43 child tax credit worksheet 2016

California Earned Income Tax Credit and Young Child Tax ... This credit gives you a refund or reduces your tax owed. If you qualify for CalEITC and have a child under the age of 6, you may also qualify for the Young Child Tax Credit (YCTC). Together, these state credits can put hundreds or even thousands of dollars in your pocket. PDF 2016 Form W-4 - UNC Personal Allowances Worksheet. below. The on page 2 further adjust your ... having withheld compares to your projected total tax for 2016. See Pub. 505, especially if your earnings exceed $130,000 (Single) or $180,000 (Married). ... Child Tax Credit, for more information. •If your total income will be less than $70,000 ($100,000 if married ...

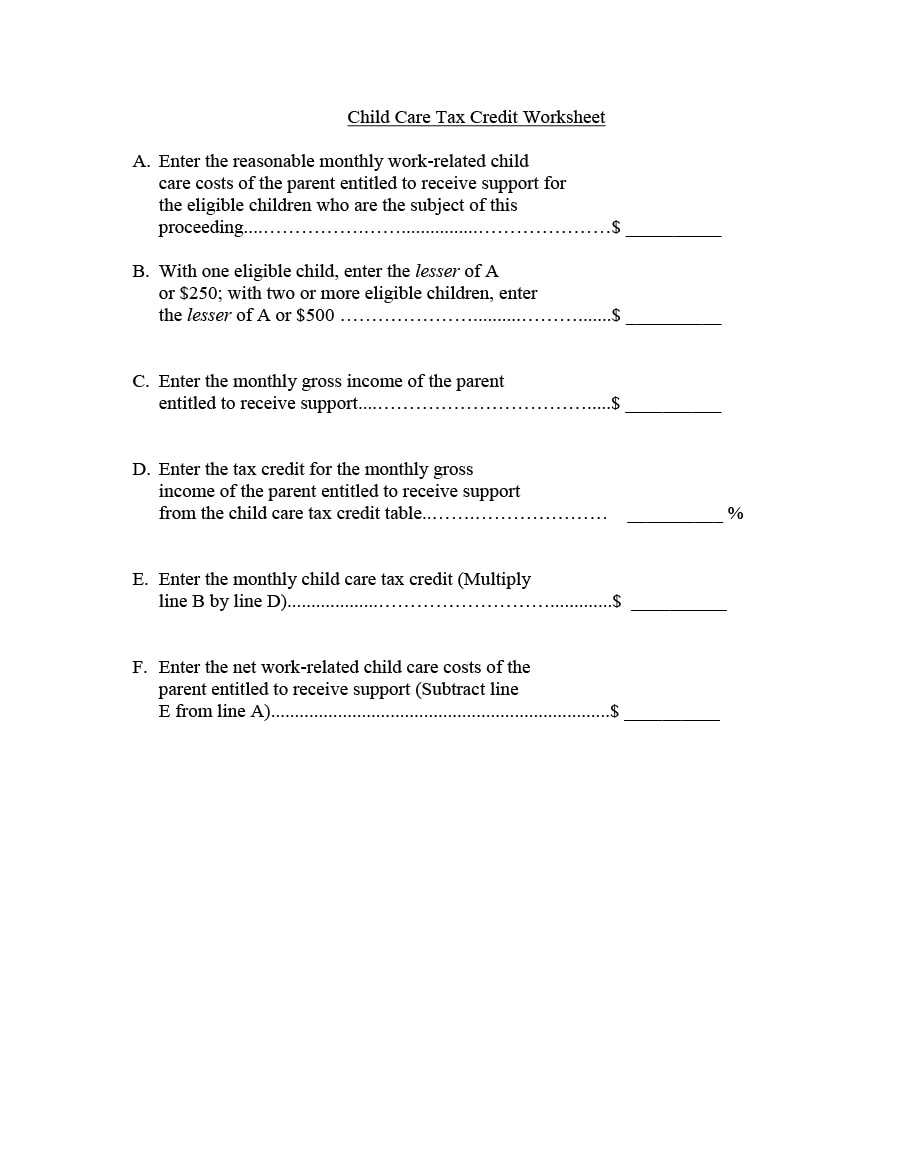

Individual Income Tax Forms - 2019 | Maine Revenue Services Property Tax Fairness Credit and Sales Tax Fairness Credit: Included: Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, Line 20: Included: Tax Credit Worksheets

Child tax credit worksheet 2016

Tax Return Forms | Maine Revenue Services Income/Estate Tax. Individual Income Tax (1040ME) Corporate Income Tax (1120ME) Estate Tax (706ME) Franchise Tax (1120B-ME) Fiduciary Income Tax (1041ME) Insurance Tax; Real Estate Withholding (REW) Worksheets for Tax Credits; Electronic Request Form to request individual income tax forms Get IRS 1040 - Schedule 8812 2016 - US Legal Forms The Child Tax Credit is being doubled for 2018 For 2018, the recently passed GOP tax reform bill doubles the amount of the Child Tax Credit from $1,000 to $2,000 per qualifying child. In other words, if you have one child, you'll be able to claim a $2,000 credit. For two children, your credit is $4,000. 2016 Child Tax Credit2016 Child Tax Credit - IRS Tax Break 2016 Child Tax Credit. This credit is for people who have a qualifying child. It can be claimed in addition to the Credit for Child and Dependent Care expenses. Ten Facts about the 2016 Child Tax Credit. The Child Tax Credit is an important tax credit that may be worth as much as $1,000 per qualifying child depending upon your income.

Child tax credit worksheet 2016. Forms and Publications (PDF) - IRS tax forms Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Form 13424-J: Detailed Budget Worksheet 0518 05/13/2020 Form 14453: Penalty Computation Worksheet 1215 01/06/2016 Form 15110: Additional Child Tax Credit Worksheet 2021 Instruction 1040 - IRS tax forms additional child tax cedit, or recovery rebate credit), such as the r net premium tax credit, health coverage tax credit, or quali ed sick and family leave credits from Schedule H or Schedule SE. Have other payments, such as an amount paid with a equest for r an extension to le or excess social security tax withheld. Owe alternative minimum tax ... PDF Form W-4 (2016) See Pub. 972, Child Tax Credit, for more information. If your total income will be less than $ 70,000 ($100,000 if married), enter 2 for each eligible child; then less 1 if you ... Withholding Allowances for 2016 Form W-4 worksheet in Pub. 505.) . . . . . . . . . . . . 5 $ 6 Enter an estimate of your 2016 nonwage income (such as dividends or ... PDF 2016 Form 1040-ES - Yale University 2016 Estimated Tax Worksheet Keep for Your Records 1. ... 2016 Tax Rate Schedules. Caution: ... Earned income credit, additional child tax credit, fuel tax credit, net premium tax credit, refundable American opportunity credit, and refundable credit from Form 8885 . . . . . . . 13b c.

Printable Maine Income Tax Forms for Tax Year 2021 Adjustments to Tax/Child Care Credit Worksheet. Tax Credit: Get Form 1040 Schedule A: Form 1040-ME Tax Tables. 2021 Income Tax Table & Tax Rate Schedule. Get Form 1040-ME Tax Tables: Schedule B. 2018 Minimum Tax Worksheet for Schedule B. Get Schedule B: Schedule NRH. 2021 Apportionment for Married Person Electing to File Single. Get Schedule ... 2016 Schedule 8812 (Form 1040A or 1040) - IRS tax forms here; you cannot claim the additional child tax credit. If you are required to use the worksheet in . Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication. Otherwise: 1040 filers: Enter the amount from line 6 of your Child Tax Credit Worksheet (see Instructions for Form 1040, line 52). 1040A filers: PDF Earned Income Credit Worksheet - 1040.com $8,300 if you do not have a qualifying child? ($13,850 if married filing joint) $18,200 if you have at least one qualifying child? ($23,750 if married filing joint) Yes. Go to line 9 now. No. Look up the amount on line 7 above in the EIC Table to find your credit. Enter the credit here If you checked "Yes" on line 8, enter the amount from line 6. Instructions for Form 5695 (2020) | Internal Revenue Service If you are claiming the child tax credit or the credit for other dependents for 2020, the amount you enter on line 4 of the worksheet depends on whether you are filing Form 2555. If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub. 972.

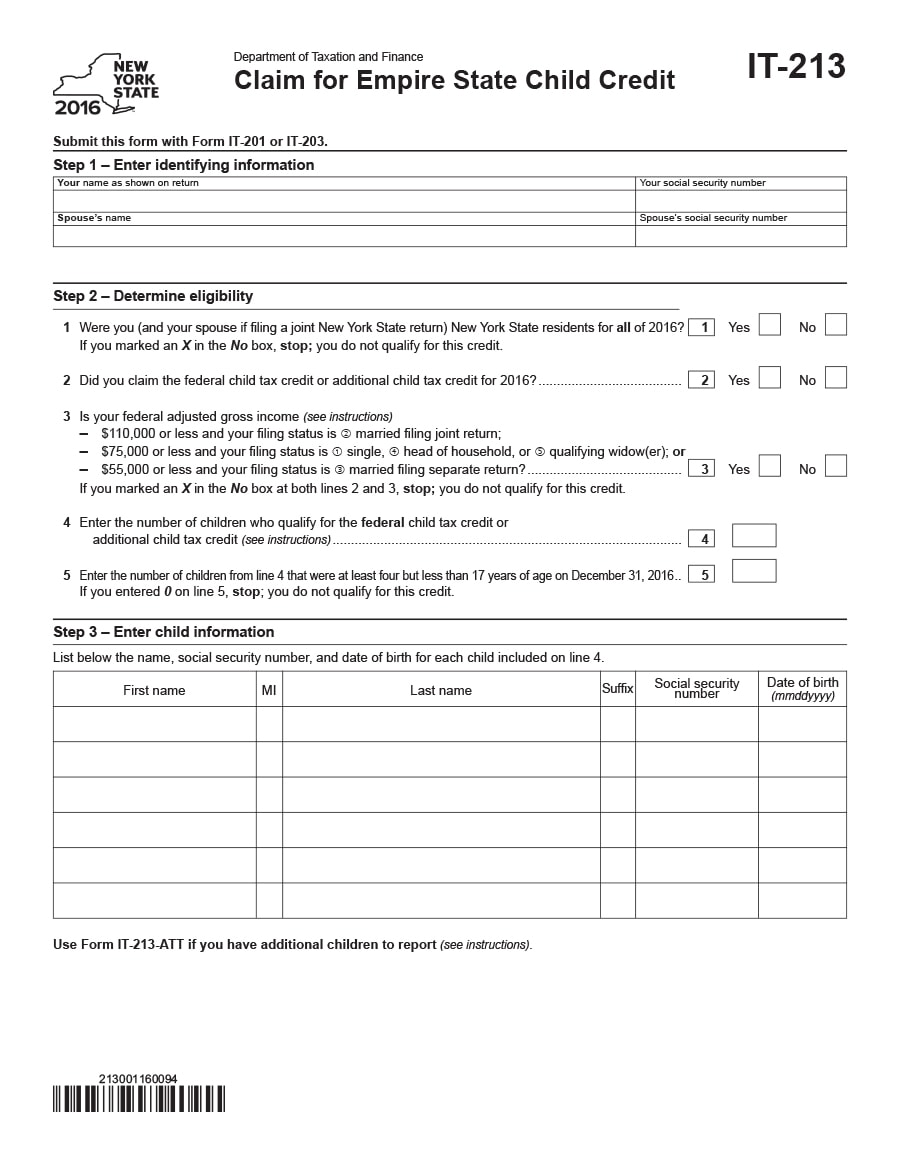

PDF Form IT-216:2016:Claim for Child and Dependent Care Credit:IT216 00refundable portion of your New York State part-year resident child and dependent care credit. 22 . New York City child and dependent care credit If you were a resident of New York City at any time during the tax year and your federal adjusted gross income is $30,000 or less (see Note under New York City credit on page 1 of the instructions ... FAQs About Child Support - KLS - Kansas Legal Services The Kansas Department of Children and Families Child Support Enforcement division can report unpaid child support and attach a Federal or State income tax return due to a payer of child support. The process for contempt of Court (read about it here ) also allows a court to suspend the driver’s license of any person who is behind in support more than 6 months, and has the … PDF D-400TC 2016 Individual Income Tax Credits Other Tax Credits and Computation of Total Tax Credits to be Taken for Tax Year 2016 Credit for Children (Complete the Credit for Children Worksheet in the instructions.) 14. 2016 Individual Income Tax Credits D-400TC Web-Fill 8-16 5. 3. 1. ... you were allowed a federal child tax credit Attach Form NC-478 and any required supporting schedules ... Credit For Children | NCDOR Over $20,000 and up to $50,000. Over $50,000. $125. $100. $0. A part-year resident or nonresident may claim a prorated credit based on the percentage of income that is subject to North Carolina tax. The instructions and the Credit for Children Worksheet are located on Page 17 in the North Carolina Individual Income Tax Instructions (Form D-401).

Tax credits: income working sheet (TC825) - GOV.UK TC825 has been updated to reflect new tax year changes. 6 April 2016. TC825 has been updated to reflect new tax year changes. 6 April 2015. The 2015 to 2016 form has been added to this page. 4 ...

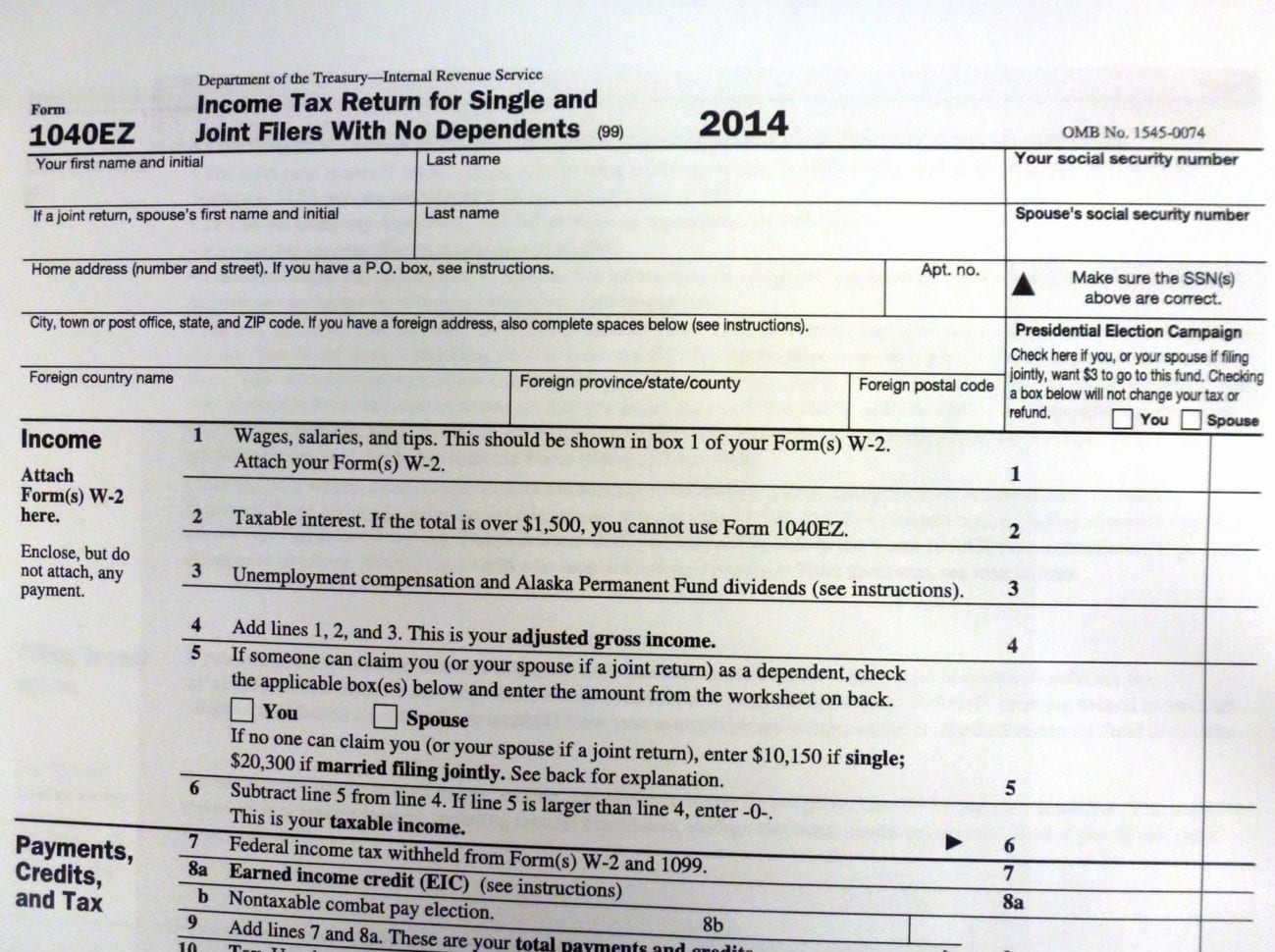

How to Qualify for 2016 Earned Income Tax Credit, Amount Here's how to file your 2016 tax return: Find and download Form 1040 Schedule EIC, Earned Income Tax Credit and other 2016 tax forms. Complete the form (s) on the online editor. Print it out and sign it at the bottom of page 2. Attach any tax documents (i.e. W-2, 1099-MISC, etc.) to your return.

Tax Cuts & Jobs Act (TCJA) | H&R Block Oct 24, 2018 · Child Tax Credit Increased . Starting in 2018, the TCJA increases the maximum child tax credit from $1,000 to $2,000 per qualifying child. The refundable portion of the credit increases from $1,000 to $1,400 and the earned income threshold for claiming the refundable credit is lowered from $3,000 to $2,500.

Tax Return Forms | Maine Revenue Services Income/Estate Tax. Individual Income Tax (1040ME) Corporate Income Tax (1120ME) Estate Tax (706ME) Franchise Tax (1120B-ME) Fiduciary Income Tax (1041ME) Insurance Tax; Real Estate Withholding (REW) Worksheets for Tax Credits; Electronic Request Form to request individual income tax forms

PDF 2016 Form 3514 California Earned Income Tax Credit 2016 California Earned Income Tax Credit FORM ... Was the child under age 24 at the end of 2016, a student, and younger than you (or your ... Enter amount from California Earned Income Tax Credit Worksheet, Part III, line 6. This amount should also be entered on Form 540, line 75; Form 540NR Long, Line 85; Form 540NR Short, ...

California Earned Income Tax Credit and Young Child Tax Credit … If you qualify for CalEITC and have a child under the age of 6, you may also qualify for the Young Child Tax Credit (YCTC). ... Paid Preparer’s California Earned Income Tax Credit Checklist (FTB 3596) CalEITC worksheet; You may be subject to a $500 penalty if you don’t comply with CalEITC requirements. Federal information.

Turbo Tax miscalculating child tax credit for a de... Email to a Friend. Report Inappropriate Content. Turbo Tax miscalculating child tax credit for a dependent born in 2016. You are right---if your child was under six at the END of 2021 then the CTC for that child should be $3600. If she was six at the end of 2021 then the CTC is $3000. Double check the date of birth you entered for her in My Info.

PDF 2015 Instructions for Schedule 8812 Child Tax Credit the end of the Child Tax Credit Worksheet, complete Parts II-IV of this schedule to fig-ure the amount of any additional child tax credit you can claim. k!-1-Oct 07, 2015 Cat. No. 59790P. ... stantial presence test for 2016, your child may be considered a resident of the United

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 04-07-2022 · A simple tax return is Form 1040 only (without any additional schedules). Situations covered: W-2 income; Limited interest and dividend income reported on a 1099-INT or 1099-DIV; Claiming the standard deduction; Earned Income Tax Credit (EIC) Child tax credits; Student Loan Interest deduction

Child Tax Credit Schedule 8812 | H&R Block Your earned income must be more than $2,500 for 2019. You must have three or more qualifying children. If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of the earned income threshold, $2,500. If you have three or more qualifying children, you can either: Claim a refundable credit of ...

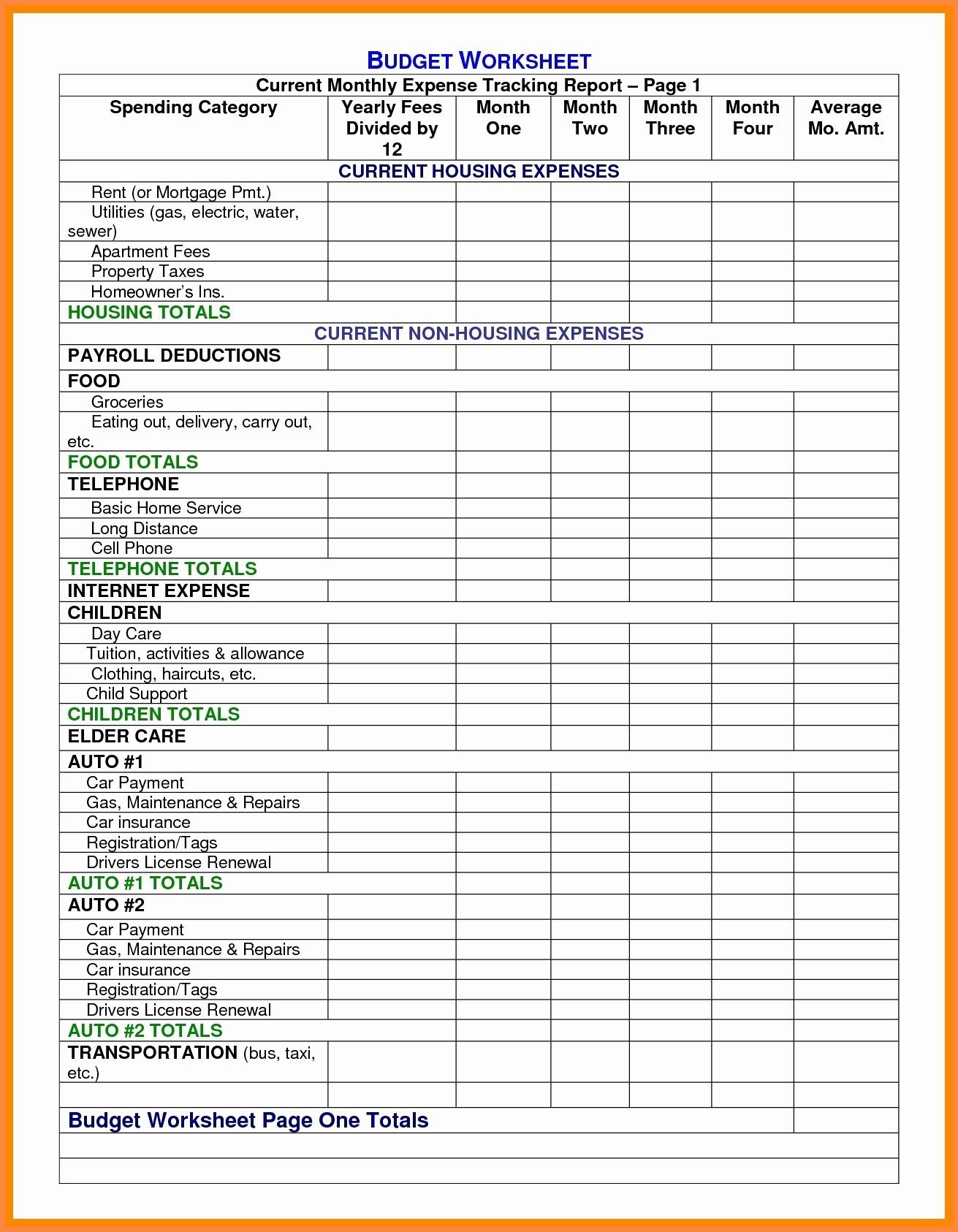

Retirement expense worksheet - Wells Fargo Retirement expense worksheet Monthly Expenses Name: Mortgage or Rent Address: Second Mortgage or Rent ... Maintenance/Repairs Credit Card Licensing/Tags Other Other Holiday Gifts Taxable Birthdays Tax-Deferred Tax-Exempt Other Other Federal State Local Other Monthly Income Amount Salary 1 Salary 2 Pensions Social Security 1

Forms and Instructions (PDF) Additional Child Tax Credit Worksheet 0321 03/22/2021 Form 13424-J: Detailed Budget Worksheet 0518 05/13/2020 ... Form 14453: Penalty Computation Worksheet 1215 01/06/2016 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 « Previous | 1 | Next » Get Adobe ® Reader ...

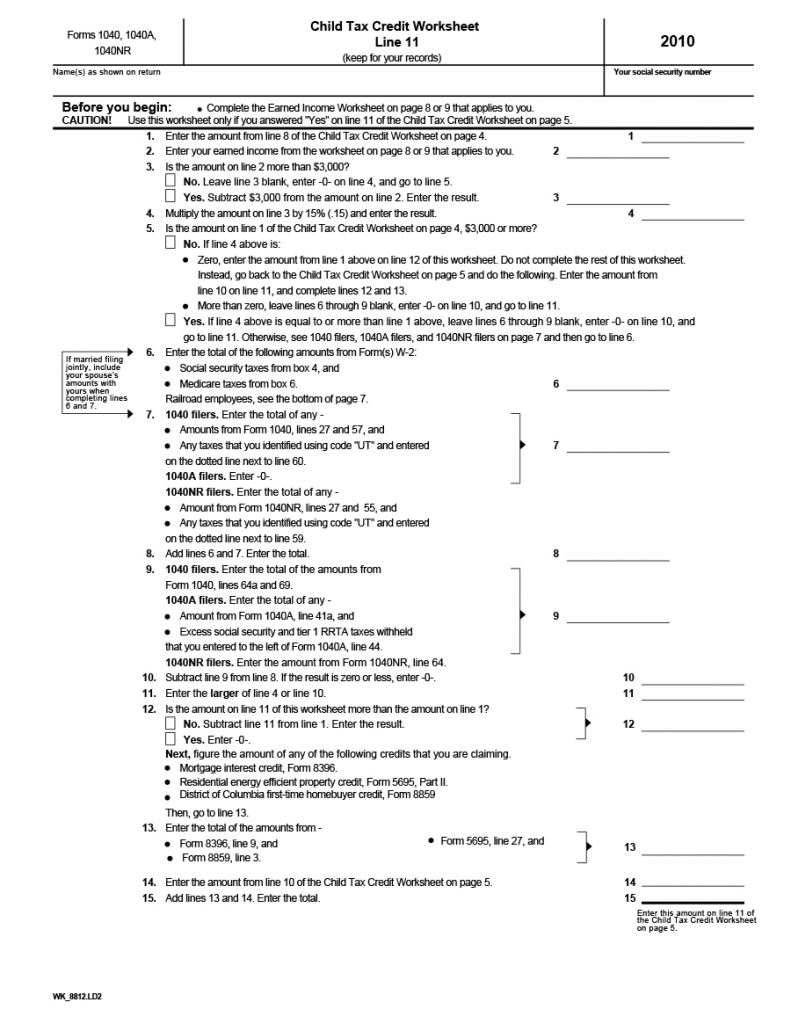

PDF Forms 1040, 1040A, Child Tax Credit Worksheet 1040NR 2016 To be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under Qualifying Child.Also see Taxpayer identification number needed by due date of return, earlier. If you do not have a qualifying child, you cannot claim the child tax credit.

Prior Years 2016 to 2012 - The North American Council on Adoptable Children If you haven't claimed the adoption tax credit for a 2012 through 2016 adoption, you may lose some or all of what you were due. ... Most families will also need to fill out the Child Tax Credit Worksheet in Publication 972 as well as Form/Schedule 8812 if they were claiming the Child Tax Credit and the Adoption Tax Credit in the same year. ...

PDF 2016 Form 3506 Child and Dependent Care Expenses Credit 2016 Child and Dependent Care Expenses Credit CALIFORNIA FORM 3506 Attach to your California Form 540 or Long Form 540NR. Name(s) as shown on tax return. SSN or ITIN. Part I . Unearned Income and Other Funds Received in 2016. See instructions. ... Worksheet - Credit for 2015 Expenses Paid in 2016. 1. Enter your 2015 qualified expenses paid in ...

Tax Calculate Your 2016 Taxes. Complete The Forms Online. The 2016 Tax Calculator and Estimator Will Help You Complete Your 2016 Tax Return Forms online on eFile.com. Estimate Your Taxes Now. 15 Tax Calculators ... Child Tax Credit $ Earned Income Tax Credit (EITC) $ You're Almost Done! * These credits require a calculated amount and not the full expense.

Office of Child Support: Policy listed by Section 6.18 Credit Reporting. Policy Manual: Section 6.18: Credit Reporting; IV-D Memorandums: 2017-010 Revisions to the Notice of Intent to Report Child Support Debt to Credit Reporting Agencies (FEN081) 2016-039 Revised Fair Credit Reporting Act (FCRA) Requirements and Requests to Third-Party Verification of Employment (VOE) Providers

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-03.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-08-232x300.jpg)

0 Response to "43 child tax credit worksheet 2016"

Post a Comment