42 2015 qualified dividends and capital gain tax worksheet

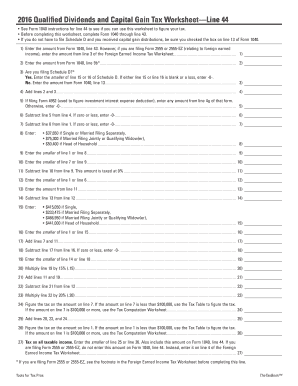

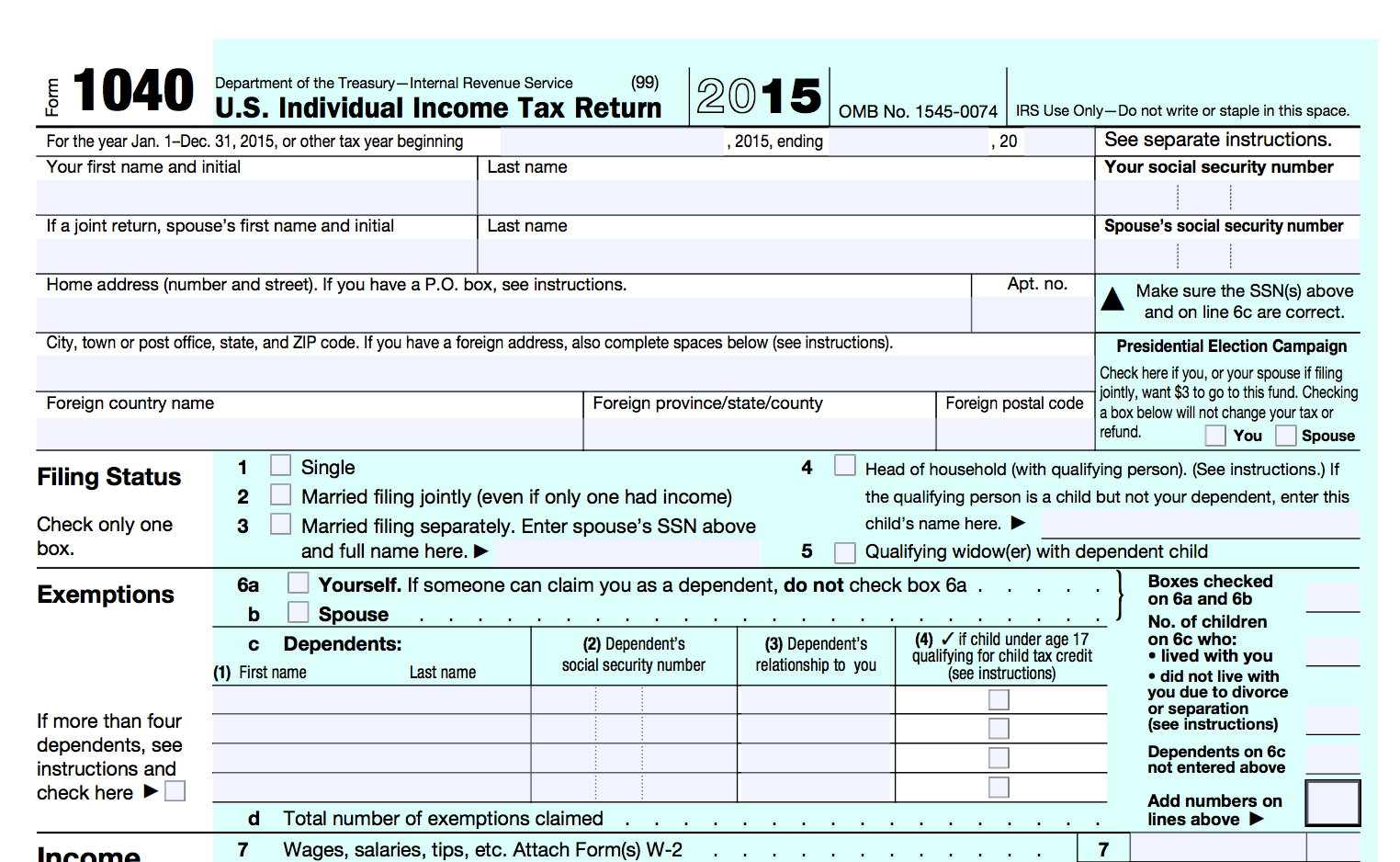

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Qualified Dividends and Capital Gains Flowchart - The Tax Adviser Example 1: The taxpayer has $36,900 of taxable income that consists of adjusted net capital gain of $16,900 and other taxable income of $20,000. The tax is $2,546, consisting of $2,546 tax on the $20,000 of other taxable income ($907.50 plus 15% of the excess over $9,075) and no tax on the adjusted net capital gain.

Qualified Dividends And Capital Tax Worksheet 2021 A qualified dividend is the Internal Revenue Code assigned to certain types of dividends that are taxable as per IRS. A qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. These tax rates are lower than the income tax rate on ordinary or unqualified dividends.

2015 qualified dividends and capital gain tax worksheet

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is ... Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Get and Sign Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021 'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […]

2015 qualified dividends and capital gain tax worksheet. Qualified Capital And Worksheet Tax Dividends Form Gain According to Delphi Digital, average losses for those months were 5 The tax is 35% of the S portion's taxable income except in figuring the maximum tax on qualified dividends and capital gains income using: Form 8949, Sales and Other Dispositions of Capital Assets income using: Form 8949, Sales and Other Dispositions of Capital Assets. Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends and Capital Gain Tax Worksheet - IRS The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099- ... 2015 Schedule D (Form 1041) - IRS by D SCHEDULE · Cited by 1 — Complete this part only if both lines 18a and 19 are gains, or qualified dividends are included in income in Part I of Form 990-T, and Form 990-T, line 34, is ...

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. Need more information or forms? Visit IRS.gov. -40-Title: Form 14216 (3-2011) Author: IRS Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet. 2022 Download Qualified Dividends Worksheet - WRKSHTS The qualified dividends worksheet, however, has 27 lines enabling you to compute your tax and you will not comprehend what each figure is attempting to get at, but marotta on. Qualified Dividends And Capital Gain Tax Worksheet (2020). A qualified dividend is a type of dividend to which capital gains tax rates are applied. Capital Gains Tax Calculation Worksheet - The Balance These capital gains bracket thresholds increase to $80,800 and $501,600 for married couples filing jointly. There are some investments, such as collectibles, that are taxed at different capital gains rates. But most exchange-traded investments will be taxed at either 0%, 15%, or 20% if you meet long-term holding requirements. 3.

2015 Form 1041-ES - IRS 2015. Form 1041-ES. Estimated Income Tax for Estates and Trusts ... capital gains and qualified dividends is ... Use the 2015 Estimated Tax Worksheet. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Qualified dividends and capital gain tax worksheet 2016 pdf Qualified Dividends and Capital Gain Tax Worksheet - Form 1040 Instructions - Page 44 capital, r is the real after-tax financing rate, d is the economic depre- ciation rate, TW is the concurrent equivalent tax rate on inflationary gains, TT is the expected Corporate Capital Budgeting Practices and the Effects of Tax

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends And Capital Gain Tax 2015 - K12 Workbook Worksheets are 40 of 117, Caution draftnot for filing, 2015 tax law highlights, Qualified dividends and capital gain tax work line, Calculations not supported in the 2015 turbotax individual, Basis issues for partnerships and s corporations, Interactive brokers, 2020 national income tax workbook. *Click on Open button to open and print to ...

2018 Qualified Dividends Worksheets - K12 Workbook Worksheets are 2018 form 1041 es, 2018 form 1040 es, 2018 estimated tax work keep for your records 1 2a, 44 of 107, Pacific grace tax accounting, Qualified dividends and capital gain tax work an, 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work line.

2015 Form 1040 (Schedule D) - IRS by D SCHEDULE · Cited by 1 — Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Do ...

2021 Instructions for Schedule D - IRS To report capital gain distributions not reported directly on Form 1040 or ... If qualified dividends that you re- ... 1250 Gain Worksheet if you complete.

2015 Instructions for Form 8801 - IRS 16 Jun 2015 — A credit carryforward to 2015 (on 2014 Form 8801, line 26), or ... Dividends and Capital Gain Tax Worksheet (Individuals),. Qualified ...

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

f8801--2015.pdf - IRS 2015. Attachment. Sequence No. 74. Name(s) shown on return ... The 2014 Qualified Dividends and Capital Gain Tax Worksheet is in the 2014 Instructions for ...

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Qualified Dividends and Capital Gains Worksheet - StuDocu Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet ..... 26. 27. Tax on all taxable income. Enter the smaller of line 25 or 26. Also include this amount on the entry space on Form 1040 or 1040 ...

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ...

️2014 Qualified Dividends Worksheet Free Download| Qstion.co 2014 qualified dividends worksheet (QSTION.CO) - Complete part iii only if you are required to do so by line 31 or by the foreign earned income tax worksheet in the instructions. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040 line 44 or in the instructions for form 1040nr line 42 to figure your tax.

Forms and Instructions (PDF) - IRS tax forms Forms and Instructions (PDF) Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing. Instructions for Schedule D (Form 1065), Capital ...

2015 Instruction 1040 Schedule D - IRS To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […]

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Get and Sign Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is ...

0 Response to "42 2015 qualified dividends and capital gain tax worksheet"

Post a Comment