38 1031 like kind exchange worksheet

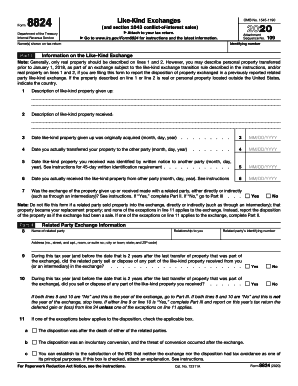

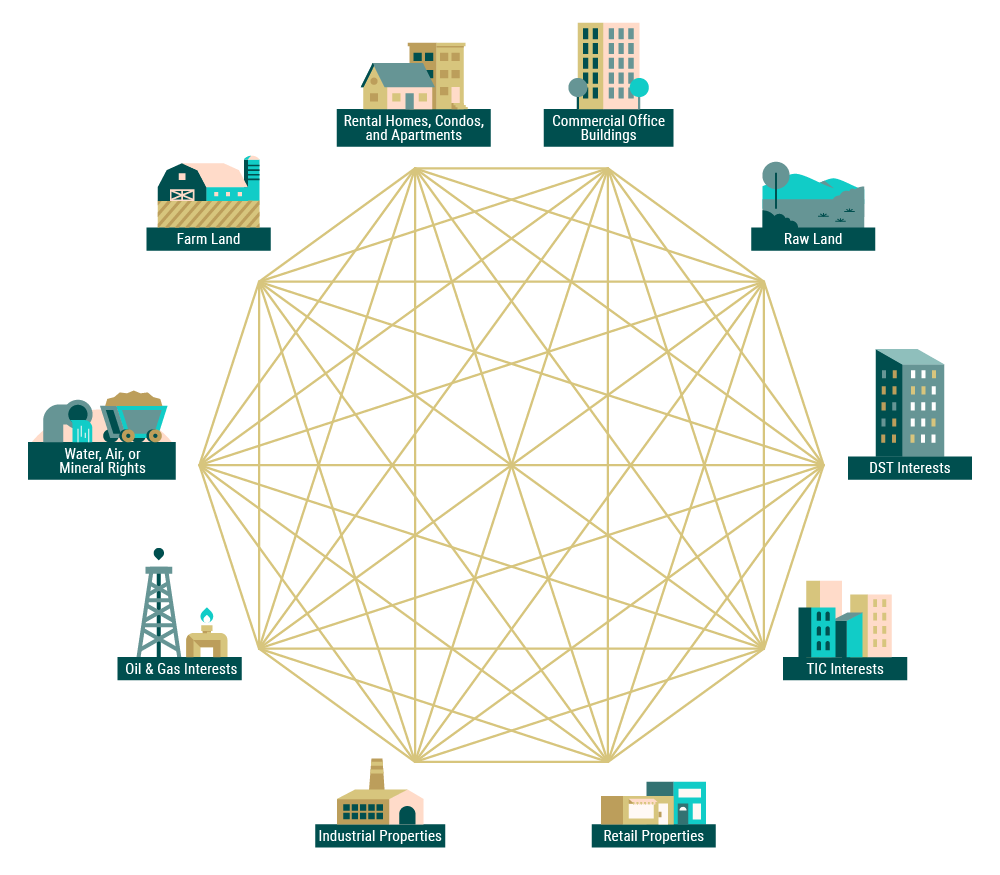

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ... 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We hope you can find what you need here. We constantly effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for those who seek an image according specific categories, you can find it in this website.

1031 like kind exchange worksheet

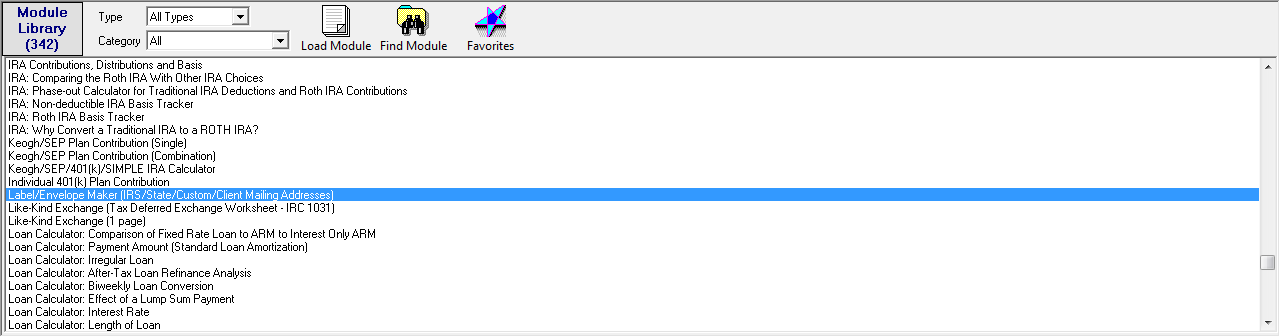

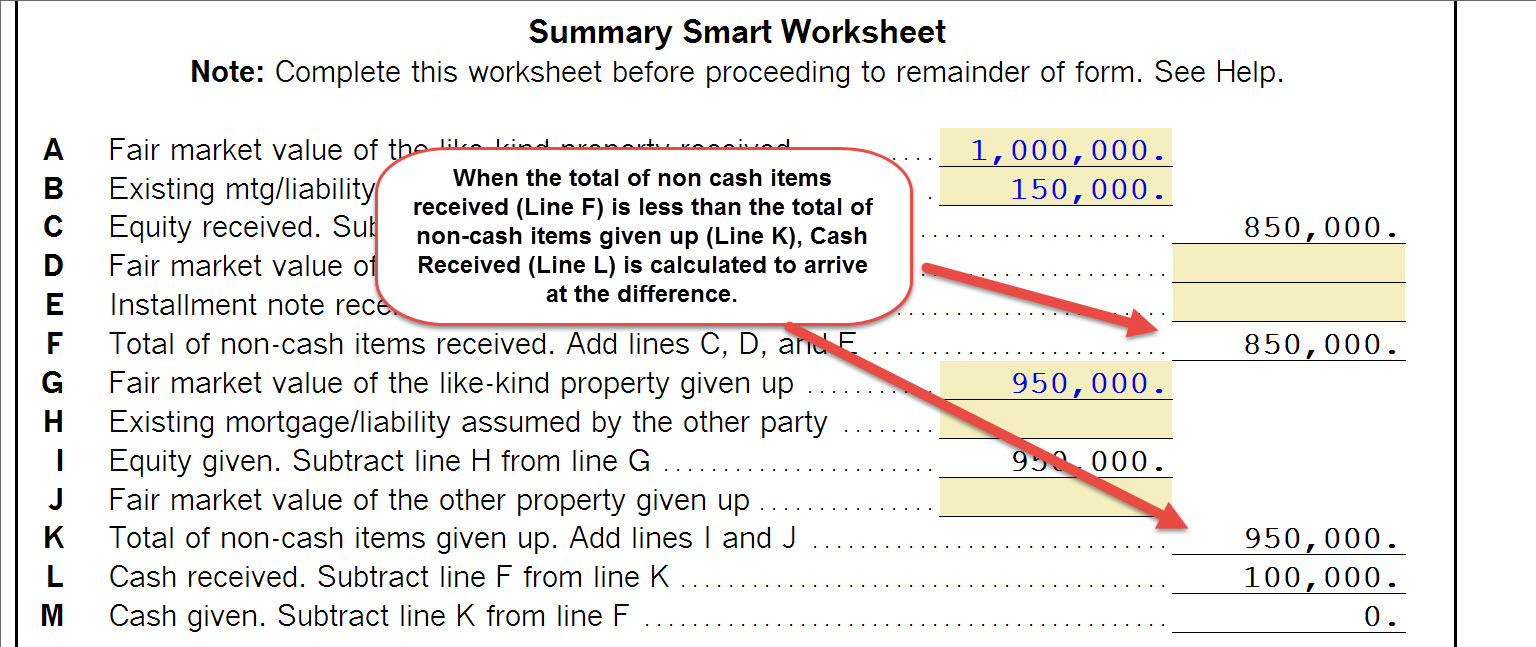

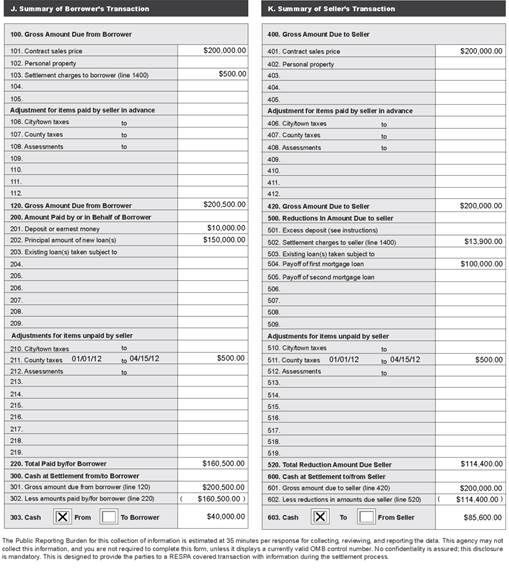

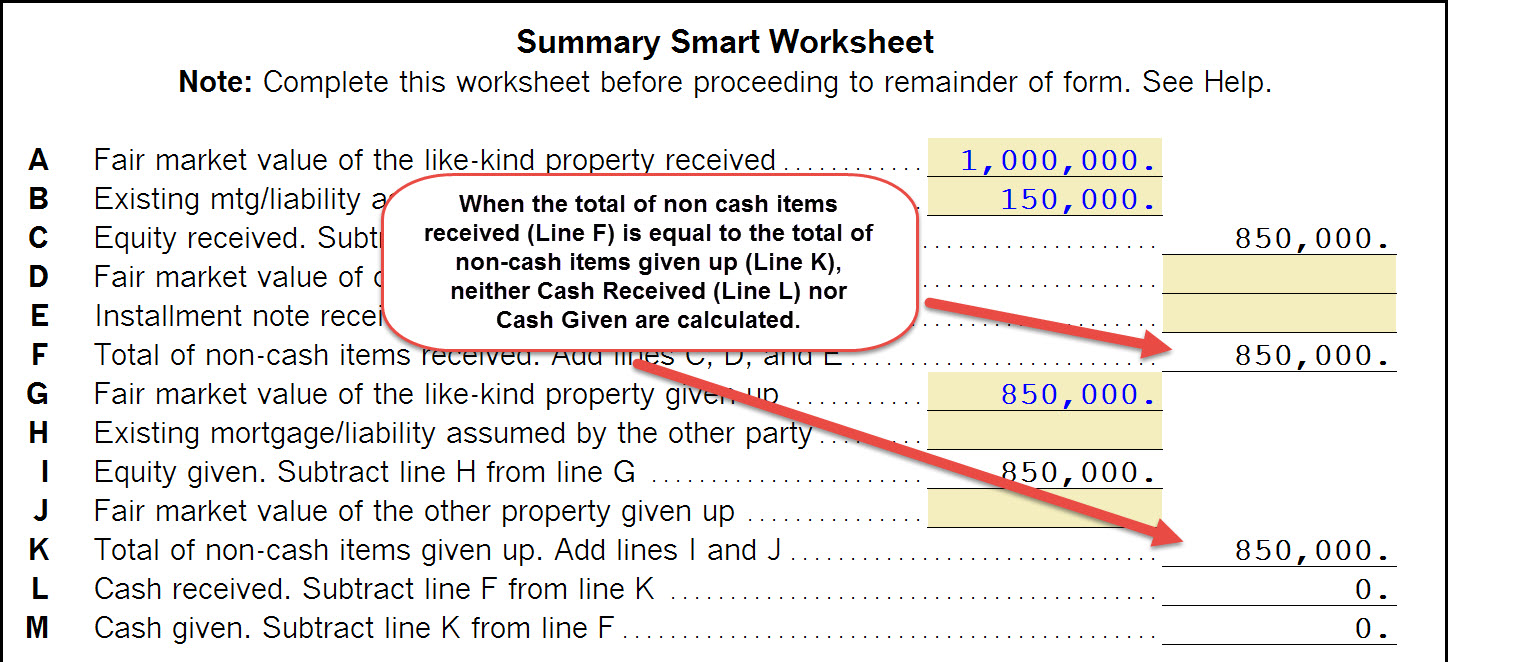

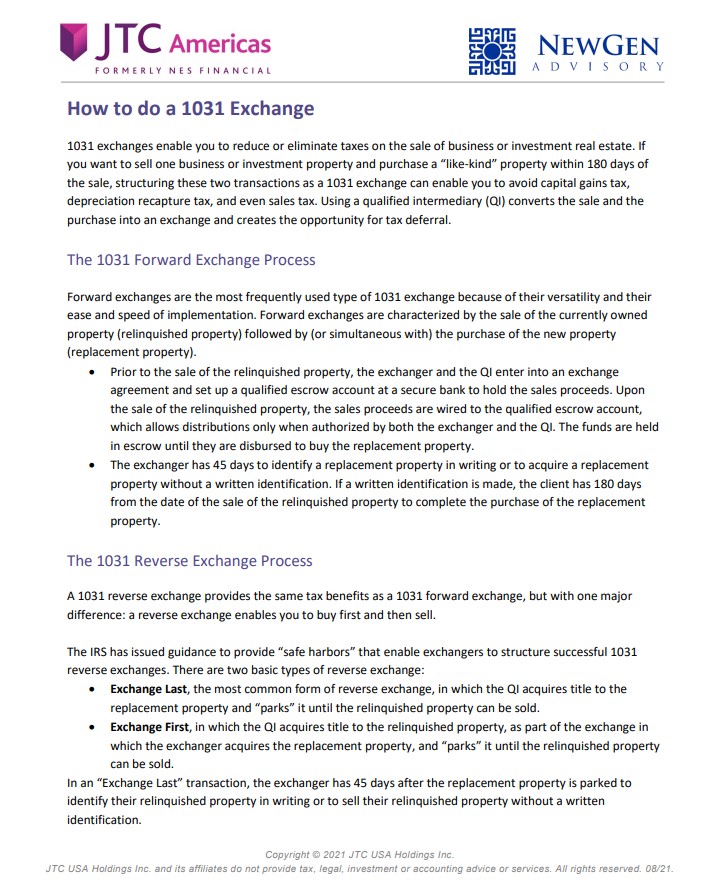

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. 1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements 1031 Exchange for Dummies: What Investors NEED to Know! A 1031 exchange lets you defer federal and state capital gains taxes. Capital gains are the increase in value of an asset from the time you purchased it to the time you sell it. If you buy a house for $200,000 and sell it for $350,000, you have capital gains of $150,000.

1031 like kind exchange worksheet. Guide to Like-Kind Exchanges & Taxable Boot Examples | 1031X $430,000 - 1031 proceeds as down payment $20,000 - Closing Costs $145,000 - New Mortgage Loan Here, For the Birds LLC faces $280,000 in capital gains (after closing costs). It will not incur any cash boot because the LLC transferred 100% of net equity from the relinquished property to the replacement property as down payment. Completing a Like Kind Exchange for business returns in ProSeries - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded. 1031 Exchange: Like-Kind Rules & Basics to Know - NerdWallet What is a 1031 exchange? A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by ... IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn Worksheet April 17, 2018 We tried to get some great references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here. We constantly attempt to show a picture with high resolution or with perfect images.

️1031 Exchange Worksheet Excel Free Download| Qstion.co Section 1031 exchange worksheet and like kind exchange formula. The 1031 exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. Depreciation taken in prior years from worksheet #1 (line d)$ _____ b. About Form 8824, Like-Kind Exchanges - Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales. Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. like kind exchange worksheet: Fill out & sign online | DocHub Adjusting paperwork with our comprehensive and intuitive PDF editor is simple. Follow the instructions below to fill out 1031 exchange worksheet 2019 online quickly and easily: Log in to your account. Log in with your email and password or register a free account to test the product before choosing the subscription. Import a form

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain. PDF Like-Kind Exchanges Under IRC Section 1031 - Internal Revenue Service as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or 1031 Exchange for Dummies: What Investors NEED to Know! A 1031 exchange lets you defer federal and state capital gains taxes. Capital gains are the increase in value of an asset from the time you purchased it to the time you sell it. If you buy a house for $200,000 and sell it for $350,000, you have capital gains of $150,000. 1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

![A Guide to Loss to Lease Definition [with Calculator] - IPG](https://ipgsf.com/wp-content/uploads/2021/06/documents-table-coffee.jpg)

0 Response to "38 1031 like kind exchange worksheet"

Post a Comment