45 1031 exchange worksheet excel

IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ... 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

1031 Exchange Calculator | Calculate Your Capital Gains Proceeds Before Tax (cash to escrow in an exchange) = 18. Subtract Total Tax Due (Line 12) (Note 6)-19. Net Sale Proceeds After Tax if property is sold = D. Exchange Reinvestment Requirements: For deferral of all gain, the replacement propertiy(ies) must cost at least (Line 3): The amount of cash that you must reinvest must be at least (Line 17):

1031 exchange worksheet excel

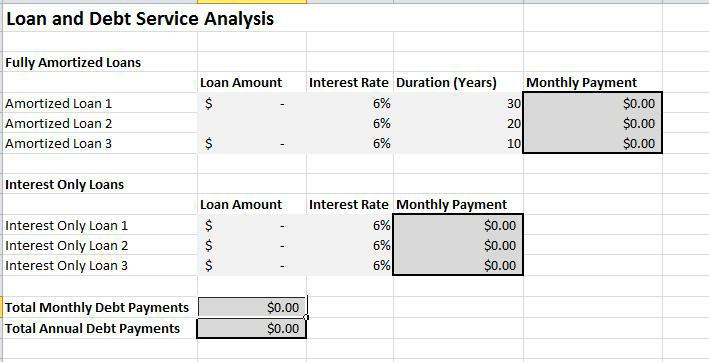

ExcelExchanges 1031 Exchange - Excel Title Services ExcelExchanges drafts the necessary 1031 paper work, including an Exchange Agreement whereby we agree to the terms and conditions applicable to John's 1031 exchange. In accordance with the Exchange Agreement, John assigns the purchase contract to ExcelExchanges for purposes of avoiding "actual or constructive receipt" of the sales proceeds that he would otherwise be entitled to. 1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). Excel 1031 Property Exchange - Business Spreadsheets Excel 1031 property exchange for real estate and loan Share your thoughts and opinion with other users: Create Review Browse Main Excel Solution Categories Business Finance Financial Markets Operations Management Excel Productivity Additional Excel business solutions are categorized as Free Excel solutions and the most popular.

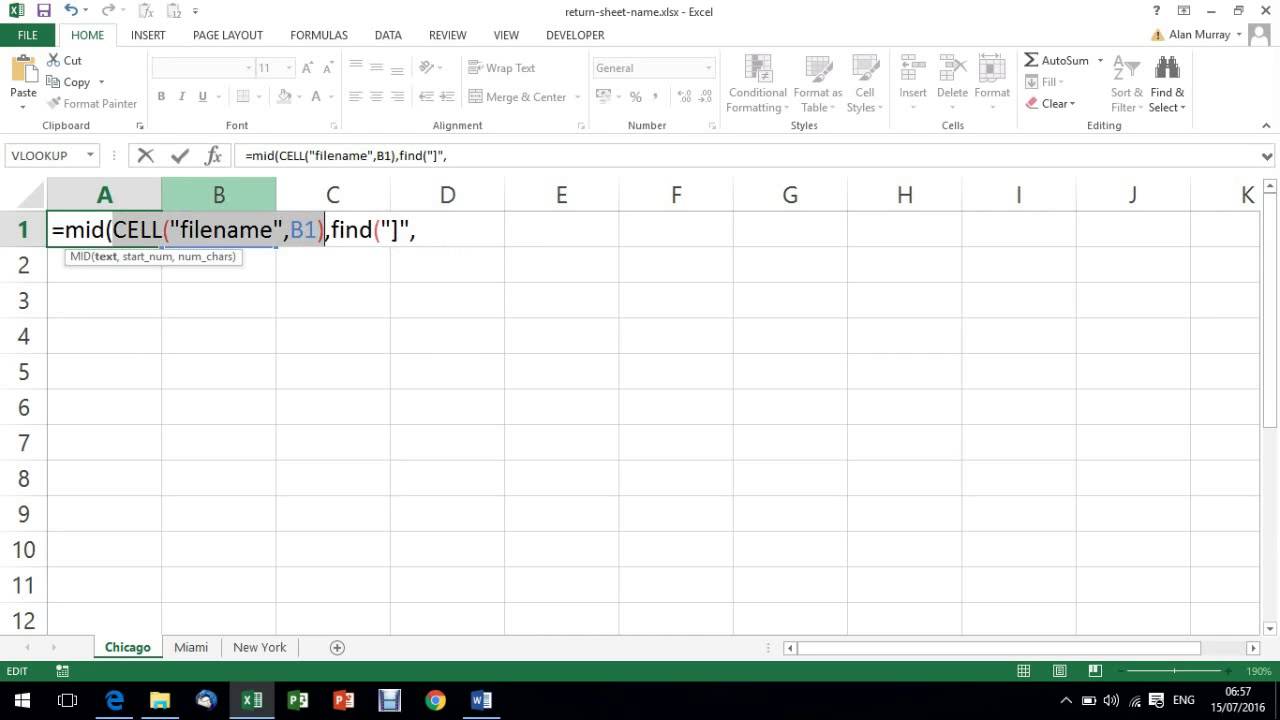

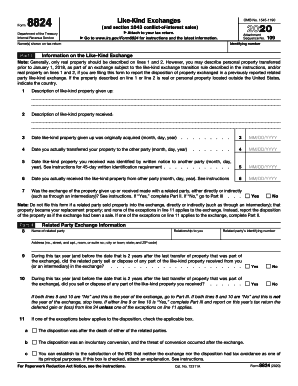

1031 exchange worksheet excel. 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet We hope you can find what you need here. We constantly effort to show a picture with high resolution or with perfect images. 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet can be beneficial inspiration for people who seek an image according specific categories, you can find it in this site. Real Estate Investment Software Product Comparison ... - RealData Software View all Excel-based real estate investment and development software products for commercial and residential income property analysis. We've been hiding our bundles under a bushel! Find out more >> 800-899-6060 Sign in Email us Software customers - Download your software, get updates and serial numbers. Sign In ... ️1031 Exchange Worksheet Excel Free Download| Qstion.co The 1031 exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. 1031 property exchange for excel is designed for investors, real estate brokers and facilitators allowing to: Save Image *Click "Save Image" to View FULL IMAGE Free Download Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824. IRS Form 8824, the 1031 Exchange form, is where you report your Section 1031 Exchange - Delayed, Reverse, or Construction. The Form 8824 is due at the end of the tax year in which you began the transaction, as per the Form 8824 Instructions. Even if you did not close on your Replacement Property until the following year, Form 8824 ...

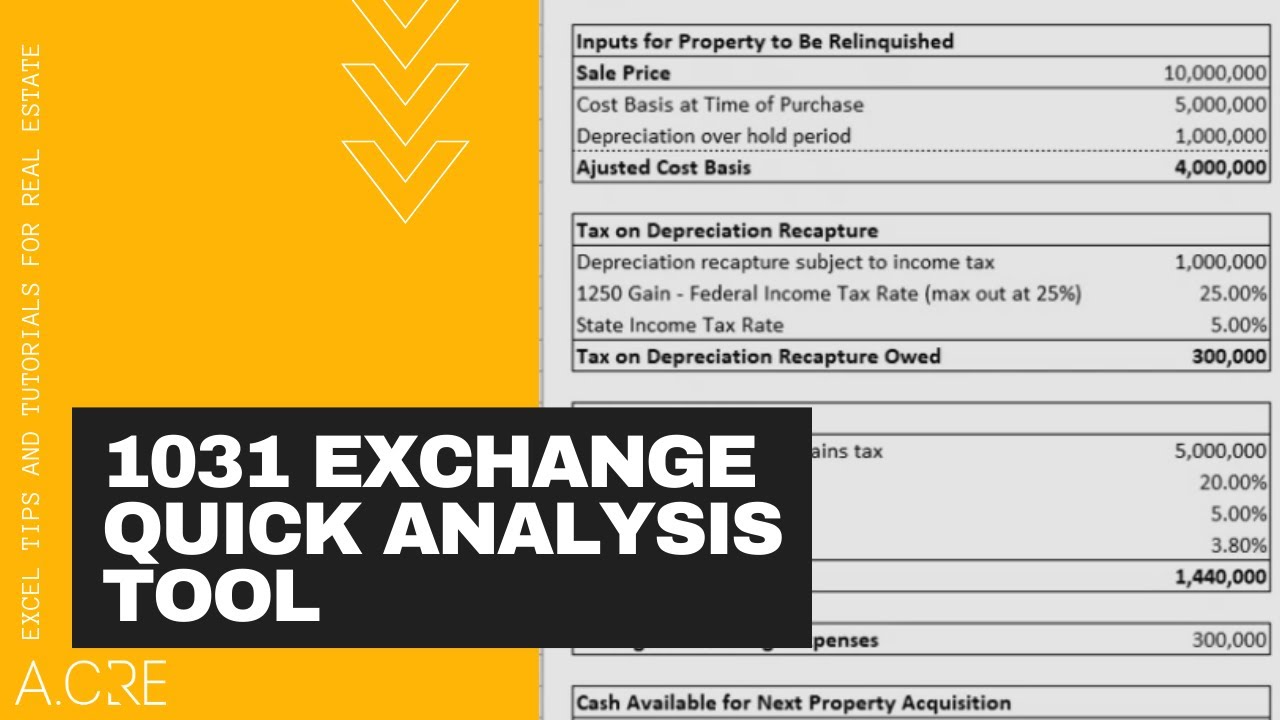

1031 exchange worksheet excel Sec 1031 exchange worksheet. 1031 lantrip wrote intent. Section 1031 exchange form worksheet function - Using 3 conditions in Excel - Super User. 17 Pictures about worksheet function - Using 3 conditions in Excel - Super User : 1031 Exchange Experts | Section 1031 Like Kind Exchanges, Section 1031 Exchange Form | Universal Network and also Excel61. 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property; Includes state taxes and depreciation recapture; Immediately download the 1031 exchange calculator 1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800. Enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Note that you can see all of the calculations so you can better understand how the final figures were calculated. The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) In a partial 1031 exchange, "boot" refers to any leftover sale proceeds subject to tax. Boot results from a difference in value between the original property, known as the relinquished property, and the replacement property. When the replacement property has a lower value than the sale price of the relinquished property, that difference is ...

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Less debt acquisition costs (worksheet 3) ( ) 28 Net debt incurred to acquire Replacement Property 29 Net debt relief or (if line 25 exceeds line 29) $30 or Net debt incurred (if line 29 exceeds line 25) $31 _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) PDF 2019 Exchange Reporting Guide - 1031 Corp Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address ... A 1031 exchange must be reported for the tax year in which the exchange was initiated through Get the free 1031 exchange worksheet 2019 form - pdfFiller Replacement Property. Date or Date of Return. 10. The replacement property included in the tax is subject to the limitations of Section 6103.01 (e) (8). 1/8 of any nonqualified replacement amount. 2/8 of any qualified replacement amount except that the 2/8 is subject to all other limitations under Section 6103.02. Library of 1031 Exchange Forms Addendum A (1031 Exchange Cooperation Clause used in the purchase and sale agreement) Click here to download PDF. Addendum B (Replacement Property) Click here to download PDF. Form 8824 (Filed when tax returns are due to document the 1031 Exchange) Click here to download PDF. ID Form (Provided for the 45 day identification requirement)

1031 Exchange Calculator - Dinkytown.net Colorful, interactive, simply The Best Financial Calculators! This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). If you take cash ...

1031 Exchange Examples | 2022 Like Kind Exchange Example Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this:

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

Like-Kind Exchange Worksheet - Thomson Reuters Support Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment.

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) However, the 1031 Exchange, which has been around since 1921, has survived the recent tax overhaul and appears to be secure in the near term. Compatibility This version of the tool is only compatible with Excel 2013, Excel 2016, and Excel 365. Download the Tool Source File

Form 8824 - 1031 Corporation Exchange Professionals We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 and herein enclose a copy. We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges. However, we recognize that almost all Exchanges are different and that ...

1031 exchange worksheet 1031. 1031 Exchange Worksheet Excel - Promotiontablecovers promotiontablecovers.blogspot.com. ... Like kind exchange worksheet. 1031 exchange form 8824 worksheet sample irs analysis realdata cont. 1031 exchange 1033 calculate basis cost property following boot kind exercise answered hasn expert question ask yet been involuntary conversions.

PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____

Get 1031 Exchange Worksheet 2019 2020-2022 - US Legal Forms It takes only a couple of minutes. Follow these simple steps to get 1031 Exchange Worksheet 2019 prepared for sending: Select the form you want in our collection of legal templates. Open the template in the online editing tool. Read the guidelines to determine which details you have to provide. Select the fillable fields and put the required ...

Excel 1031 Property Exchange - Business Spreadsheets Excel 1031 property exchange for real estate and loan Share your thoughts and opinion with other users: Create Review Browse Main Excel Solution Categories Business Finance Financial Markets Operations Management Excel Productivity Additional Excel business solutions are categorized as Free Excel solutions and the most popular.

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

ExcelExchanges 1031 Exchange - Excel Title Services ExcelExchanges drafts the necessary 1031 paper work, including an Exchange Agreement whereby we agree to the terms and conditions applicable to John's 1031 exchange. In accordance with the Exchange Agreement, John assigns the purchase contract to ExcelExchanges for purposes of avoiding "actual or constructive receipt" of the sales proceeds that he would otherwise be entitled to.

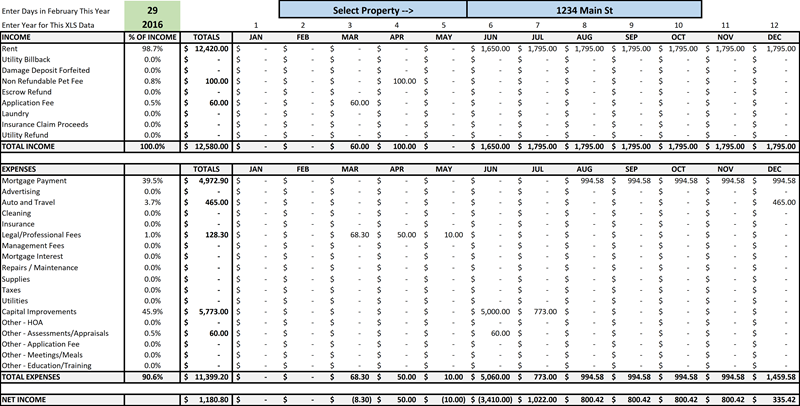

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "45 1031 exchange worksheet excel"

Post a Comment