38 self employed expenses worksheet

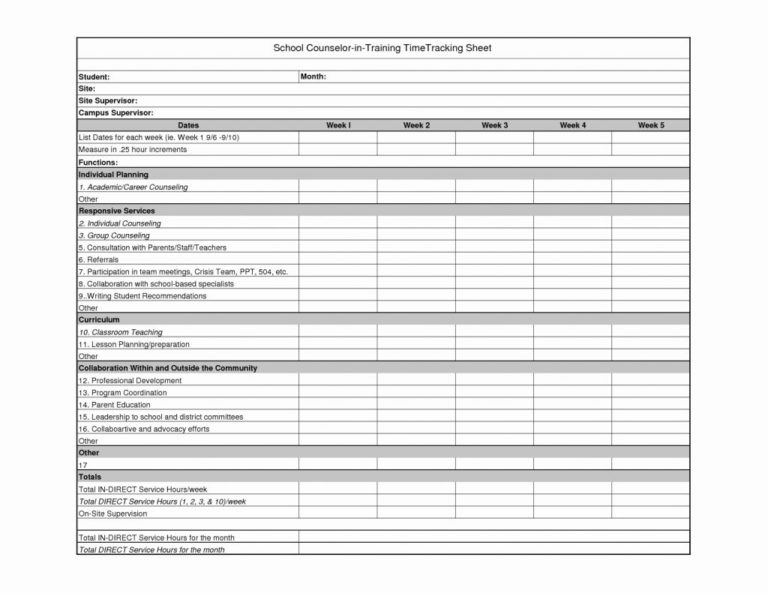

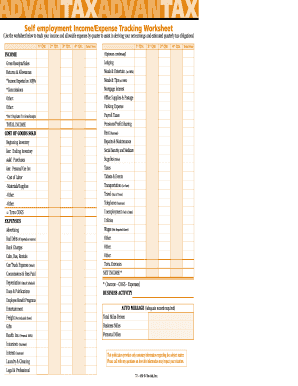

PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it's usually better to just track your actual home expenses. Hopefully, this free worksheet — and the Keeper Tax app — can take the hassle out of expense tracking. {filing_upsell_block}

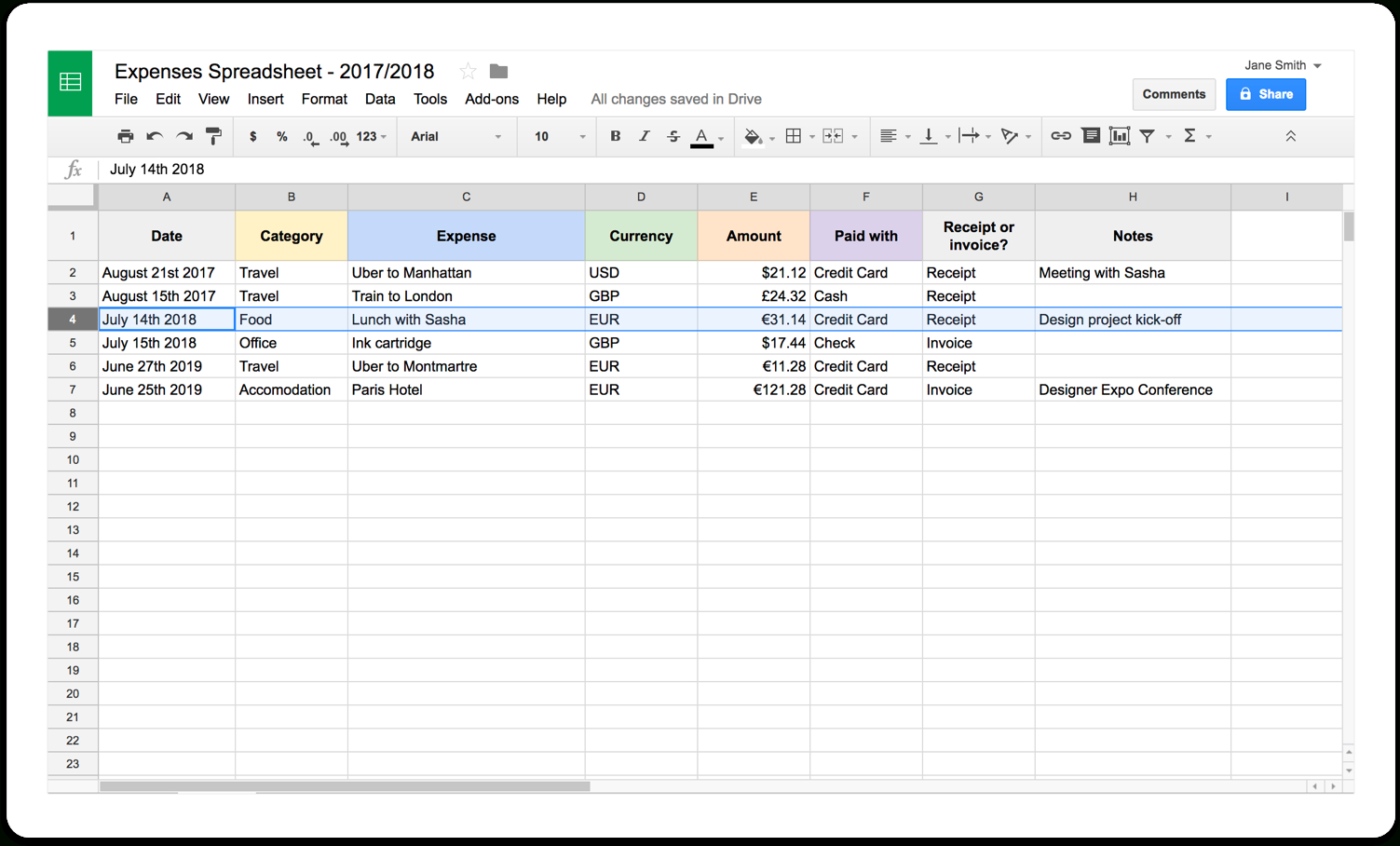

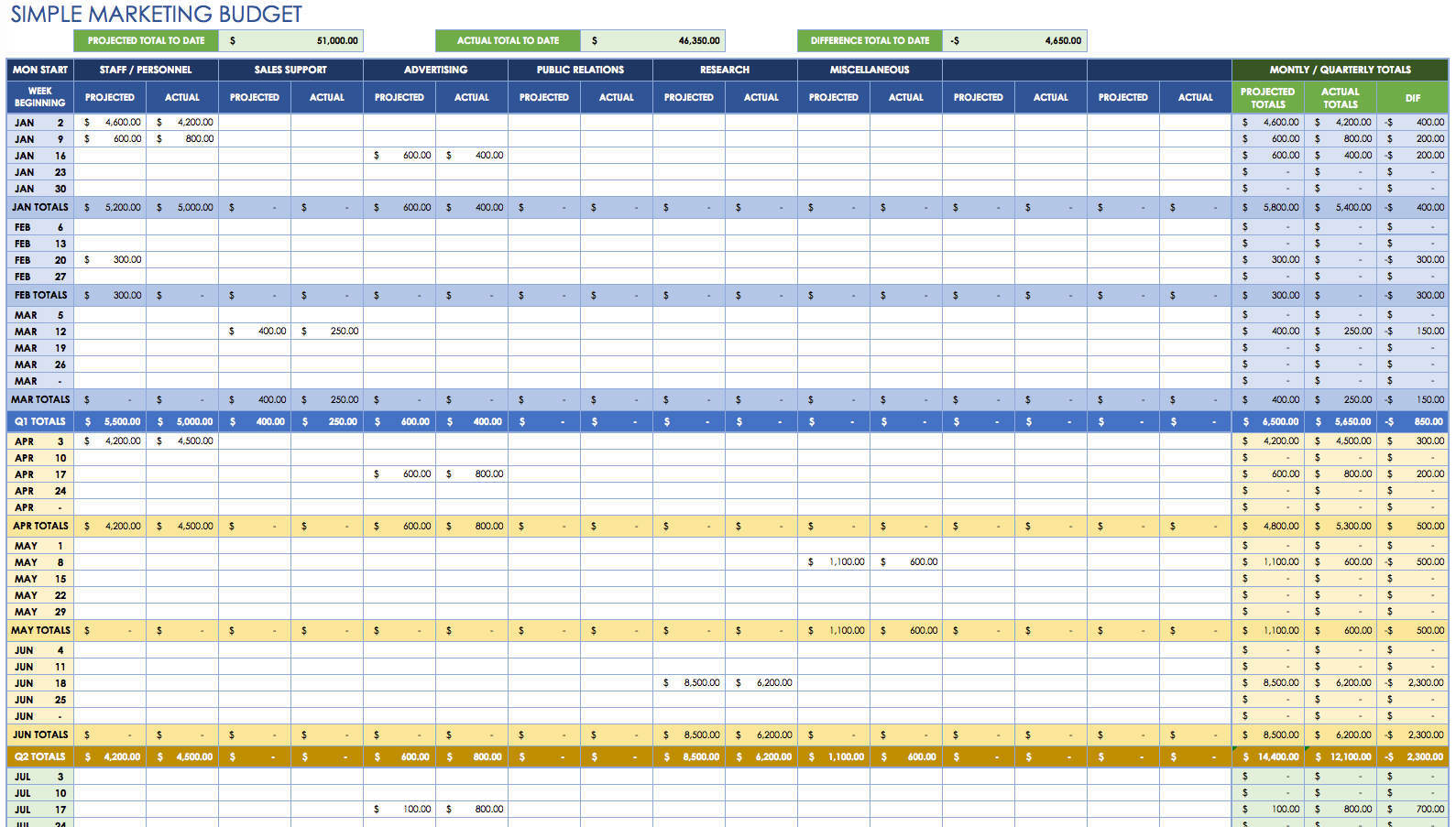

Free expenses spreadsheet for self-employed - Bonsai Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

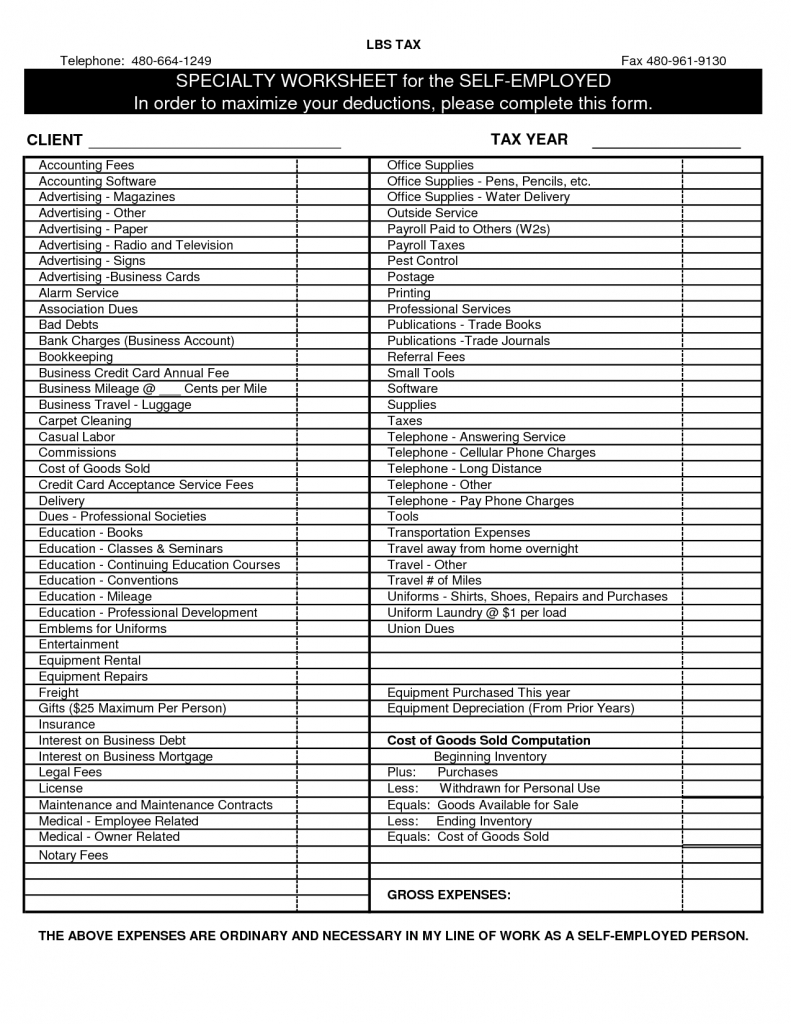

Self employed expenses worksheet

What Is the Self-Employed Health Insurance Deduction? Jun 06, 2022 · The remaining deduction may not be lost—you can claim any premiums you can't deduct as self-employed health insurance as out-of-pocket medical expenses on Schedule A, Itemized Deductions. However, you'll have to itemize deductions to get a benefit, and you only get to deduct out-of-pocket medical expenses that exceed 7.5% of your adjusted ... PDF 2021 Self-Employed (Sch C) Worksheet - cotaxaide.org 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) ... I had more than $35,000 in business expenses I received a Form 1095-A I kept an inventory for my business I need to report a business loss I have assets to depreciate (any > $2,500) I don't use the cash method of accounting ... WORKSHEET FOR DOCUMENTING ELIGIBLE HOUSEHOLD AND REPAYMENT INCOME 10. Disability (Unreimbursed expenses in excess of 3% of annual income per 7 CFR 3555.152(c) and HB-1-3555 Chapter 9.) Calculate and record the calculation of the deduction in the space below. 11. Medical Expenses (Elderly/Disabled households only. Unreimbursed medical expenses in excess of 3% of annual income per

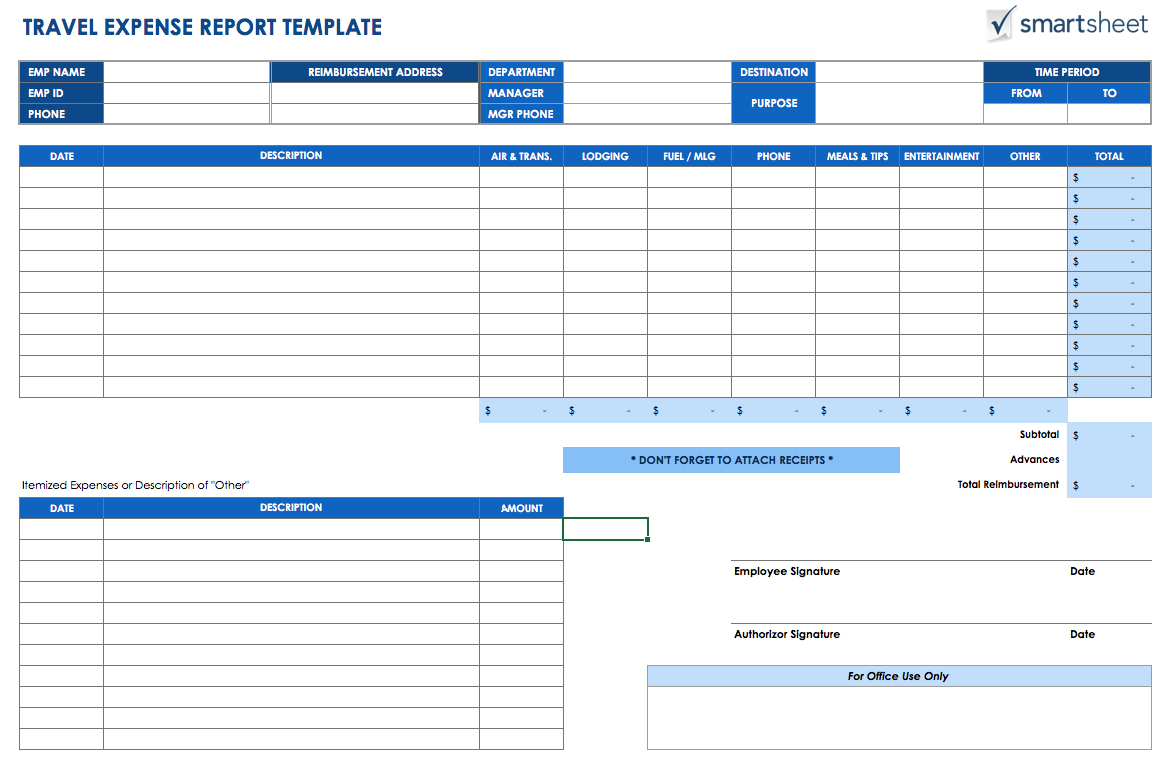

Self employed expenses worksheet. PDF Self Employment Monthly Sales and Expense Worksheet SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) Worksheet Self Employment Monthly Sales and Expense NAME MONTH CLIENT ID NUMBER 1. Self Employment Income You must tell us about your monthly self employment income. • If you provide us copies of your business ledgers or profit and loss statements, you do not PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. ... Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ ... PDF Self Employment Income Worksheet - Tacoma Public Utilities Self Employment Income Worksheet . Self Employed Applicants Name: _____ Home Address: _____ ... Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. 8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... Title the first worksheet as "income" and the second one as "expenses" by right-clicking the tab at the bottom of each worksheet, then selecting the "rename" option, and entering the name. Add the headings for columns You have to do this for all of the columns located in the top row of your daily worksheet .

PDF Schedule C Worksheet for Self Employed Businesses and/or Independent ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ... PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate. PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... *Expenses must be ordinary and necessary and have a business purpose. The income and expenses above must be backed by ... Contractor's Deduction Worksheet Author: Peg Hadley Created Date: 2/22/2014 1:56:43 PM ...

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... Publication 560 (2021), Retirement Plans for Small Business For this reason, you determine the deduction for your own contributions indirectly by reducing the contribution rate called for in your plan. To do this, use either the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed in chapter 5. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in ... Tracking your self-employed income and expenses - Viviane Ayala Worksheets Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

Self Employment Worksheet - First Choice Tax Service Directions: 1. Click on the button below to get the Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person. Download Here.

The Ultimate Medical Expense Deductions Checklist - TurboTax ... Oct 16, 2018 · Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA ...

Self-Employed Individuals – Calculating Your Own Retirement ... Nov 05, 2021 · Plan contributions for a self-employed individual are deducted on Form 1040, Schedule 1 (on the line for self-employed SEP, SIMPLE, and qualified plans) and not on the Schedule C. If you made the deduction on Schedule C, or made and deducted more than your allowed plan contribution for yourself, you must amend your Form 1040 tax return and ...

Complete List of Self-Employed Expenses and Tax Deductions Self-employed professionals face unique challenges when tax season comes around. But because they don't have taxes withheld from their paychecks like traditional workers, they can use deductions to cover their expenses and lower their tax burden. But when it comes to self-employed deductions, the process certainly isn't one-size-fits-all.

Self-Employed Tax Deductions Worksheet (Download FREE) If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

Publications and Forms for the Self-Employed Publication 15-A, Employer's Supplemental Tax Guide PDF. Publication 225, Farmer's Tax Guide. Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C) Publication 463, Travel, Gift, and Car Expenses. Publication 505, Tax Withholding and Estimated Tax.

Cash Flow Analysis (Form 1084) - Fannie Mae Meals Expenses: Deduct the portion of business-related meals and entertainment expenses that have been excluded for tax reporting purposes. These expenses, to the full extent they are incurred, are taken into account; therefore, the portion of these expenses that have been excluded must be identified and subtracted from business cash flow.

PDF SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all self ... ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs

12+ Business Expenses Worksheet Templates in PDF | DOC self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

Expenses if you're self-employed: Overview - GOV.UK Overview If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example...

Get and Sign Self Employed Tax Deductions Worksheet Form The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

PDF Self-employed Income and Expense Worksheet self-employed income and expense worksheet taxpayer name ssn principal business or profession business name employer id number business address business entity (circle one) individual spouse joint business city, state, zip code income expenses $ gross receipts or sales $ advertising $ returns & allowances auto & travel $ $

Self-Employed Borrower Tools by Enact MI We get it, mental math is hard. That's why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrower's average monthly income and expenses. Please note that these tools offer suggested guidance, they don't replace instructions or applicable guidelines from the GSEs.

Guide On Self-Employed Bookkeeping With FREE Excel Template The self-employed bookkeeping template runs from April to March. If your accounting period is 6th April to 5th April, the best advice is to add the end of the year April figures into March. It keeps checking the bank figure much easier. Full instructions on using the cash book template are available here.

0 Response to "38 self employed expenses worksheet"

Post a Comment