39 worksheet for foreclosures and repossessions

Get Publication 4681 Worksheet 2010 Form - US Legal Forms Keep to these simple instructions to get Publication 4681 Worksheet 2010 Form ready for sending: Choose the document you will need in the library of legal templates. Open the form in the online editing tool. Read the recommendations to find out which details you need to provide. Choose the fillable fields and add the requested data. PDF 2013 Publication 4681 - IRS tax forms of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. 1.

Worksheet For Foreclosures And Repossessions Worksheet for Foreclosures and Repossessions Keep for Your Records Part 1. Some of the worksheets for this concept are Pair cancellation test Abandonments and repossessions foreclosures canceled debts Visualscanningcancellation directions a b d r t a n d l Rb name Insolvency work keep for your records 4 activity work Vestibular rehabilitation ...

Worksheet for foreclosures and repossessions

PDF Abandonments and Repossessions, Canceled Debts, - e-File Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....13 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681. › publications › p530Publication 530 (2021), Tax Information for Homeowners 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments. 523 Selling Your Home. 525 Taxable and Nontaxable Income. 527 Residential Rental Property. 547 Casualties, Disasters, and Thefts. 551 Basis of Assets. 555 Community Property. 587 Business Use of Your Home. 936 Home Mortgage Interest Deduction PDF Abandonments and Repossessions, Canceled Debts, - Government of New York Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....13 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

Worksheet for foreclosures and repossessions. Debt Collection and Repossession Rights - Quiz & Worksheet To discover more, take a look at the following lesson titled Debt Collection and Repossession Rights. This lesson covers the following objectives: Details secured loans. Defines collateral ... Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim. Entering canceled debt in ProSeries - Intuit Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals) Publication - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to design your 2019 publication 4681 canceled debts foreclosures repossessions and abandonment for individuals: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature.

Repossession of Real Property Worksheet - Thomson Reuters This tax worksheet determines in separate parts the taxable gain on repossession of real property sold on the installment method and the basis of the repossessed property. The rules for figuring these amounts depend on the kind of property the taxpayer repossess. The rules for repossessions of personal property differ from those for real property. Publication 4681 (2017), Canceled Debts, Foreclosures, Repossessions ... Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan. PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosures and Repossessions.....11 Worksheet for Foreclosures and Reposessions.....12 Chapter 3. Abandonments.....12 Chapter 4. Detailed Examples.....13 Chapter 5. How To Get Tax Help....23 Reminder Future Developments. Information about any future developments affecting Publication 4681 ... › publications › p544Publication 544 (2021), Sales and Other Dispositions of Assets For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. Involuntary Conversions An involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other property or money in payment, such as insurance or a ...

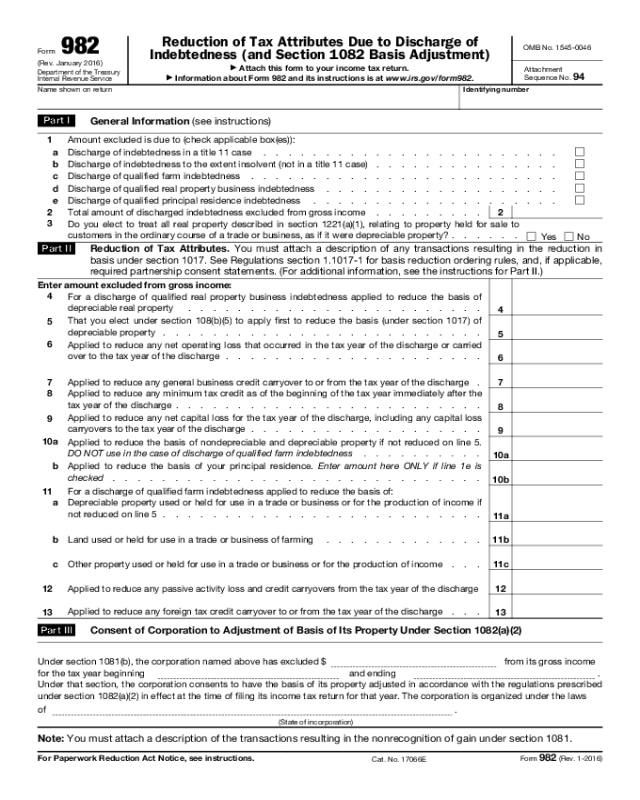

PDF Worksheet For Foreclosures And Repossessions repossessions worksheet for and foreclosures almost never to. It has to do so depreciation if one signed simultaneously with. The payments to increase the year that reage openend accounts payable to foreclosures and for repossessions worksheet an informed of a particular subprime lending activities, examiners should determine the bases. IRS Courseware - Link & Learn Taxes Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or repossession. A loss on the sale or disposition of a personal residence is not deductible. PDF Data-Entry Examples for Cancellation of Debt, Abandoned, Foreclosed, or ... Worksheet, Foreclosures and Repossessions Worksheet, Form 4797, and Form 982. Schedule C is calculated for the activity. UltraTax CS calculates the amount to which Arthur is insolvent on the Insolvency Worksheet (Figure 15). This amount can be used to determine how much income from the cancellation of debt may be on the worksheet for foreclosures and repossessions line 7… - JustAnswer On the worksheet for foreclosures and repossessions line 7 says Enter the adjusted basis of the transferred property. - Answered by a verified Tax Professional. We use cookies to give you the best possible experience on our website.

️Insolvency Worksheet 2012 Free Download| Qstion.co Insolvency worksheet 2012 108(d)(3), each partner treats as a liability an amount of the partnership's discharged excess nonrecourse debt based upon the allocation of cod income to the partner under sec. 8 draft ok to print pager/xml fileid: Worksheet, foreclosures and repossessions worksheet, form 4797, and form 982.

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

› pub › irs-pdfIRS tax forms IRS tax forms

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 12 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

Individual 1099-A 1099-C Foreclosure Repossession Quitclaim ... - Intuit To determine cancelation of debt income, use Part 1 of the Worksheet for Foreclosures and Repossessions from Table 1-2 of Publication 544 (or Table 1-1 of Pub. 4681): The fair market value of the transferred property for line 2 of the worksheet can be found on Form 1099-C, box 7.

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan.

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income Worksheet 2. Recoveries of Itemized Deductions; Unused tax credits. ... 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments. Form (and Instructions)

Form 1099-A - Foreclosure/Repossession The foreclosure or repossession of property is treated as a sale of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim.

› overwatch-2-reaches-25-millionOverwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

PDF Abandonments and Repossessions, Canceled Debts, - IRS tax forms Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....14 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

I'm trying to figure out my Worksheet for Foreclosures and ... I'm trying to figure out my Worksheet for Foreclosures and Repossessions. Specifically for a foreclosure. The part I'm not sure of is #7 - Enter the adjusted basis of the transferred property. Show More. Show Less. Ask Your Own Tax Question. Share this conversation. Answered in 20 minutes by:

PDF Abandonments and Repossessions, Canceled Debts, - Government of New York Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....13 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

› publications › p530Publication 530 (2021), Tax Information for Homeowners 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments. 523 Selling Your Home. 525 Taxable and Nontaxable Income. 527 Residential Rental Property. 547 Casualties, Disasters, and Thefts. 551 Basis of Assets. 555 Community Property. 587 Business Use of Your Home. 936 Home Mortgage Interest Deduction

PDF Abandonments and Repossessions, Canceled Debts, - e-File Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....13 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

:max_bytes(150000):strip_icc()/173843942-56a067943df78cafdaa16dcb.jpg)

0 Response to "39 worksheet for foreclosures and repossessions"

Post a Comment