43 social security worksheet for 1040a

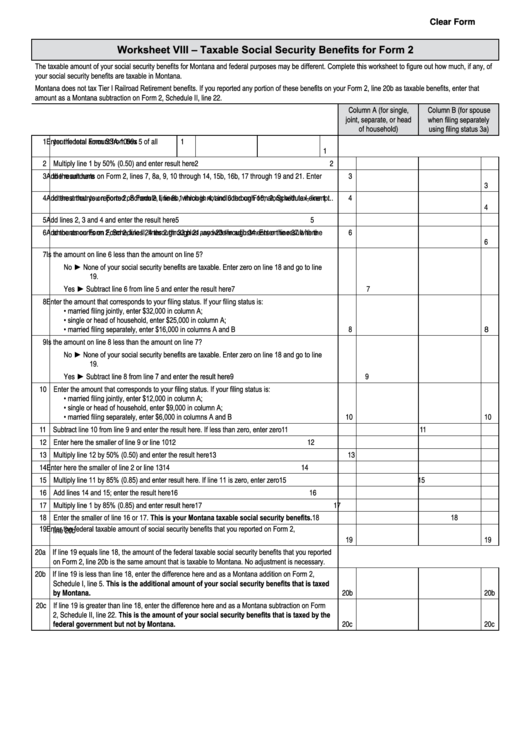

Worksheet to Figure Taxable Social Security Benefits The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Social Security worksheet for Form 1040 Social Security worksheet for Form 1040A The file is in Adobe portable document format (PDF), which requires the use of Adobe Acrobat Reader. 1040a Worksheet - Fill and Sign Printable Template Online | US Legal Forms Find the 1040a Worksheet you require. Open it up with online editor and start adjusting. Complete the empty fields; involved parties names, addresses and numbers etc. Customize the blanks with unique fillable fields. Add the day/time and place your e-signature. Click on Done following twice-checking everything.

PDF Social Security Benefits Worksheet—Lines 14a and Social Security Benefits Worksheet—Lines 14a and 14bKeep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. If you are married filing separately and you lived apart from your spouse for all of 2013, enter "D" to the right of the word "benefits" on line 14a. If you do not, you may get a math error notice from the IRS.

Social security worksheet for 1040a

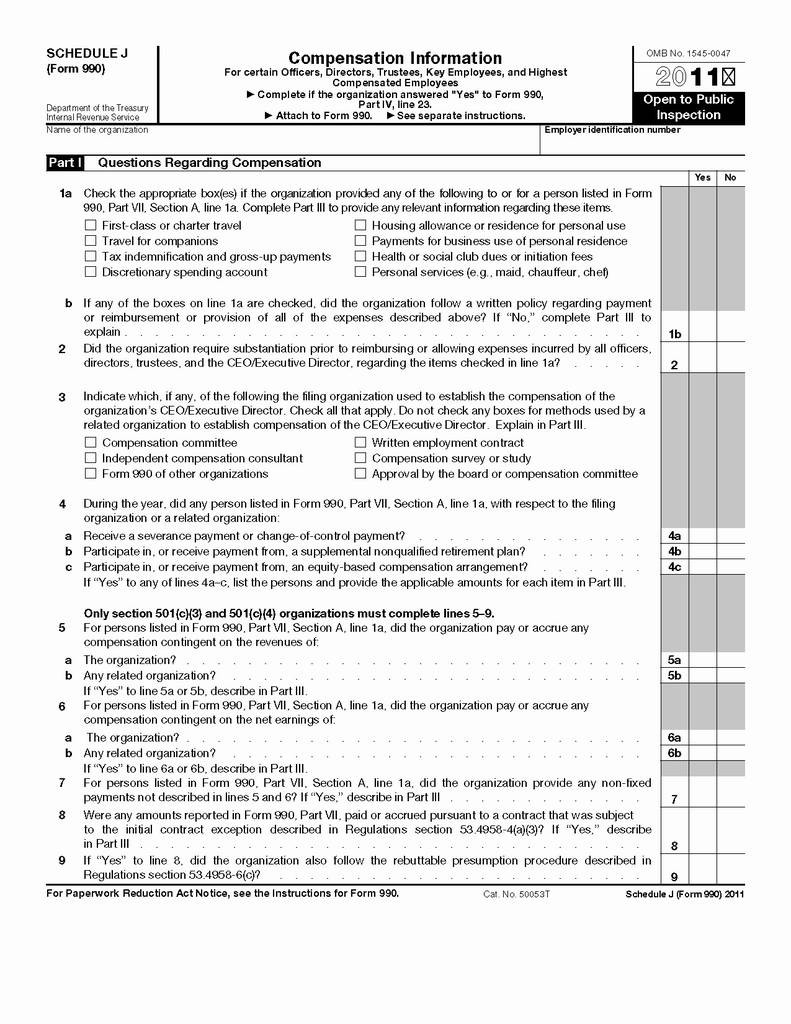

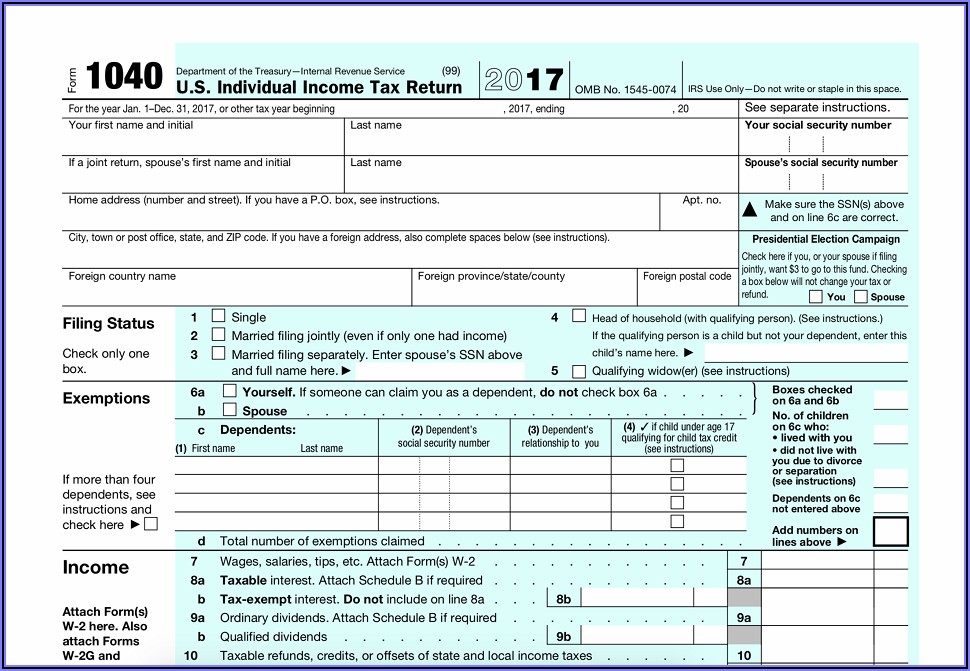

PDF 2017 Form 1040A - IRS tax forms 1040A U.S. Individual Income Tax Return (99) 2017 Department of the Treasury—Internal Revenue Service . OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. Your first name and initial . Last name Your social security number . If a joint return, spouse's first name and initial . Last name . Spouse's social security number PDF Social Security Benefits Worksheet (PDF) - IRS tax forms Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to Printable Federal Form 1040A - Individual Income Tax Printable Federal Income Tax Form 1040A. Form 1040A is the U.S. Federal Individual Income Tax Return. It itemizes allowable deductions in respect to income, rather than standard deductions. They are due each year on April 15 of the year after the tax year in question. For more information about the Federal Income Tax, see the Federal Income Tax ...

Social security worksheet for 1040a. Social Security 1040 Worksheet Form - signNow Worksheet for Taxable Social Security 2020. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get everything done in minutes. ... If filing federal 1040A, use lines 7, 8a, 9a, 10, 11b, 12b, and 13, plus one-half of any Railroad Retirement Social Security benefits from RRB-1099 ... PDF Social Security Benefit Adjustment Worksheet Form CT-1040NR/PY Yes: Complete this worksheet. No: Do not complete this worksheet. Enter the amount of federally taxable Social Security benefits you expect to report on federal Form 1040, Line 20b, or federal Form 1040A, Line 14b, on the 2008 Estimated Connecticut Income Tax Worksheet, Line 2. 1040a - Fill Online, Printable, Fillable, Blank - pdfFiller Fill 1040a, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now! Home; For Business. Organizations; ... Lines 14a and 14b Social Security Benefits Worksheet? Lines 14a and 14b Before you begin: Keep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. ? If you PDF Social Security Benefits Worksheet—Lines 14a and - Taxes Are Easy Social Security Benefits Worksheet—Lines 14a and 14b Keep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. If you are married filing separately and you lived apart from your spouse for all of 2016, enter "D" to the right of the word "benefits" on line 14a.

proconnect.intuit.com › support › en-usEntering 1098-T Tuition Statement, Box 4 adjustments for a ... Feb 10, 2022 · Lacerte will generate an Education Credit Recapture (ECR) Worksheet and carry the recapture amount to the tax line on Form 1040, Line 44 (1040A, Line 28). The amount will be calculated on the worksheet based on the entries made. PDF Social Security Benefits WorksheetLines 14a and 14b Keep for Your Records Social Security Benefits Worksheet—Lines 20a and 20bKeep for Your Records 1. Enter the total amount from box 5 of allyour Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040, lines 7, 8a, 9 through 14, 15b, 16b, 17 through 19, and 21. Do not include amounts from box 5 of Forms SSA-1099 or RRB-1099 3. Add lines 2, 3, and 4 4. 5. PDF Appendix B. Worksheets for Social Security Recipients Who Contribute to ... Use Worksheet 1 to figure your modified adjusted gross income. This amount is needed in the computation of your IRA deduction, if any, which is figured using Worksheet 2. The IRA deduction figured using Worksheet 2 is entered on your tax return. Worksheet 1 Computation of Modified AGI (For use only by taxpayers who receive social security benefits) Michigan Tax Forms 2021 : Printable State MI-1040 Form and MI … 18.04.2022 · Preparation of your Michigan income tax forms begins with the completion of your federal tax forms.Several of the Michigan state income tax forms require information from your federal income tax return, for example. If you have not done so already, please begin with your federal Form 1040.Remember that federal tax Form 1040EZ and Form 1040A have been …

Entering 1098-T Tuition Statement, Box 4 adjustments for a prior … 10.02.2022 · Lacerte will generate an Education Credit Recapture (ECR) Worksheet and carry the recapture amount to the tax line on Form 1040, Line 44 (1040A, Line 28). The amount will be calculated on the worksheet based on the entries made. If there was an adjustment made to tuition in a year when the Tuition Deduction was claimed rather than an Education Credit, the … PDF 2016 Modification Worksheet - Rhode Island 2016 Modification Worksheet Taxable Social Security Income Worksheet 2 Enter your spouse's date of birth, if applicable ... Taxable amount of social security from Federal Form 1040, line 20b or Federal Form 1040A, line 14b..... 11 12 11 Eligible percentage. Enter the percentage from line 10, or 1.0000, whichever applies..... Social Security Taxable Worksheets - K12 Workbook Displaying all worksheets related to - Social Security Taxable. Worksheets are 30 of 107, Social security benefits work forms 1040 1040a, Enacted after we release it will be posted on that, Income calculation work, 2016 modification work, Work vi taxable social security benefits for form 2, Social security benefits work work 1 figuring, 2013 social security benefits work lines 20a and 20b. 2016 Schedule 8812 (Form 1040A or 1040) - IRS tax forms Your social security number . Part I Filers Who Have Certain Child Dependent(s) with an ITIN (Individual Taxpayer Identification Number) ! CAUTION. Complete this part only for each dependent who has an ITIN and for whom you are claiming the child tax credit. If your dependent is not a qualifying child for the credit, you cannot include that dependent in the calculation of …

Social Security Benefits Schedul For 1040 - K12 Workbook Worksheets are 30 of 107, Social security benefits work work 1, Social security benefits work forms 1040 1040a, 2013 social security benefits work lines 20a and 20b, 2017 modification work, 2016 modification work, Appendix work for social security recipients who, 2017 schedule r form 1040a or 1040. ... *Click on Open button to open and print to ...

› TaxForms › IT540Bi(07)Instructions for Nonresident and Part-year Resident (NPR ... Line 8– Social Security benefits – In the box under the Federal column, print the amount of Social Security benefits from your Federal Form 1040A, Line 14b, or Federal Form 1040, Line 20b. Of that Federal amount, print the amount of Social Security benefits earned in Louisiana in the box under the Louisiana column.

PDF Social Security Benefits Worksheet - 1040.com the amount from line 8a of Form 1040 or Form 1040A on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040A or 1040), line 2. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also enter this amount on Form 1040, line 20a, or Form 1040A, line 14a Enter one-half of line 1 Combine the amounts from:

Social Security Taxable Benefits Worksheets - K12 Workbook Worksheets are 30 of 107, Social security benefits work 2018, Social security benefits work forms 1040 1040a, Social security how much is taxable and 4 equivalent, 2013 social security benefits work lines 20a and 20b, Social security benefits work work 1 figuring, Social security and taxes, Benefits children selected by the center may appear in.

› publications › p915Publication 915 (2021), Social Security and Equivalent ... In 2020, she applied for social security disability benefits but was told she was ineligible. She appealed the decision and won. In 2021, she received a lump-sum payment of $6,000, of which $2,000 was for 2020 and $4,000 was for 2021. Jane also received $5,000 in social security benefits in 2021, so her total benefits in 2021 were $11,000.

› forms › federalPrintable Federal Form 1040A - Individual Income Tax Printable Federal Income Tax Form 1040A. Form 1040A is the U.S. Federal Individual Income Tax Return. It itemizes allowable deductions in respect to income, rather than standard deductions. They are due each year on April 15 of the year after the tax year in question. For more information about the Federal Income Tax, see the Federal Income Tax ...

1040 (2021) | Internal Revenue Service - IRS tax forms Social Security Benefits Worksheet—Lines 6a and 6b; Line 7. Capital Gain or (Loss) Exception 1. Exception 2. Total Income and Adjusted Gross Income. Line 10; ... Don't include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2021, or (b) one-half of your social ...

PDF source 12:17 - 3-Jan-2018 - IRS tax forms In addition to receiving social security payments, he received a fully taxable pension of $18,600, wages from a part-time job of $9,400, and taxable interest income of ... Form 1040, line 20a; or Form 1040A, line 14a. Do not use this worksheet if you repaid benefits in 2017 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

North Carolina Tax Forms 2021 18.04.2022 · Remember that federal tax Form 1040EZ and Form 1040A have been discontinued. Seniors age 65 and older have the option of filing federal Form 1040-SR this year. Where can I get North Carolina tax forms? Printable North Carolina tax forms for 2021 are available for download below on this page. These are the official PDF files published by the ...

› tax-forms › michiganMichigan Tax Forms 2021 : Printable State MI-1040 Form and MI ... Apr 18, 2022 · Remember that federal tax Form 1040EZ and Form 1040A have been discontinued. Seniors age 65 and older have the option of filing federal Form 1040-SR this year. Where can I get Michigan tax forms? Printable Michigan tax forms for 2021 are available for download below on this page.

› forms-pubs › about-form-1040About Form 1040, U.S. Individual Income Tax Return Using a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) When Filing Your Tax Return-- 25 JUNE-2021. Unemployment Exclusion Update for married taxpayers living in a community property state-- 24-MAY-2021. Tax Treatment of Unemployment Benefits. Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends-- 06-APR ...

Arizona State Tax Forms tax forms, Arizona tax forms. Start filing your tax return now : TAX DAY NOW MAY 17th - There are -410 days left until taxes are due.: Try our FREE income tax calculator

0 Response to "43 social security worksheet for 1040a"

Post a Comment