40 ira deduction worksheet 2014

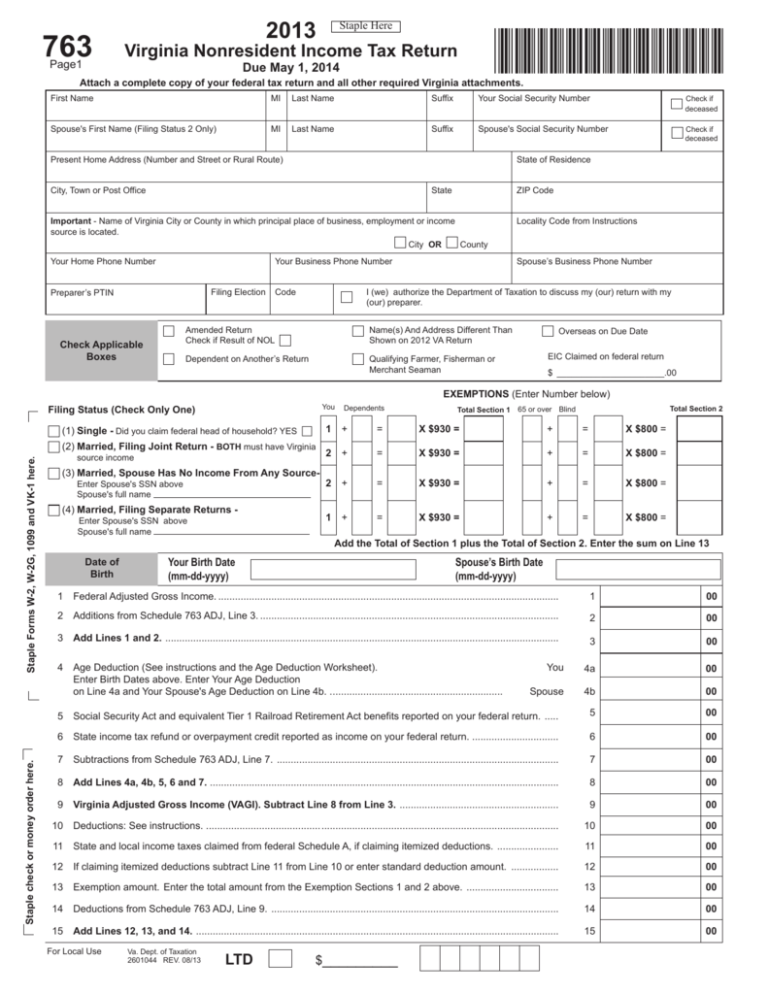

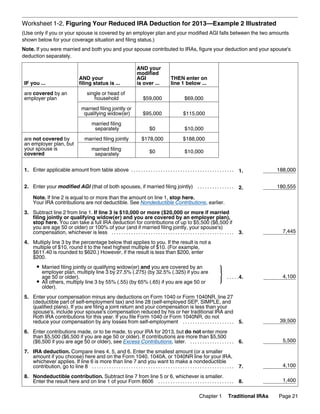

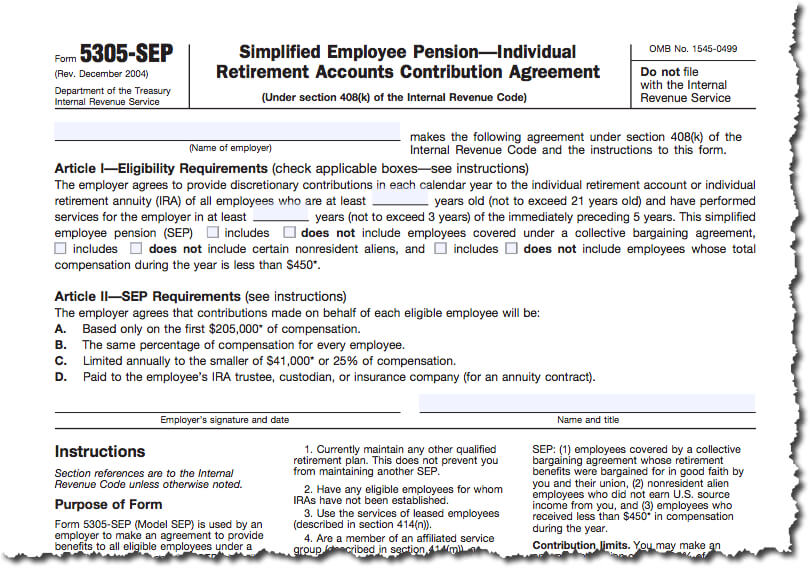

2020/2021 Tax Estimate Spreadsheet - Michael Kummer 11.12.2014 · Published: Nov 9, 2021 Dec 11, 2014 Last Updated: Nov 09, 2021 . Written by Michael Kummer. If you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. The formulas and spreadsheets shown and linked … Publication 560 (2021), Retirement Plans for Small Business The deduction for contributions to your own SEP-IRA and your net earnings depend on each other. For this reason, you determine the deduction for contributions to your own SEP-IRA indirectly by reducing the contribution rate called for in your plan. To do this, use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed, whichever is appropriate for your plan's …

Roth IRA - Wikipedia A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free ...

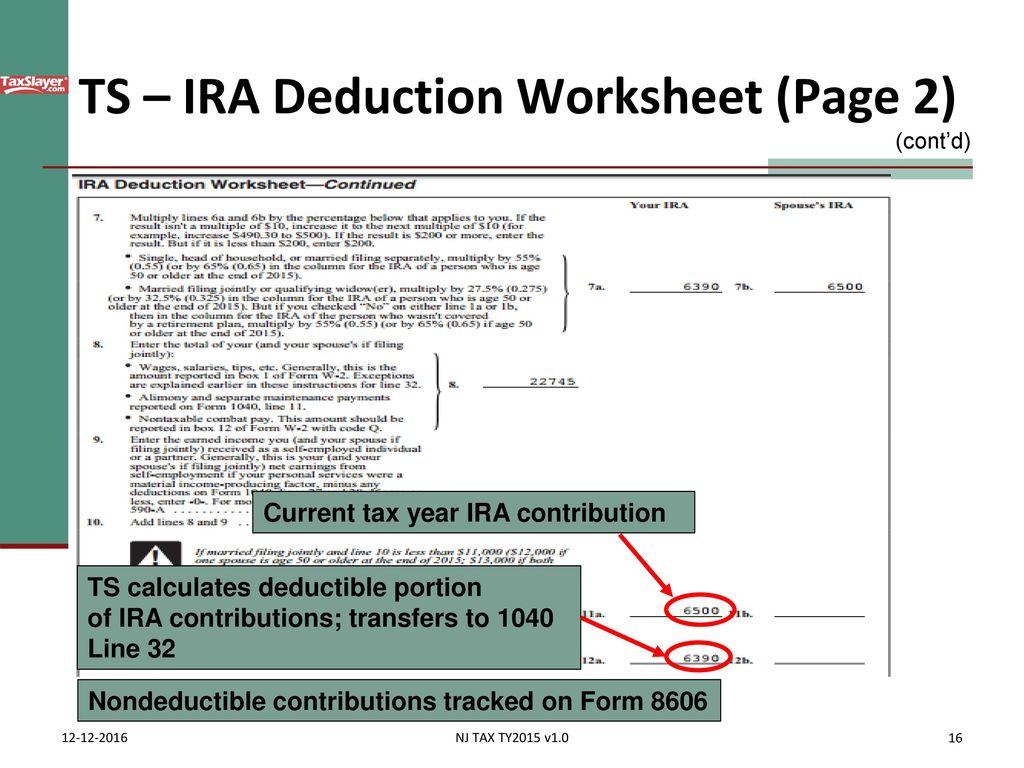

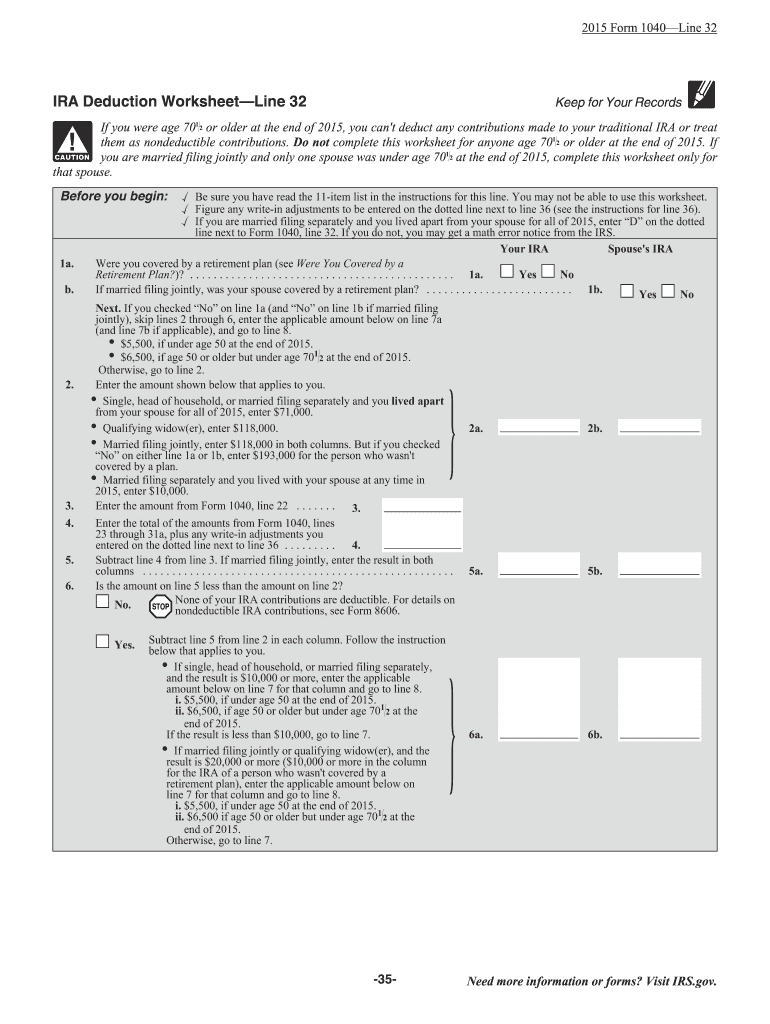

Ira deduction worksheet 2014

Maryland Tax Form 502 Instructions | eSmart Tax STANDARD DEDUCTION METHOD (Check the box on line 17 of Form 502) The STANDARD DEDUCTION METHOD gives you a standard deduction of 15% of Maryland adjusted gross income (line 16) with minimums of $1,500 and $3,000 and maximums of $2,000 and $4,000, depending on your filing status. Use STANDARD DEDUCTION WORKSHEET (16A) for your filing status to ... Schedule 1 Instructions for 2021 Taxes - Policygenius 20.12.2021 · See how much you can deduct by using the worksheet in the Self-Employed Health Insurance Deduction Worksheet, in the Schedule 1 instructions. Line 18 asks you to write in any penalty you owe for the early withdrawal of savings. A common example is early withdrawal penalties for a CD (maybe consider a no-penalty CD). Penalties you can include on ... Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 04.07.2022 · The deduction value for medical expenses varies because the amount changes based on your income. In 2021, ... such as contributions to a traditional IRA and deductible student loan interest. As a result of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has nearly doubled from where it was in 2016. For 2021, the standard deduction is …

Ira deduction worksheet 2014. Publication 590-A (2021), Contributions to Individual Retirement ... Examples—Worksheet for Reduced IRA Deduction for 2021. The following examples illustrate the use of Worksheet 1-2. Example 1. For 2021, Tom and Betty file a joint return on Form 1040. They are both 39 years old. They are both employed. Tom is covered by his employer's retirement plan. However, Betty isn’t covered by her employer's retirement plan. Tom's salary is $62,000, and … 2019 Instructions for Schedule CA (540) | FTB.ca.gov - California Charitable Contribution and Business Expense Deduction Disallowance – For taxable years beginning on or after January 1, 2014, California law disallows a charitable contribution deduction to an educational organization that is a postsecondary institution or to the Key Worldwide Foundation, and a deduction for a business expense related to a payment to the Edge College … How to Do a Backdoor Roth IRA - White Coat Investor 04.12.2021 · The contribution and deduction income limits are particularly low if you are filing your taxes Married Filing Separately (MFS). Both the ability to contribute directly to a Roth IRA and the ability to deduct a traditional IRA contribution if you (or your spouse) are eligible for a retirement plan at work phase out between $0 and $10,000. Basically, the best option for … Should You Contribute to a Non-Deductible IRA? - Investopedia Apr 26, 2022 · For a deductible IRA, filing as single or head of household eligibility phases out between $66,000 and $76,000 of modified adjusted gross income (MAGI) for 2021. In 2022 it goes up to $68,000 and ...

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 04.07.2022 · The deduction value for medical expenses varies because the amount changes based on your income. In 2021, ... such as contributions to a traditional IRA and deductible student loan interest. As a result of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has nearly doubled from where it was in 2016. For 2021, the standard deduction is … Schedule 1 Instructions for 2021 Taxes - Policygenius 20.12.2021 · See how much you can deduct by using the worksheet in the Self-Employed Health Insurance Deduction Worksheet, in the Schedule 1 instructions. Line 18 asks you to write in any penalty you owe for the early withdrawal of savings. A common example is early withdrawal penalties for a CD (maybe consider a no-penalty CD). Penalties you can include on ... Maryland Tax Form 502 Instructions | eSmart Tax STANDARD DEDUCTION METHOD (Check the box on line 17 of Form 502) The STANDARD DEDUCTION METHOD gives you a standard deduction of 15% of Maryland adjusted gross income (line 16) with minimums of $1,500 and $3,000 and maximums of $2,000 and $4,000, depending on your filing status. Use STANDARD DEDUCTION WORKSHEET (16A) for your filing status to ...

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

0 Response to "40 ira deduction worksheet 2014"

Post a Comment