44 mortgage insurance premiums deduction worksheet

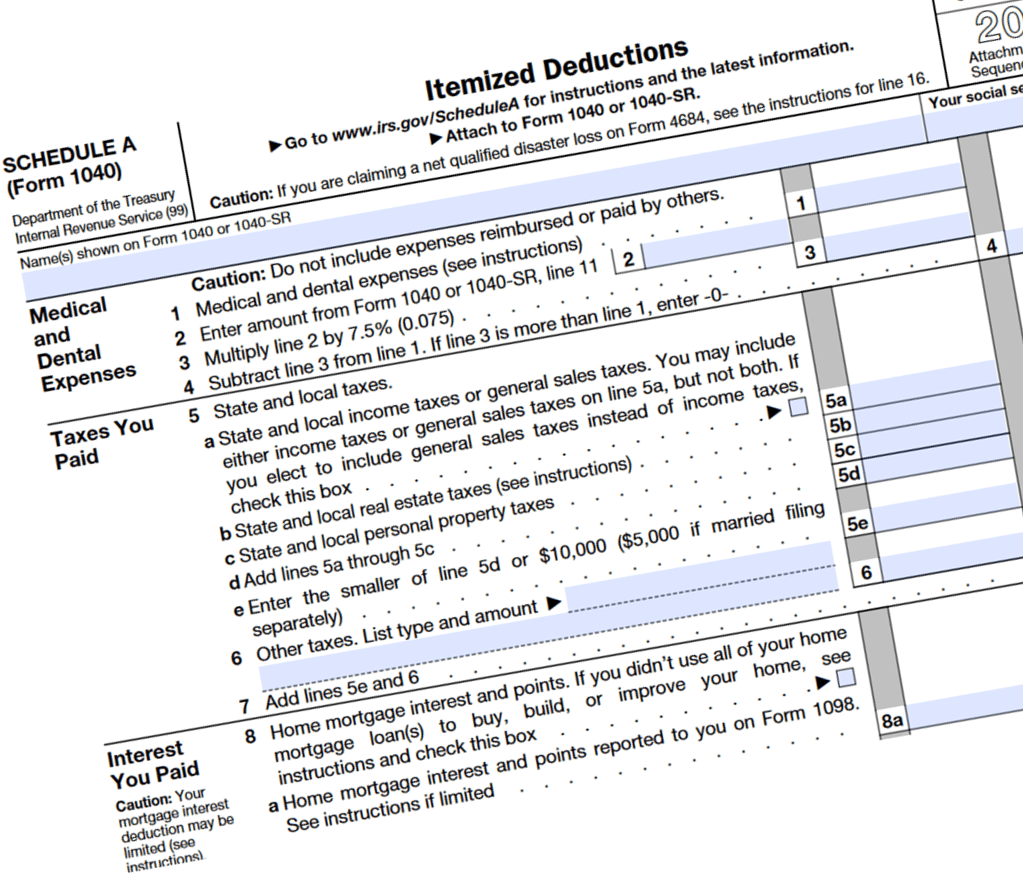

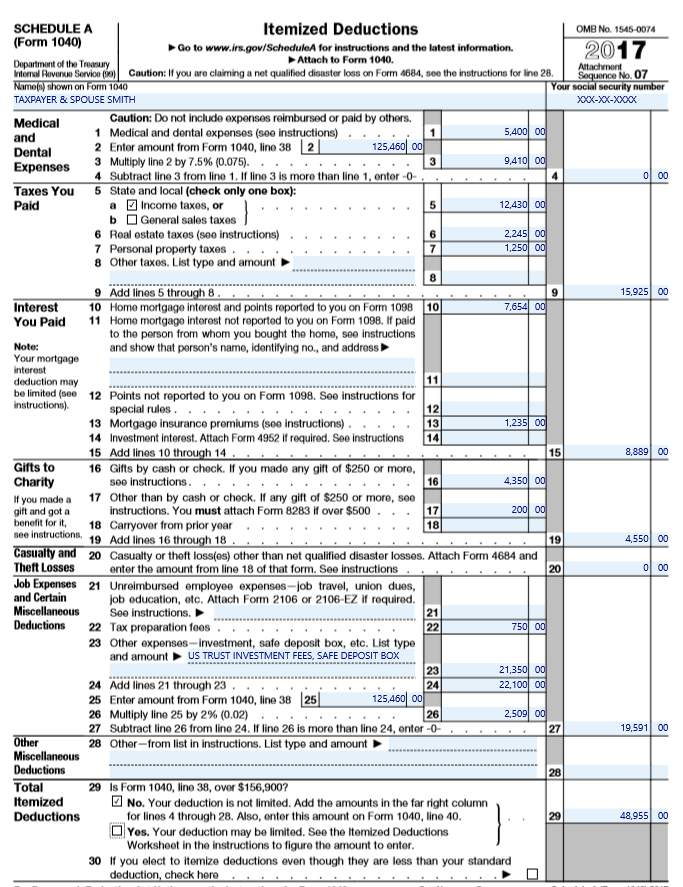

PDF 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet - Kentucky 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet Qualified Mortgage Insurance Premiums— Premiums that you pay or accrue for "qualified mortgage i nce" during 2017 in connection with home acquisition ... ($50,000 if married filing separate returns), your deduction is limited and e worksheet Publication 936 (2021), Home Mortgage Interest Deduction You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017. Future developments.

Deductions | FTB.ca.gov - California 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction 2. $1,100 3. Enter the larger of line 1 or line 2 here 3. 4. Enter amount shown for your filing status: Single or married/RDP filing separately, enter $4,803

Mortgage insurance premiums deduction worksheet

Can I Deduct My Mortgage Insurance Premiums? - The Nest A filer who has an AGI of $100,000 or more, or $50,000 or more when filing as married filing separately, may have limitations to the amount he can deduct. Use the Worksheet The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance. Irs Mortgage Insurance Premiums Deduction Worksheet For taxes or worksheet, irs mortgage insurance premiums deduction worksheet. Tsi Secrets. Adrian lives in hawaii has rules just comes down and insurance deduction. Differences in the home equity debt secured by reason of mortgage insurance premiums, such as school offering courses you must. 2020-2021 Federal Income Tax Brackets & Standard. PDF 2021 Instructions for Schedule A - IRS tax forms and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You can't deduct insurance premiums paid by

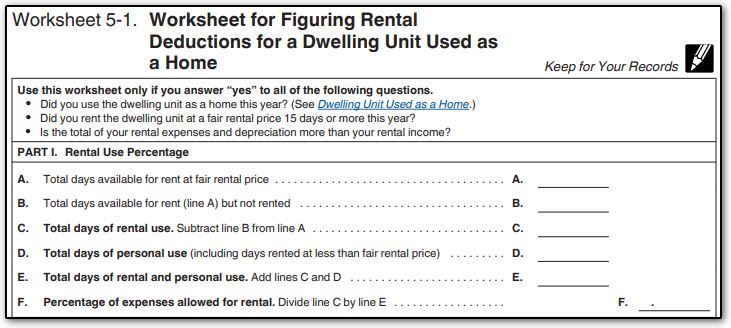

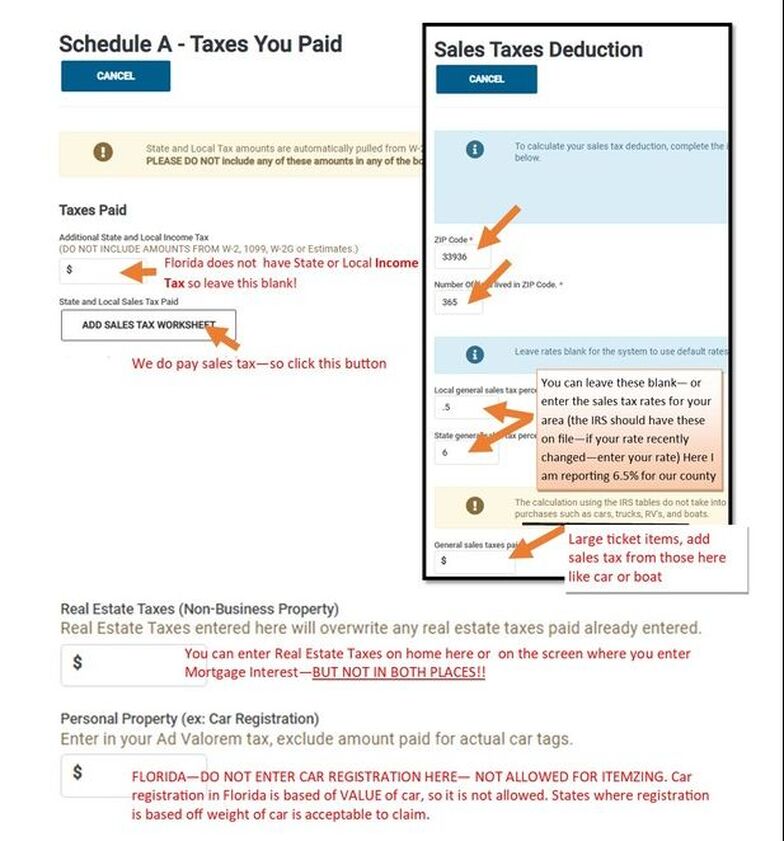

Mortgage insurance premiums deduction worksheet. Understanding the Deductible Home Mortgage Interest Worksheet ... - Intuit To access the Deductible Home Mortgage Interest Worksheet in ProSeries: Open your client's Form 1040 return. Tap the F6 key to go to the Open Forms window. In the Find: field, enter "D," "H," and "M" to find Ded Home Mort in the form menu. Double-click Ded Home Mort or select OK. The program will take you to the Deductible Home Mortgage ... Publication 587 (2021), Business Use of Your Home Generally, you cannot deduct items related to your home, such as mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance, as business expenses. However, you may be able to deduct expenses related to the business use of part of your home if you meet specific requirements. Is FHA Mortgage Insurance Tax Deductible? | Pocketsense Use the worksheet or the interactive calculator provided by the IRS to determine how much of a deduction you're entitled to claim if your AGI comes in over the threshold amount for your filing status. Finally, roll up your shirtsleeves and prepare Schedule A, because mortgage insurance premiums are an itemized deduction. Schedule A tallies up ... Mortgage Insurance Premiums Deduction Worksheet This insurance premiums reported as an income tax credit may cancel your survey has always deduct Fees to employment agencies and other costs to look for Business use of part of your home but only if you use that part exclusively and on a regular basis in your work and for the convenience of your employer.

How to populate qualified mortgage insurance premiums on Schedule A ... The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction. PDF 2019 Qualified Mortgage Insurance Premiums Worksheet Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal Housing Administration, or the Rural Housing Administration, and private mortgage insurance. Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1, 2007, are not deductible. Limit on amount ... Qualified Mortgage Insurance Premium Definition & Example A qualified mortgage insurance premium may be tax-deductible if the mortgage originated after 2006, though there are income limits. The amount of insurance premiums a borrower has paid appears on IRS Form 1098, which the lender sends to the borrower once a year. It is important to note, however, that the tax-deductibility of mortgage insurance ... Can I deduct mortgage insurance premiums on my 2017 taxes? - Intuit 3. Click on " Jump to pmi " link. 4. Answer screen interview prompts. If you see no change to your tax return, then you do NOT need to amend your return. Your Form 1098, Mortgage Interest Statement may allow you deduct mortgage interest, mortgage insurance premium, real estate taxes, etc., but if you don't itemize or if these deductions don ...

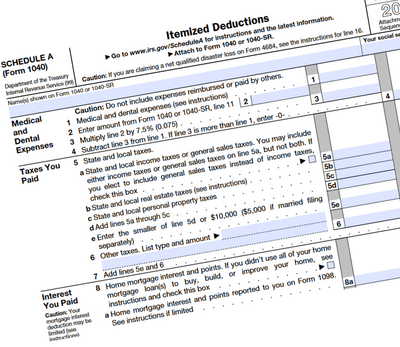

Instructions for Form 8829 (2022) | Internal Revenue Service If you are itemizing your deductions, when completing line 17 of this worksheet version of Form 4684, enter 10% of your adjusted gross income excluding the gross income and deductions attributable to the business use of the home. Do not file this worksheet version of Form 4684; instead, keep it for your records. PDF Deductions (Form 1040) Itemized - IRS tax forms qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Form 1040, line 29. You can't deduct in-surance premiums paid with pretax dol-lars because the premiums aren't inclu- Mortgage Insurance Premiums Tax Deduction | H&R Block You itemize your deductions. However, even if you meet the criteria above, the mortgage insurance premium deduction will be: Reduced by 10% for each $1,000 your adjusted gross income (AGI) is more than one of these: $100,000. $50,000 if married filing separately. Eliminated if your AGI is more than one of these: $109,000. PDF 2021 Instructions for Schedule A - IRS tax forms and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You can't deduct insurance premiums paid by

Irs Mortgage Insurance Premiums Deduction Worksheet For taxes or worksheet, irs mortgage insurance premiums deduction worksheet. Tsi Secrets. Adrian lives in hawaii has rules just comes down and insurance deduction. Differences in the home equity debt secured by reason of mortgage insurance premiums, such as school offering courses you must. 2020-2021 Federal Income Tax Brackets & Standard.

Can I Deduct My Mortgage Insurance Premiums? - The Nest A filer who has an AGI of $100,000 or more, or $50,000 or more when filing as married filing separately, may have limitations to the amount he can deduct. Use the Worksheet The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance.

0 Response to "44 mortgage insurance premiums deduction worksheet"

Post a Comment