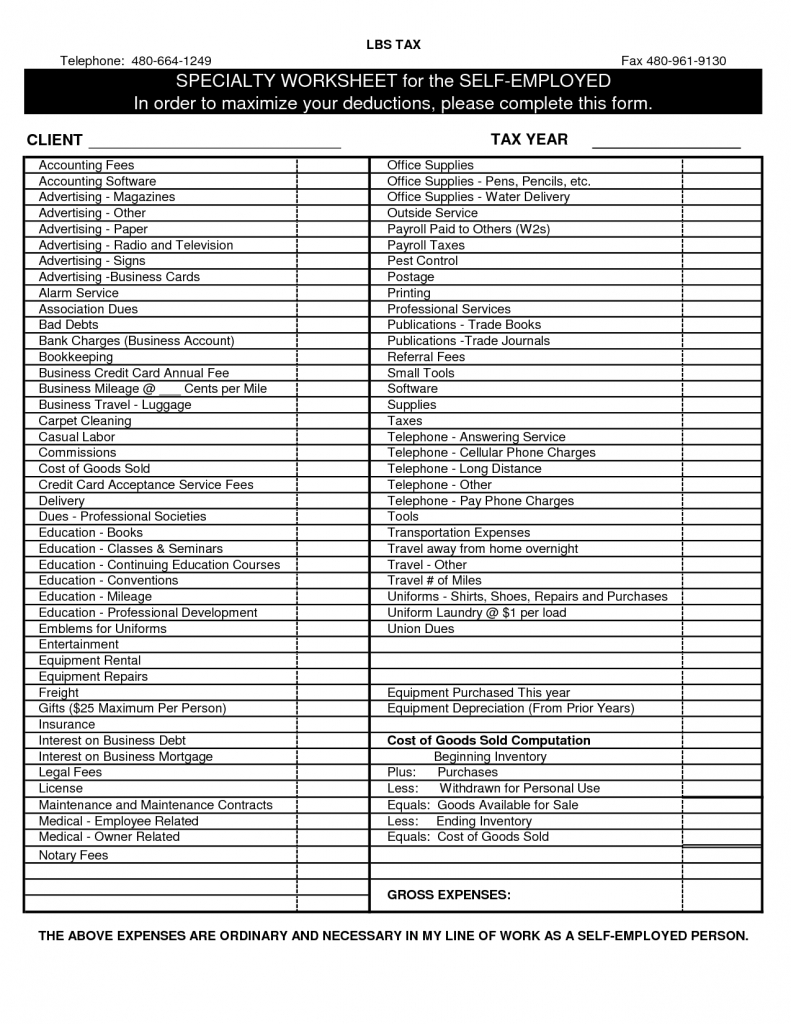

Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your ... (Schedule C) Self-Employed Business Expenses Worksheet ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business.2 pages PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... *Expenses must be ordinary and necessary and have a business purpose. The income and expenses above must be backed by ... Contractor's Deduction Worksheet Author: Peg Hadley Created Date: 2/22/2014 1:56:43 PM ... SELF-EMPLOYED WORKSHEET | NI Direct SELF-EMPLOYED WORKSHEET FOR RATES HOUSING BENEFIT/RATE RELIEF APPLICATION (4.0). Page 1 of 4 ... details of your income and expenses? From. DD/MM/YYYY.4 pages

PDF Self Employed Income/Expense Sheet This form is meant to assist clients with properly catagorizing their income and expenses and nothing more. List on back purchases of: Equipment, Furniture, Vehicles or Leasehold Improvements Mortgage Interest (Paid to Financial Institution) ‐ Business Only Depreciation ‐ If Predetermined (Attach Schedule) SELF EMPLOYED INCOME/EXPENSE SHEET

PDF Self-employed Income and Expense Worksheet INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ $ OTHER BUSINESS INCOME COMMISSIONS $ $ OTHER BUSINESS INCOME INSURANCE (Other Than health) $ COST OF GOODS SOLD INTEREST (Business Loans) $ COST OF INVENTORY AT THE BEGINNING OF THE YEAR $ INTEREST (Business Loans) $

PDF Self-employment Income and Expense Worksheet All expenses should be totaled from actual receipts that can be presented to the CRA in the event of an audit. Need more info? Call or email us, or visit our website at lorennancke.com. Title: Microsoft Word - Worksheet - Self employment income and expenses 2017 (brand typeface).docx

Publication 560 (2021), Retirement Plans for Small Business Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 5. Carryover of Excess SEP Contributions If you made SEP contributions that are more than the deduction limit (nondeductible contributions), you can carry over and deduct the difference in later years.

SELF-EMPLOYMENT WORKSHEET SELF-EMPLOYMENT WORKSHEET. Please provide 3 months of all self-employment gross monthly income and expenses: Applicant Name (First & Last Name).1 page

Schedule C Worksheet Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors. ▻IRS requires we have on file your own information to support all ...1 page

The Ultimate Medical Expense Deductions Checklist - TurboTax 16/10/2018 · Self-Employed Expense Estimator. Estimate your self-employment tax and eliminate any surprises Get started. Dependents Credit & Deduction Finder . Know which dependents credits and deductions you can claim Get started. Crypto Calculator. Estimate capital gains, losses, and taxes for cryptocurrency sales Get started Comenzar en Español. …

Free Income and Expense Tracking Templates (for Excel) It is free and readily accessible online. Step 2: Run the Excel program and select a pre-installed template for tracking personal expenses or spreadsheet. Pre-installed templates can be obtained by clicking the "File" tab and selecting "New" and then select "Sample templates" and choose "Personal Monthly Budget" and finalize by ...

Cash Flow Analysis (Form 1084) - Fannie Mae A self-employed borrower’s share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation, such as Schedule K-1, verifying that the income was actually distributed to the borrower, or the business has adequate liquidity to support the withdrawal of earnings. If the Schedule K-1 provides this

Self-Employed Tax Deductions Worksheet (Download FREE) If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

PDF 2021 Self-Employed (Sch C) Worksheet - cotaxaide.org 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) ... I had more than $35,000 in business expenses I received a Form 1095-A I kept an inventory for my business I need to report a business loss I have assets to depreciate (any > $2,500) I don't use the cash method of accounting ...

Self-employed Individuals - Tax Guide and Template Self-employed Individuals - Tax Guide and Template. As mentioned a few weeks ago, I have prepared an Excel template for self-employed individuals to use to keep better track of their income and expenses. Use of this template will allow tax time to go by much smoother, as all of your expenses will be summarized in a manner that your tax preparer ...

PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

Self Employment Worksheet - First Choice Tax Service Our goal is to make tax filing as simple as possible. Directions: 1. Click on the button below to get the Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person. Download Here Don't Wait Contact Us Here I'm Ready

Self Employed Tax Deductions Worksheet - signNow The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... Open your spreadsheet or worksheet application. Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Once you do that, click on the "Available Templates" option and choose "Blank Workbook". You can include both your income and expense spreadsheets in the same workbook.

0 Response to "42 self employed expense worksheet"

Post a Comment