38 1040 qualified dividends and capital gains worksheet

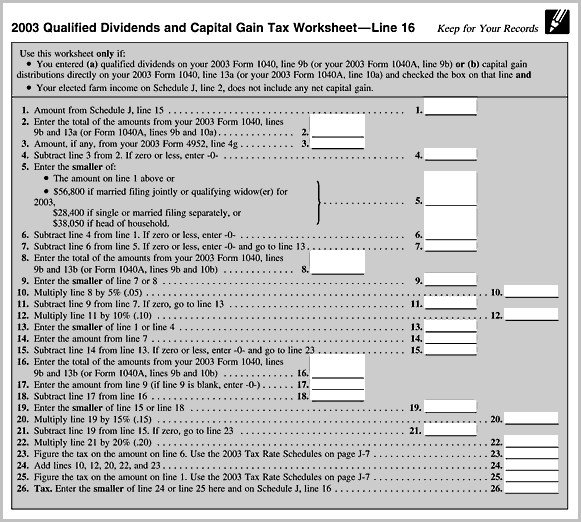

Qualified Dividends and Capital Gains not taxed until over $80,800 - Intuit Form 1040 Line 15 is $156,000, if I deduct the $80,800, net taxable income should be about $75,200, giving me a tax bill of about $9,000. ... We are unable to see your tax return or the Qualified Dividends and Capital Gains worksheet. Qualified Dividends and Capital Gains worksheet segregates your income and taxes the income at the 0%, 15%, 20% ... How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

1040 qualified dividends and capital gains worksheet

Qualified Dividends and Capital Gain Tax Worksheet Blank Form 1040 Blank Schedule 1 Blank Schedule B Blank Qualified Dividends and Capital Gain Tax Worksheet (ignore 2019 year and treat as 2020 Step 3: Complete Schedule B first, then Schedule 1, then Form 1040 down through Line 10. Then complete the Qual Div worksheet and use that information to complete the rest of the Form 1040 PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Capital Gains and Losses ... Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Gain Qualified Capital Tax Form Worksheet Dividends And Cash distributions from C-corporations are typically qualified dividends and generate taxable dividend income Similarly, for the 2020 tax year, the capital gains rate, is the same as 2018 but the brackets changed slightly due to inflation 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your ...

1040 qualified dividends and capital gains worksheet. Qualified Dividends and Capital Gains Worksheet - StuDocu Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. Before you begin: 1. Enter the amount from Form 1040 or 1040-SR, line 11b. Qualified Dividends Tax Worksheet - Fill Out and Use - FormsPal The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form. Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ...

› pub › irs-newsQualified Dividends and Capital Gain Tax Worksheet: An ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative Qualified Dividends And Capital Gains Worksheet (PDF) - 50.iucnredlist qualified-dividends-and-capital-gains-worksheet 1/4 Downloaded from 50.iucnredlist.org on August 25, 2022 by guest Qualified Dividends And ... 1040 or 1040-SR, line 3b 6b. Qualified dividends Form 1040 or 1040-SR, line 3a 6c. Dividend equivalents See page 9 7. Royalties Schedule E smartasset.com › taxes › dividend-tax-rateThe Dividend Tax Rate for 2021 and 2022 - SmartAsset Jan 07, 2022 · So let’s say you’re single and have $150,000 of annual income, with $10,000 of that being dividends. Your dividends would then be taxed at 15%, while the rest of your income would follow the federal income tax rates. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. For 2021, these rates remain ... Qualified Dividends and Capital Gains Worksheet.docx Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the boxon Form 1040 or 1040-SR, line 6. 1. Enter the amount from Form 1040 or 1040-SR, line 11b.

PDF Page 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ... 2018 Qualified Dividends Worksheets - K12 Workbook 2018 Qualified Dividends. Displaying all worksheets related to - 2018 Qualified Dividends. Worksheets are 2018 form 1041 es, 2018 form 1040 es, 2018 estimated tax work keep for your records 1 2a, 44 of 107, Pacific grace tax accounting, Qualified dividends and capital gain tax work an, 2017 qualified dividends and capital gain tax work ... › ask › answersHow Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · Dividends are income earned by investing in stocks, mutual funds, or exchange-traded funds, and they are included in your tax return on Schedule B, Form 1040. Capital gains are the amount an asset ...

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Form Worksheet Capital Gain Tax And Dividends Qualified For tax year 2020, the standard deduction is $24,000 for joint filers and $12,000 for singles The schedule D Tax worksheet D For example, if the tax of capital gains T cg is 35%, and the tax on dividends T d is 15%, then a £1 dividend is equivalent to £0 More Alerts and Bulletins The Schedule D tax worksheet helps investors figure out the ...

Qualified Dividends And Capital Gain Tax Worksheet: Fillable, Printable ... Qualified Dividends And Capital Gain Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit Your Qualified Dividends And Capital Gain Tax Worksheet Online Free of Hassle Click the Get Form button on this page. You will be forwarded to our PDF editor.

Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Now, working with a Qualified Dividends And Capital Gain Tax Worksheet 2019 takes a maximum of 5 minutes. Our state web-based blanks and clear guidelines eliminate human-prone errors. Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue.

› tax-form › 10402021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Standard Deduction Worksheet for Dependents (Line 12a) Student Loan Interest Deduction Worksheet; Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes. When published, the current year 2021 1040 PDF file will download.

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

Qualified Dividends and Capital Gains Worksheet (Sheehan, L.).docx Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the boxon Form 1040 or 1040-SR, line 6. 1. Enter the amount from Form 1040 or 1040-SR, line 11b.

0 Response to "38 1040 qualified dividends and capital gains worksheet"

Post a Comment