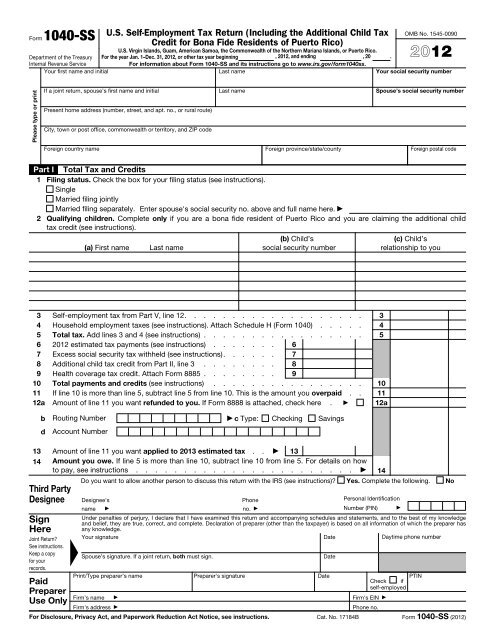

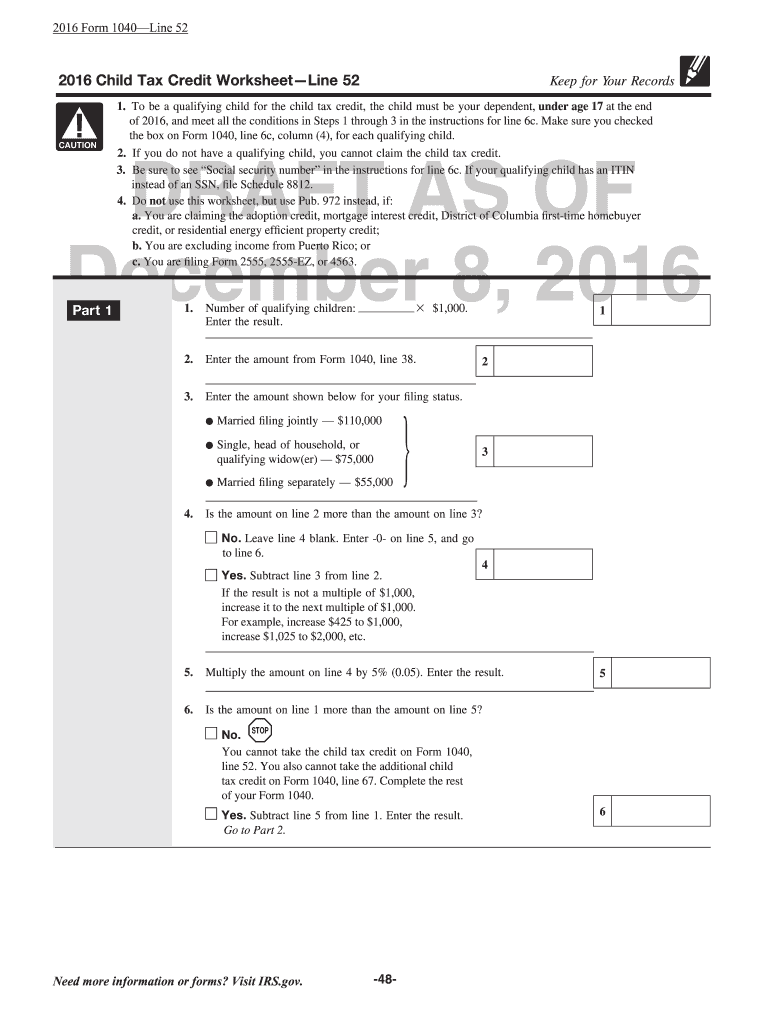

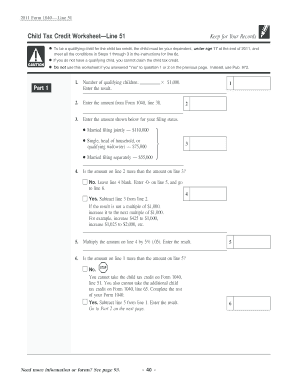

38 2012 child tax credit worksheet

Individual Income Tax Forms - 2019 | Maine Revenue Services Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, Line 20: Included: Tax Credit Worksheets: Worksheets for Tax Credits Claimed on Form 1040ME, Schedule A: Included: Minimum Tax Credit Worksheet (PDF) Calculators and tools - ird.govt.nz Business and organisations Ngā pakihi me ngā whakahaere. Income tax Tāke moni whiwhi mō ngā pakihi; Employing staff Te tuku mahi ki ngā kaimahi; KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi; Goods and services tax (GST) Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha; IRD numbers Ngā tau …

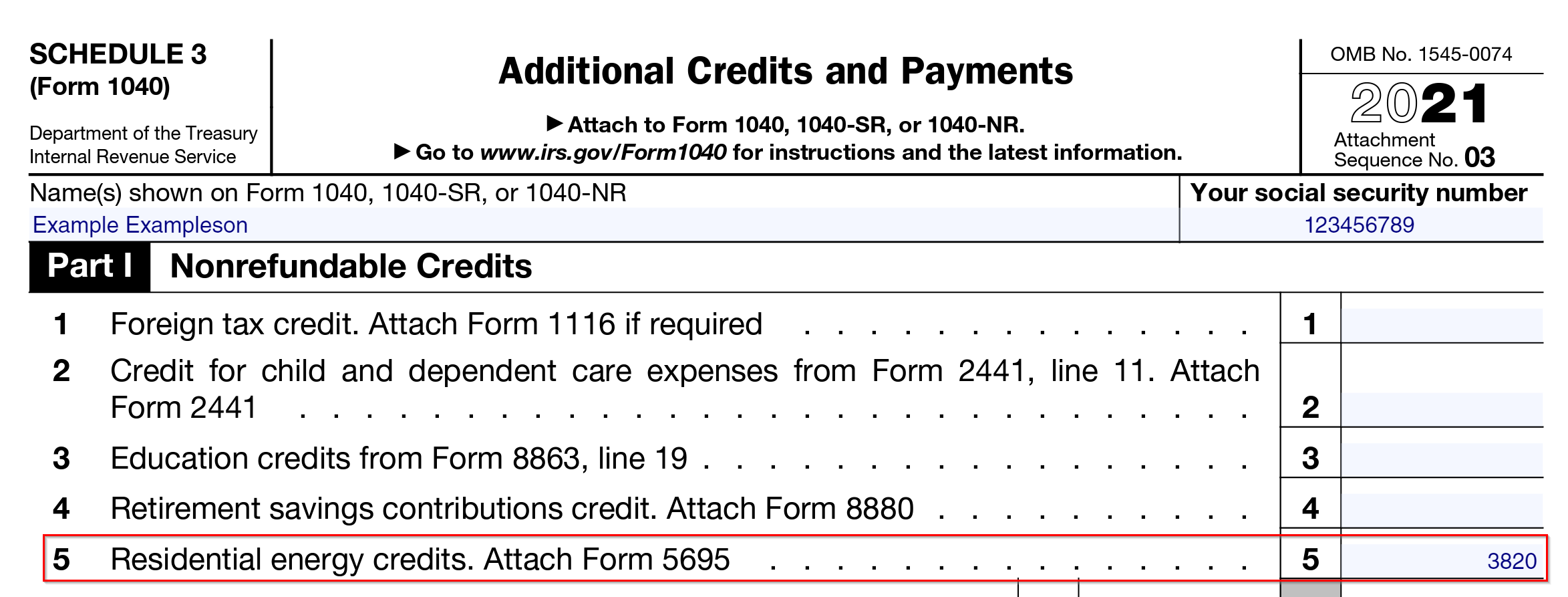

How To Claim The Solar Tax Credit Using IRS Form 5695 23.08.2022 · Line 14 is where it gets tricky. The thing about the solar tax credit is it isn’t “fully refundable,” meaning you can only take a credit for what you would have owed in taxes. This is different from other, fully refundable tax credits like the Child Tax Credit and the Health Coverage Tax Credit. That’s why you use the worksheet below ...

2012 child tax credit worksheet

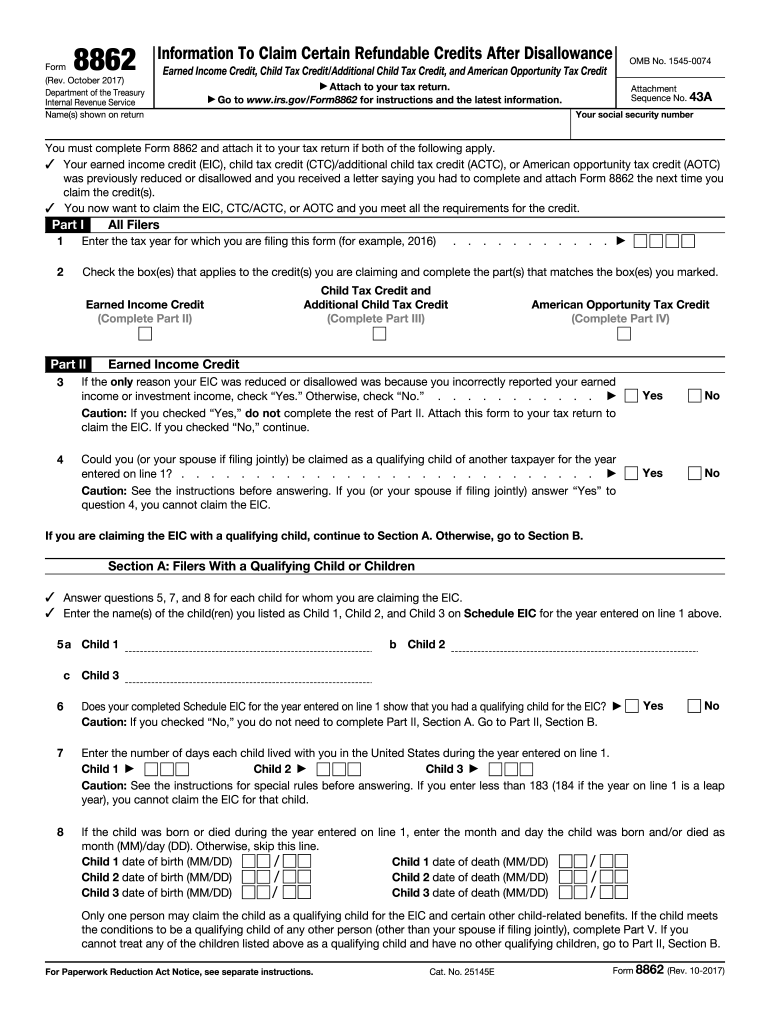

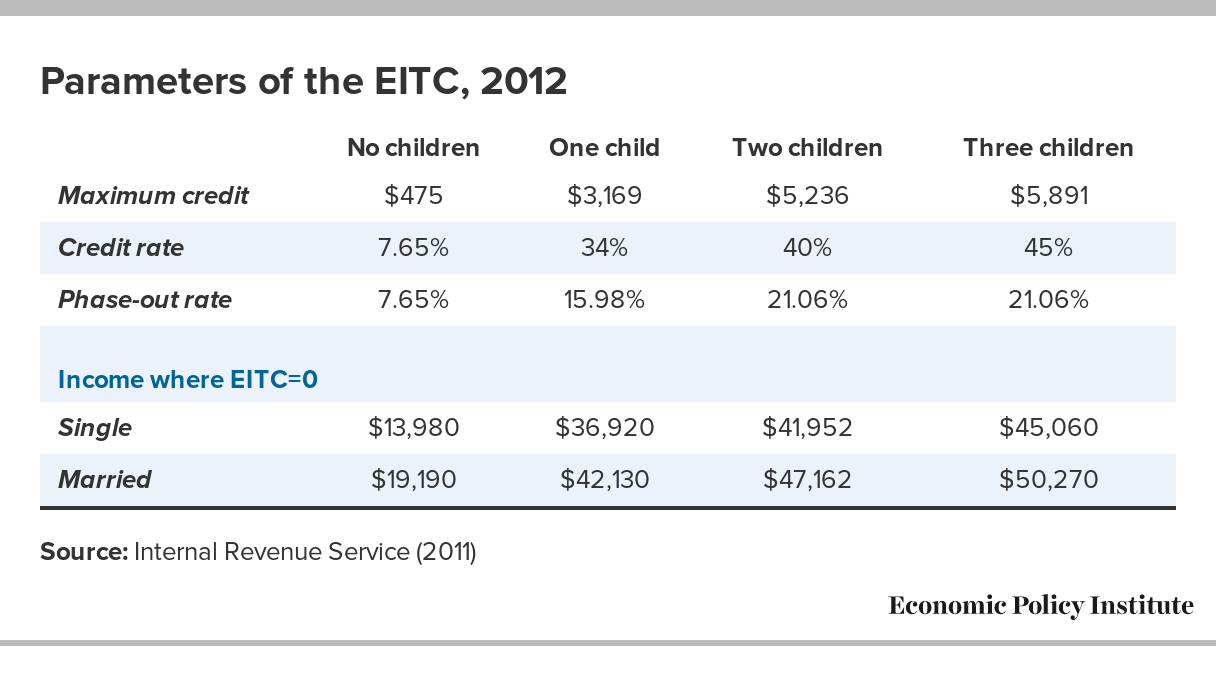

Maryland Tax Form 502 Instructions | eSmart Tax NEW FOR 2013. Inclusive language: We have modified our instructions to use more inclusive language as a result of Maryland's recognition of same sex marriage. Reporting your Federal earned income: If you are claiming a federal Earned Income Credit (EIC), enter the earned income you used to calculate your federal EIC on line 1b. on Form 502. Earned income … The Difference Between Claiming 1 and 0 on Your Taxes - LoanMart All loans will be serviced by LoanMart. See State Disclosures for additional information. LoanMart is currently not lending in California and does not make loans or credit. 1 Loan approval is subject to meeting the lender's credit criteria, which may include providing acceptable property as collateral. Actual loan amount, term, and Annual Percentage Rate of the loan that a consumer … Credit (EIC) Page 1 of 44 13:39 - 10-Jan-2022 Earned Income - IRS tax … have one qualifying child who has a valid SSN, or • $21,430 ($27,380 for married filing jointly) if you don’t have a qualifying child who has a valid SSN. Do I Need This Publication? Certain people who file Form 1040 or 1040-SR must use Worksheet 1 in this publication, instead of Step 2 in their Form 1040 and 1040-SR instructions, when they are

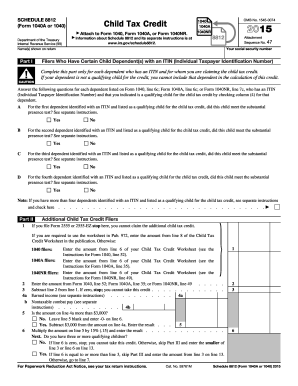

2012 child tax credit worksheet. Instructions for Form 5695 (2020) | Internal Revenue Service If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub. 972. Otherwise, enter the amount from line 14 of the Line 14 Worksheet in Pub. 972. . If you aren't claiming the child tax credit or the credit for other dependents for 2020, you don't need Pub. 972.. Residential Energy Efficient Property … Opportunity Maine – Tax Credit for Student Loans For Bachelors degrees NOT considered to be in STEM (science, technology, engineering or math) fields by Maine Revenue Services, tax credits may offset any individual income taxes you owe the State of Maine (non-refundable). If the tax credit is worth more than what you owe the State of Maine in individual income taxes, you may use the balance over the following 10 tax … Credit (EIC) Page 1 of 44 13:39 - 10-Jan-2022 Earned Income - IRS tax … have one qualifying child who has a valid SSN, or • $21,430 ($27,380 for married filing jointly) if you don’t have a qualifying child who has a valid SSN. Do I Need This Publication? Certain people who file Form 1040 or 1040-SR must use Worksheet 1 in this publication, instead of Step 2 in their Form 1040 and 1040-SR instructions, when they are The Difference Between Claiming 1 and 0 on Your Taxes - LoanMart All loans will be serviced by LoanMart. See State Disclosures for additional information. LoanMart is currently not lending in California and does not make loans or credit. 1 Loan approval is subject to meeting the lender's credit criteria, which may include providing acceptable property as collateral. Actual loan amount, term, and Annual Percentage Rate of the loan that a consumer …

Maryland Tax Form 502 Instructions | eSmart Tax NEW FOR 2013. Inclusive language: We have modified our instructions to use more inclusive language as a result of Maryland's recognition of same sex marriage. Reporting your Federal earned income: If you are claiming a federal Earned Income Credit (EIC), enter the earned income you used to calculate your federal EIC on line 1b. on Form 502. Earned income …

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-04.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-03.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-20.jpg)

0 Response to "38 2012 child tax credit worksheet"

Post a Comment